Biggest Gainer at the Opening Bell: Eli Lilly

On Tuesday morning, Eli Lilly (LLY), a developer and producer of pharmaceuticals gapped up over 10%.

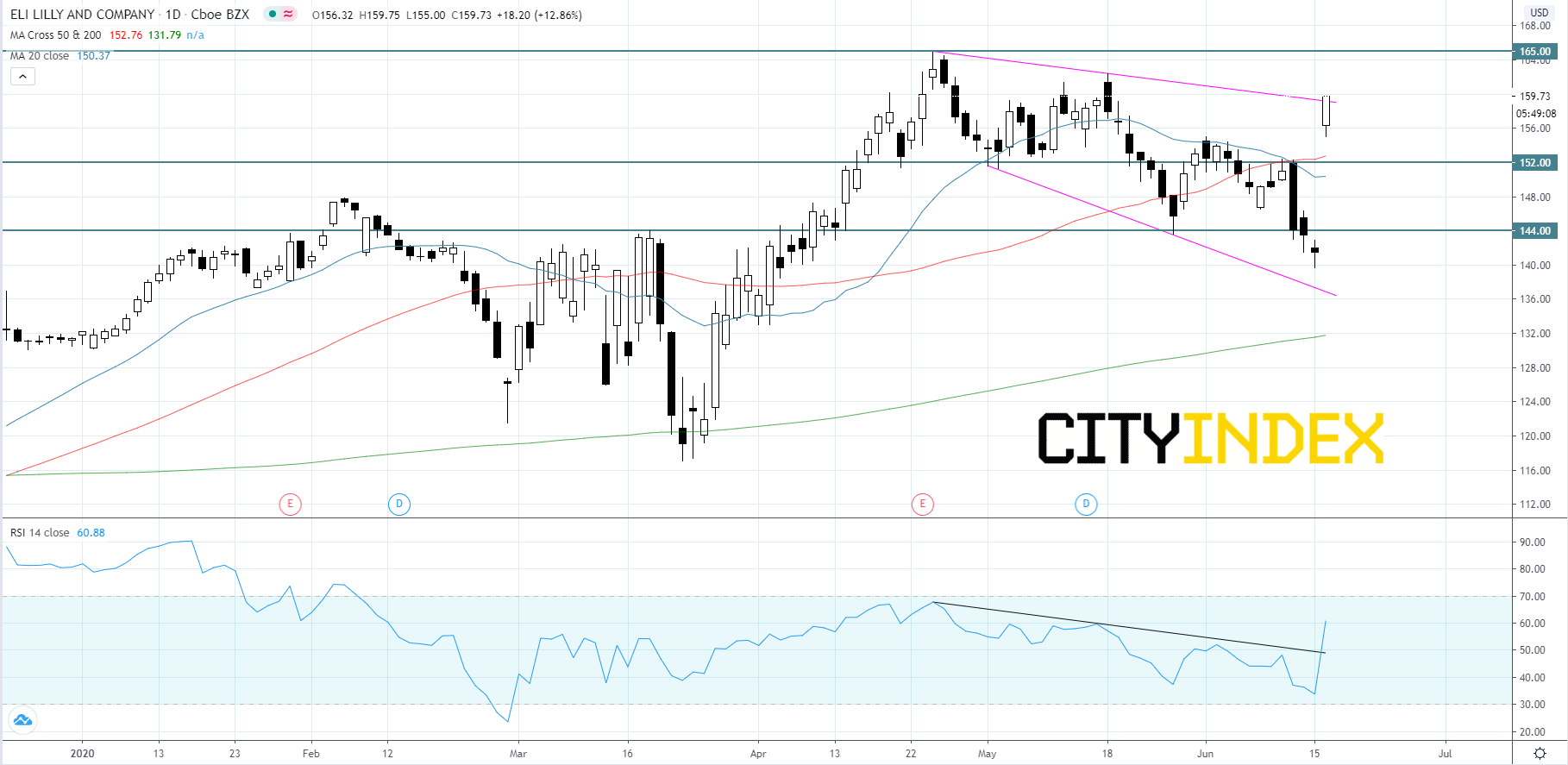

From a technical point of view, on a daily chart, Eli Lilly's stock price has been declining inside of a descending broadening wedge pattern that began to form after price topped out at around $165 on April 24th. The RSI was holding below a bearish trend line since April 24th This morning, the RSI broke above a falling trend line and is currently above 60. Price has reached a critical point within the descending broadening wedge pattern, even though the last few months have shown bearish sentiment, the massive gap up and RSI spike are very bullish signals. If price can hold above the $152.00 support then we will most likely see a retest of the all-time high at $165.00. If price can break $165.00 then price would likely continue advancing making new highs. If price cannot hold above the $152.00 support level, then price will probably fall back towards $144.00 and maybe even lower to touch the lower trend line.

Source: GAIN Capital, TradingView

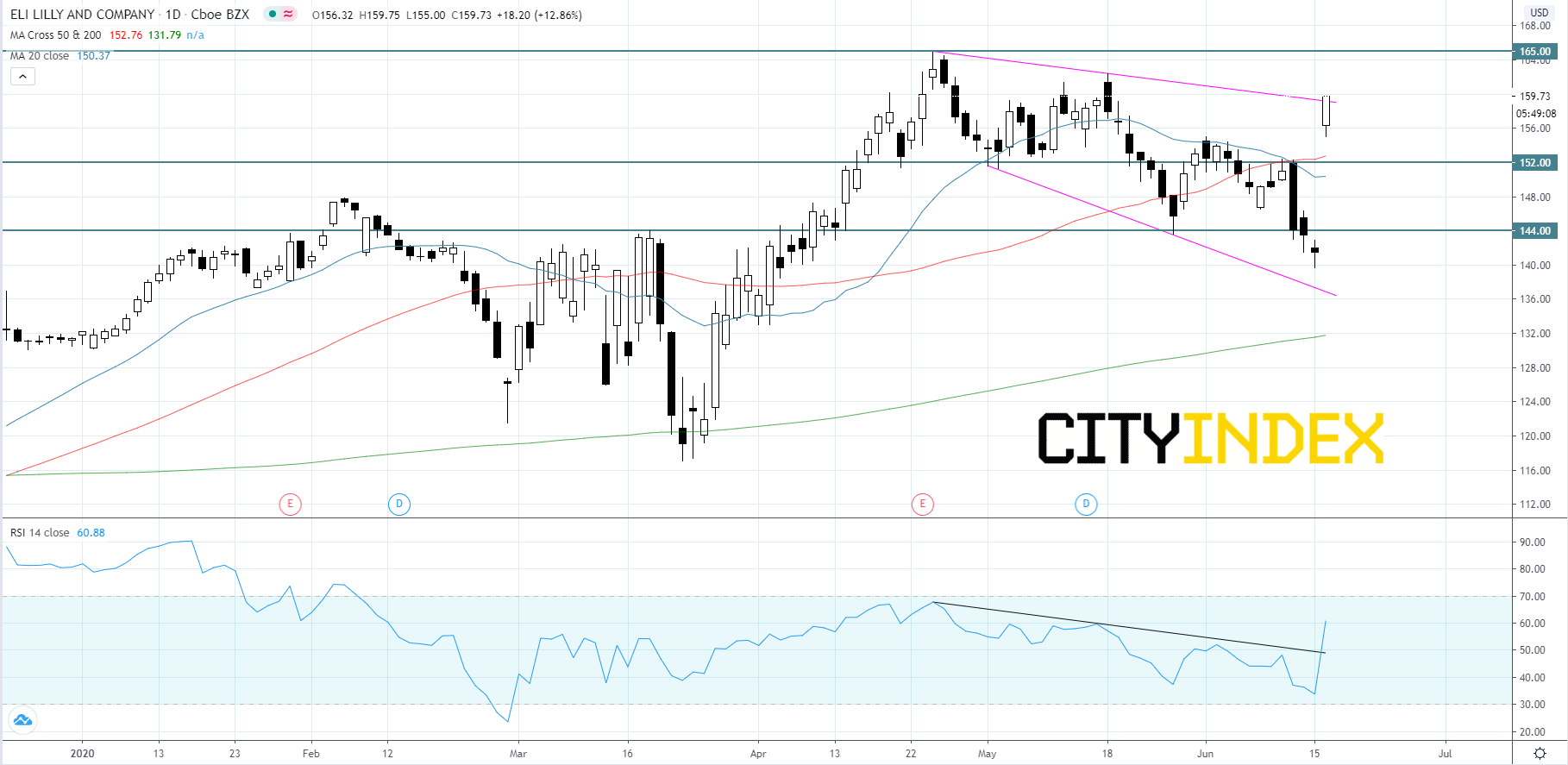

From a technical point of view, on a daily chart, Eli Lilly's stock price has been declining inside of a descending broadening wedge pattern that began to form after price topped out at around $165 on April 24th. The RSI was holding below a bearish trend line since April 24th This morning, the RSI broke above a falling trend line and is currently above 60. Price has reached a critical point within the descending broadening wedge pattern, even though the last few months have shown bearish sentiment, the massive gap up and RSI spike are very bullish signals. If price can hold above the $152.00 support then we will most likely see a retest of the all-time high at $165.00. If price can break $165.00 then price would likely continue advancing making new highs. If price cannot hold above the $152.00 support level, then price will probably fall back towards $144.00 and maybe even lower to touch the lower trend line.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM