Biggest Gainer at the Opening Bell: FedEx

On Wednesday morning, FedEx (FDX), the largest express package delivery service in the world gapped up over 13% at the open after reporting earnings after market on June 30th.

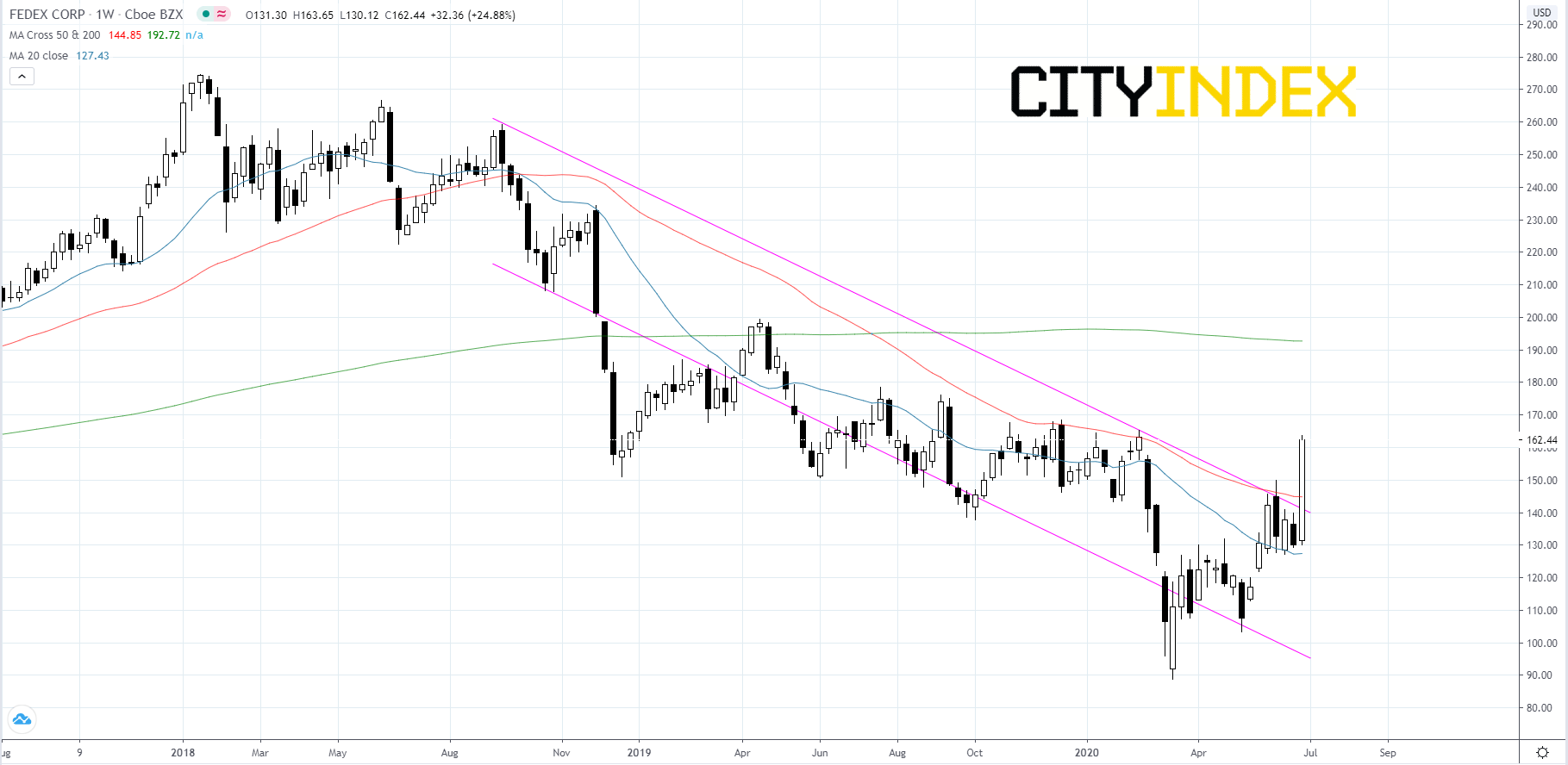

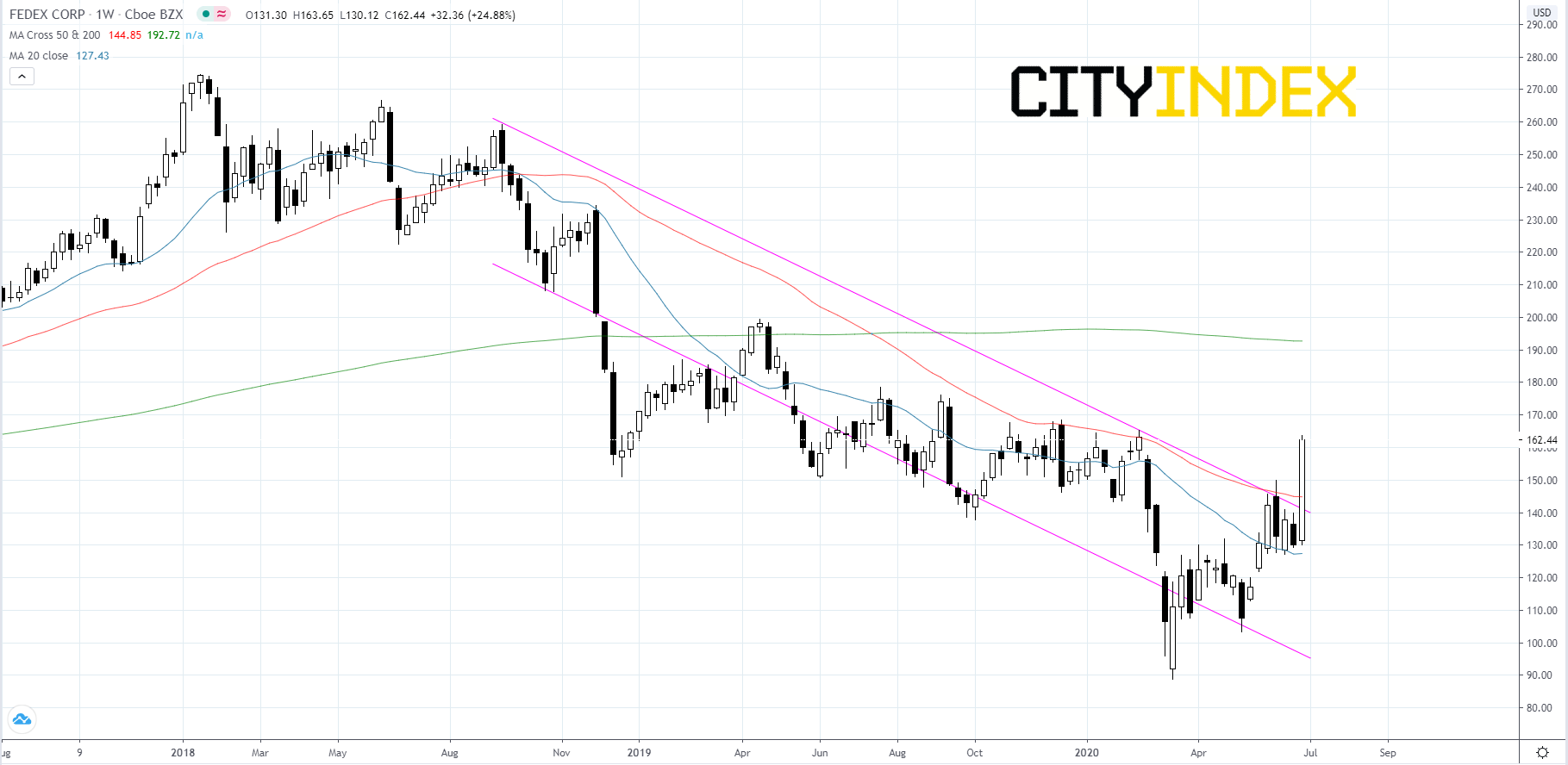

Looking at a weekly chart, FedEx's stock price has broken to the upside of a descending channel that price has been declining since September of 2018. If price can hold above the upper trend line this could be the beginning of a long-term up trend.

Source: GAIN Capital, TradingView

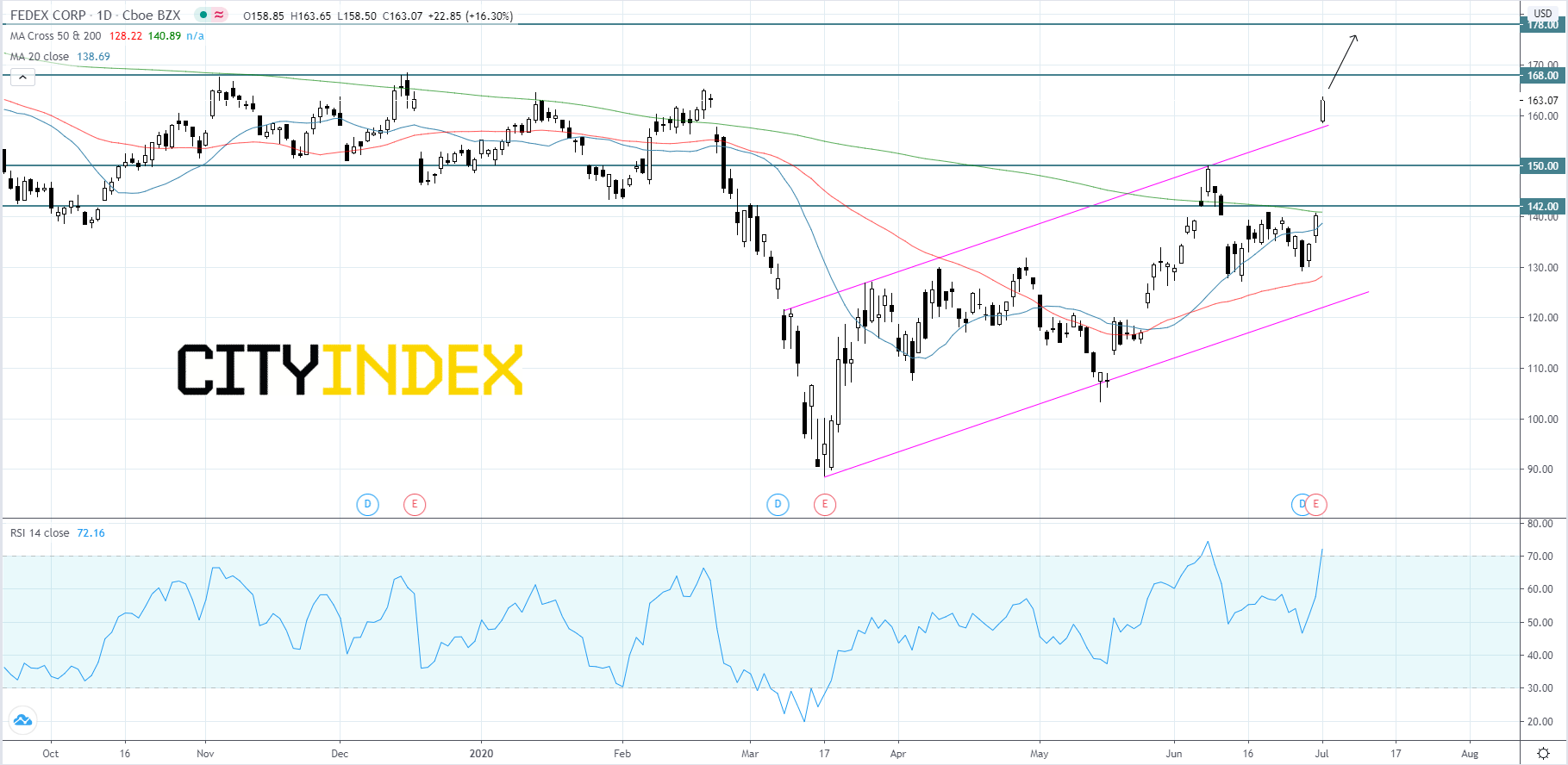

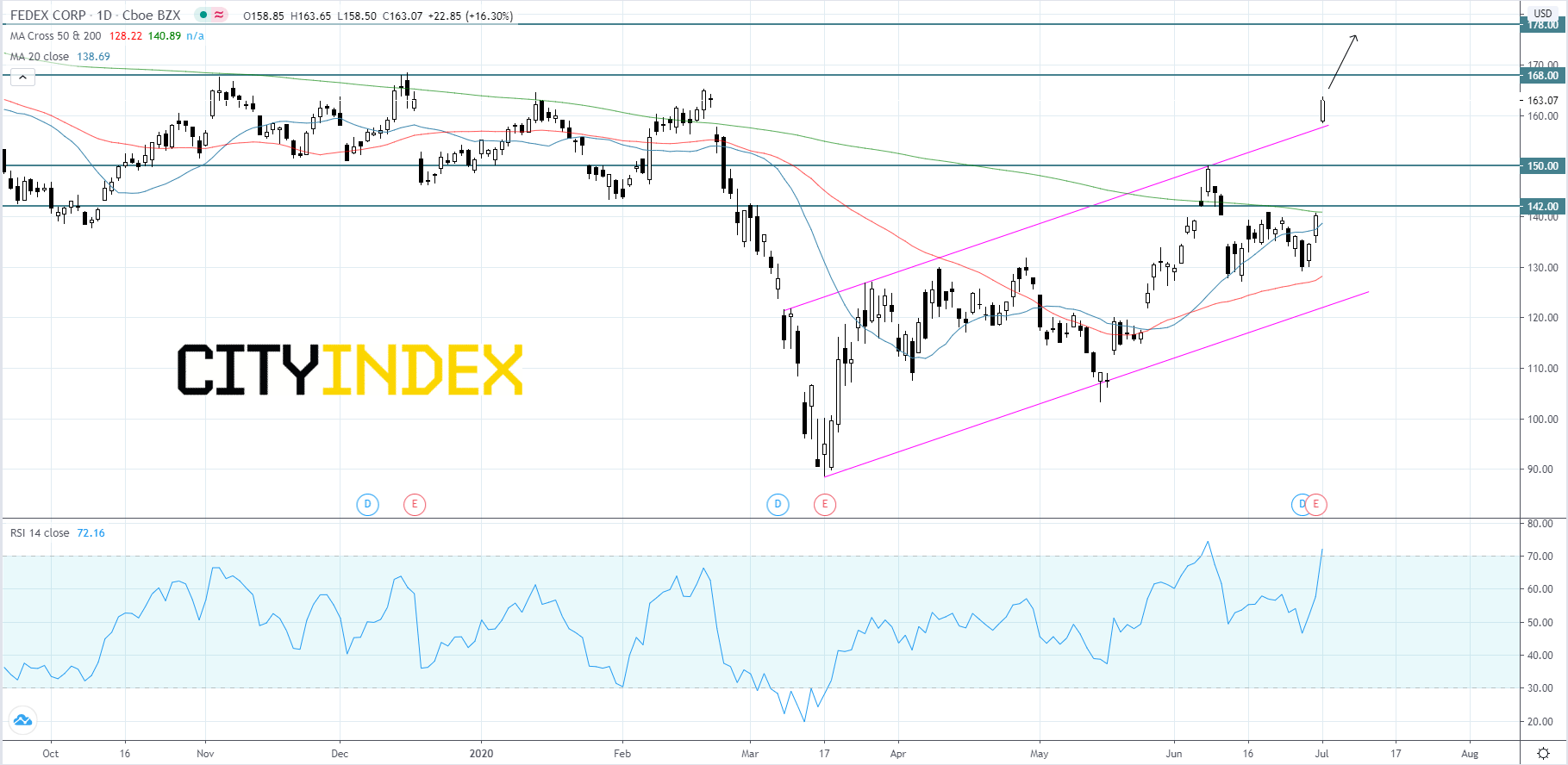

Looking at a daily chart, FedEx's stock price gapped above the upper trend line of an ascending channel that began to form in early-March. A gap up after news like an earnings release is a bullish signal. The RSI is currently in overbought territory holding above 70. Price is expected to hold above the upper trend line and continue advancing towards the $168.00 resistance level. If price can reach $168.00, it will mark a new high for the year, likely bringing in a new wave of momentum potentially pushing the price up to the $178.00 resistance level. If price fails to hold above the upper trend line we may see price dip back to the $150.00 support level. If price breaks below $150.00 support we may see price fall back to the $142.00 level on a short-term basis.

Source: GAIN Capital, TradingView

Looking at a weekly chart, FedEx's stock price has broken to the upside of a descending channel that price has been declining since September of 2018. If price can hold above the upper trend line this could be the beginning of a long-term up trend.

Source: GAIN Capital, TradingView

Looking at a daily chart, FedEx's stock price gapped above the upper trend line of an ascending channel that began to form in early-March. A gap up after news like an earnings release is a bullish signal. The RSI is currently in overbought territory holding above 70. Price is expected to hold above the upper trend line and continue advancing towards the $168.00 resistance level. If price can reach $168.00, it will mark a new high for the year, likely bringing in a new wave of momentum potentially pushing the price up to the $178.00 resistance level. If price fails to hold above the upper trend line we may see price dip back to the $150.00 support level. If price breaks below $150.00 support we may see price fall back to the $142.00 level on a short-term basis.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM