The focus will be cost savings from technology, trading and loans as giant U.S. lenders report Q4 results

Banner year for banks

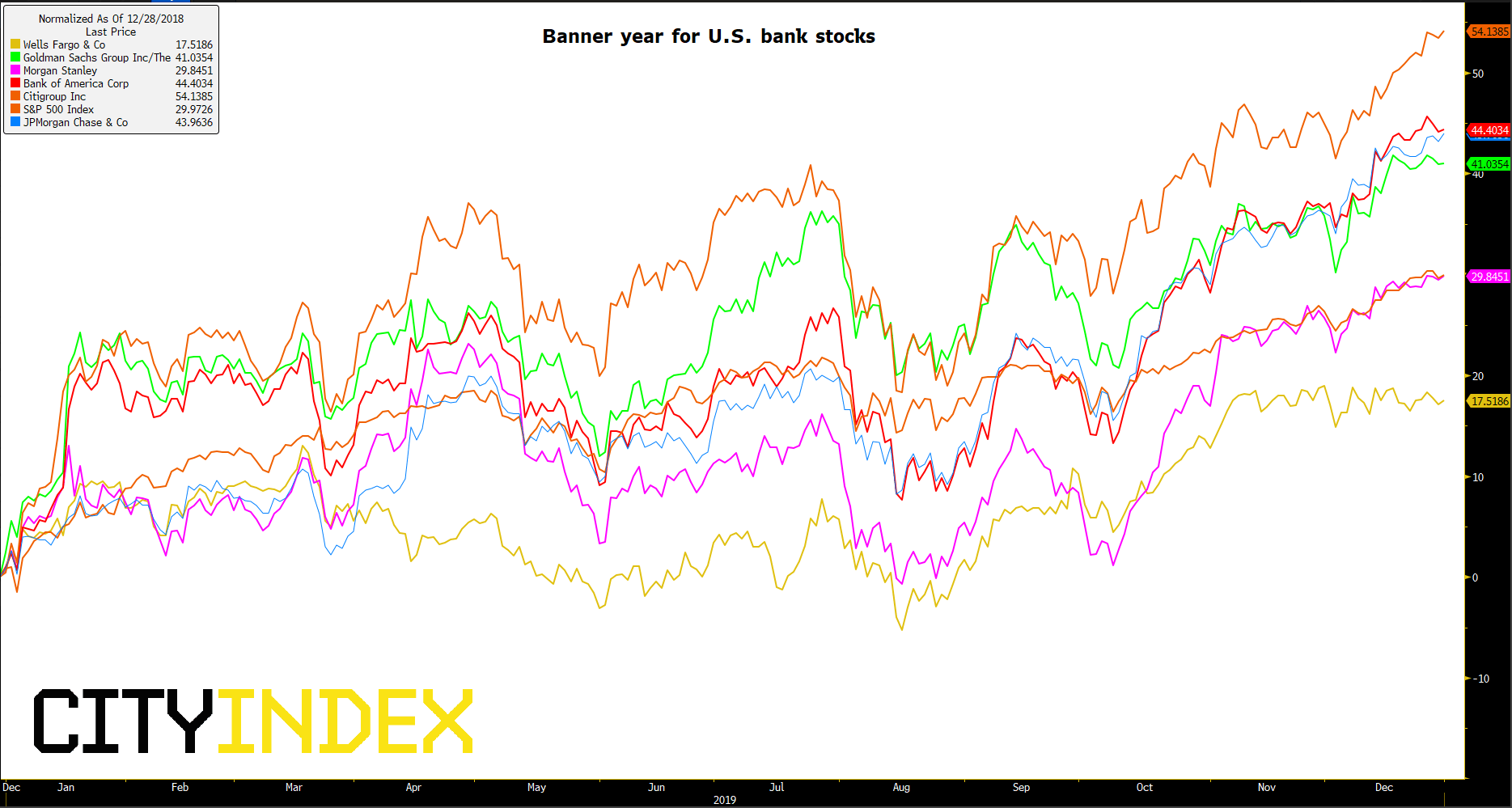

For all the craziness that buffeted stock markets in 2019, it was still a banner year for the big 6 U.S. bank shares. JPMorgan, Bank of America, Citigroup, Goldman Sachs, Morgan Stanley and even Wells Fargo each rose by two-digit percentages. The S&P 500 Banks Index gained 36.5%, its best annual gain since 1996. High U.S. employment, stable if not stellar growth and relatively firm inflation helped stave off negative sentiment on bank shares from the U.S.-China trade war. Meanwhile, angst over inverted yield curves abated as term spreads steepened. Lowered Fed rates continue to present unhealthy prospects for net interest income, but combined with the robust U.S. labour market, conditions have been perfect for a mini boom in consumer lending, especially via cards. Outstanding card debt rose 16% in the year to December, according to the Federal Reserve, the biggest contribution to U.S. consumer lending in 2019.

Costs cut as profits drop

This momentum ought to translate into a respectable set of earnings when the big 6 banks report quarterly results this week. Even so, consensus forecasts indicate a combined 10% profit drop across the dominant lenders in Q4, with decade-high profits of $120bn in 2018 difficult to beat. Investors are on the lookout for points of strength that may enable the best performing bank stocks to extend 2019’s run higher. For instance, Citigroup and JPMorgan initiatives to expand U.S. card market share should leave both well-positioned. Citi leads, with cards and services now accounting for 46% of its global consumer revenue. More broadly, banks’ investments in technology were a growing focus in Q4. As well as another front for cost cutting over the longer term, banks are spending to tighten digital strategies for better client engagement, and on innovation. Analytics and cybersecurity are also among priorities.

Trading places

Despite increasing stability, financial market trading remains among the least dependable generators of profits and growth across the big six lenders. Just in like in Q3 though, a poorly performing comparable period in the same quarter of the year before offers banks an easier bar to advance from in fixed-income, currencies and commodities (FICC). FICC sales rose 15% in Q3 after falling 7.6% in the year before. Q4 FICC results were negative by 6.6%. On the other hand, equity trading sales rose 13.1%, suggesting a more challenging task for banks to match or beat in the recent quarter. The exit of Deutsche Bank from most trading activities last year is another point to watch on the expectation that stronger trading players like JPMorgan, Citi and Goldman can pick up share. Even then, any trading gains won’t lift all boats given variable volatility and positioning. Further eye-catching misfires in banks’ markets businesses are likely.

Main Street blues

Back on Main Street, the booming lending market that has been banks’ strong suit over the last year also holds its own challenges. For one, the business loan market remained tepid through Q4. And banks with more global footprints, like Citi have also been subject to the impact of trade disputes, geopolitical volatility and market gyrations that discouraged corporate clients from borrowing. On the U.S. consumer side, loan ‘delinquency’ rates remain near recent lows, and lending standards appear more stringent than before the financial crisis. Nevertheless, investors are sensitive to surprises on aspects like net card charge offs rates, the level of current bad loans minus those recovered from prior quarters as a percentage of better-performing card loans. Banks going all-in on cards will bear the brunt of any upsets.

Normalised: Big Six U.S. bank shares in 2019

Source: Bloomberg

Below are the key points to watch and forecasts to know for JPMorgan, Citigroup, Wells Fargo and Bank of America

1. 14-Jan-2020 - JPMorgan Chase & Co Q4 2019 Earnings, before U.S. market open

As usual, JPMorgan’s sheer scale is providing advantages that rivals find difficult to match. A combination of tactical outspending on essential hit points – chiefly $11.5bn on technology last year—and reduced expenses elsewhere, for example, after relocating staff to less-expensive regions, should provide Q4 with a steady base. With deposit growth almost three times the total of the 12-largest regional banks combined since late 2015, and Q3 2019 deposit costs 100 basis points lower than their average, JPM also looks on track to meet an expected 11%-to-12% ‘core capital’ ratio (CET1). That ought to underpin the 12.50% Q4 dividend rise Wall Street expects, the same as in Q3, whilst other pay-outs also hit the mark. More broadly, the yield curve is inching away from problematic levels of a year ago, easing pressure on lenders. Still, JPM’s 2019 loan growth is forecast to badly lag major global rivals, -0.95% vs. a 5% median. Though net card ‘write-offs’ (charge-offs) are set to remain among the lowest for any U.S. bank, chances of a positive surprise in Q4 are moderate. JPM has missed its top-line estimate every December quarter since 2013. Consensus revenue: $27.84bn, +3.9%; EPS: $2.33, +18%

2. 14-Jan-2020 - Citigroup Inc Q4 2019 Earnings, before U.S. market open

Citigroup has signalled that its cost cutting programme is ahead of target following late-2019 headcount reductions. Efficiency savings through 2020 should now be at least $2.8bn, compared with an initial $2.5bn goal. Citi is also on track for an aggressive reduction of its customer footprint, meaning fewer locations, aiming for zero impact on customer numbers, but with a positive effect on expenses. The group also indicated that its $60bn three-year pay-out goal is on plan. That should propel gross returns to shareholders in 2019/20 over 100% of earnings in 2019, as per 2018. The 51 cents per share quarterly dividend pace set this year should be matched in Q4. Still, with CEO Michael Corbat reiterating in May that outsized capital return will focus on buybacks, those eyeing a pay-out surprise will look beyond dividends. Key risks hinges on disappointment: Citi stock soared around 54% last year, reducing investor tolerance for less than perfect execution. Consensus revenue: $17.88bn, +4.4%; Adjusted EPS: $1.83, +13.9%

3. 14-Jan-2020 - Wells Fargo & Co Q4 2019 Wells Fargo & Co Earnings, 13.00 GMT

Ironically, despite being hamstrung for over three years by a Federal Reserve restriction on growth, Wells Fargo attracted increasing interest due to peer-leading pay-outs. The shares still sharply underperformed in 2019 but began 2020 up over 20% from a mid-August cycle low. That left WFC with a respectable 10% one-year advance. That pales against high double-digit gains by all key rivals. Whilst improved, sentiment on the shares remains wary. It will be up to newly appointed CEO Charlie Scharf to engineer a break in perceptions from the bank fined and sanctioned for a fake account scandal. The timeline for the Fed to remove restrictions is still opaque. Meanwhile, key branch metrics signal progress with customer growth, albeit this is unlikely to be spectacular overall. With the richest dividend yield and pay-out ratio among the big six U.S. banks, cash return remains the best defence for Wells shares against upsets. The quarterly dividend is again forecast to rise 18.6%. Consensus revenue: $20.03bn, -4.7%; Adjusted EPS: $1.10, -0.4%

4. 15-Jan-2020 - Bank of America Corp Q4 2019 Earnings, 11:45 GMT

Manageable credit card write-off rates (AKA net charge-offs) in the three months to mid-December and steadily declining account acquisition costs imply a tailwind for BofA. The bank enjoyed the least costly account growth compared to all but one major U.S. bank in Q3. It also paced the account growth of small regional rivals combined by 15%. BofA also had a free hand at selective deposit growth, cutting branches in less cost-effective areas whilst accelerating in higher-potential regions. On top of baseline advantages, a record Wealth & Investment Management margin in Q3 was achieved with help from higher fees. The group’s corporate investment bank may pose a negative counterbalance, as weakness sets in in 2020. Trading revenues will remain variable though weak overall at all giant lenders but BofA kept pace in light negative territory in 2019. Consensus revenue: $22.40bn, -1.7%; Adjusted EPS: $0.69, -2.8%

5. 15-Jan-2020 - Goldman Sachs Group Inc Q4 2019 Earnings, before U.S. market open

Goldman Sachs under fresh CEO David Solomon has managed to capture the spotlight with eye-catching moves, though these have been backed with substance in recent quarters. GS is set for the highest total loan growth among heavyweight rivals with 6.2% forecast in 2019/20. That compares with a 5% rise at Bank of America. M&A advisory looks to be another dependable prop. GS had the top global spot by announced deal volume through late December, enabling the bank to keep its lead for a third year. Elsewhere, Apple Card and other initiatives aimed at lowering the average age of clients and broadening their economic profile remain promising but are low-potential opportunities in the short term. GS’s revitalised trading business holds more, particularly after Deutsche exited equities in 2019. Goldman’s total 2019 markets revenues are forecast to fall 3%, the least bad relative to competitors. With a still leading dependence on markets, a modest upturn in any trading segment would underpin Goldman’s top line. GS stock would also be set to extend its 2019 rise of 40%. Conversely, the stock may retreat, depending on the extent of any let-down. Consensus revenue: $8.54bn, +5.7%; Adjusted EPS: $5.34, +12.5%