Big miss to NFP, will it keep the Fed on hold?

The Non-Farm Payroll headline print for August was unexpected to say the least. The US economy added just 235,000 jobs to the economy vs 750,000 expected. (See Matt Weller’s NFP Preview here). The July revision from 943,000 to 1,053,000 was hardly a consolation given the large miss for August. On the positive side, the Unemployment Rate fell to 5.2% from 5.4% and Average Hourly Earnings increased to 0.6% from 0.3%. However, the damage may have been done for those who considered conditions met for the Fed to announce tapering at the September meeting.

At the Jackson Hole Symposium, Jerome Powell said that there is “much ground to cover” for the Fed to meet its employment goals, which would give them the go-ahead to taper. Today’s Non-Farm Payroll print does not offer much hope for that goal to be met. To the dismay of many Fed forecasters, this may mean that a taper announcement will not occur at the September meeting, getting pushed further out into Q4. At least the Fed should be happy that as inflation is heading higher, earnings data shows that wages are moving higher as well.

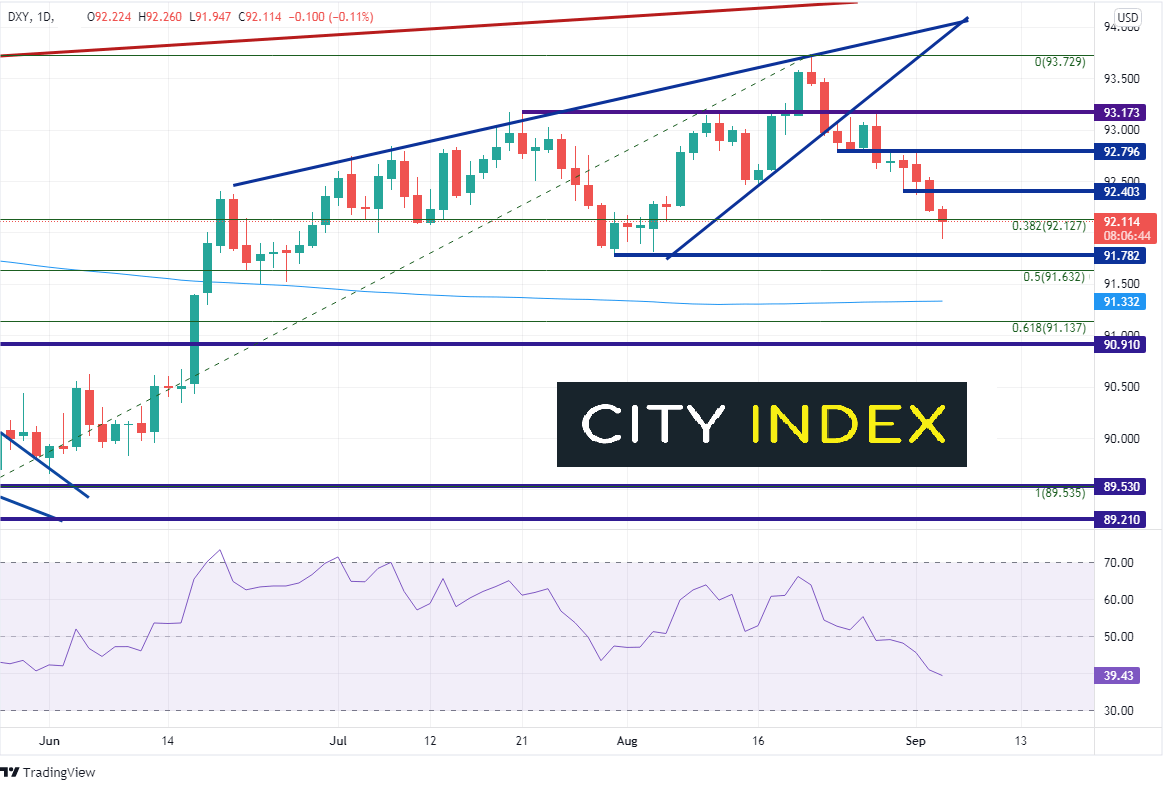

The US Dollar sold off 92.23 down to 91.94 immediately following the release of the data and has now broken through the 38.2% Fibonacci retracement from the May 25th low to the August 20th highs, near 92.12. If today closes below 92.22, it will be the 9th of the past 11 days that the DXY will have closed lower. Horizontal support is near 91.78, followed but the 50% retracement level near 91.63 and the 200 Day Moving Average at 91.33. Although it is possible for price to bounce in the near-term, the charts show that it will be difficult to make any headway on the upside. If price closes above or near 92.22, a hammer will have formed. Horizontal resistance above is at 92.40 and 92.80. The August 20th highs are at 93.73.

Source: Tradingview, Stone X

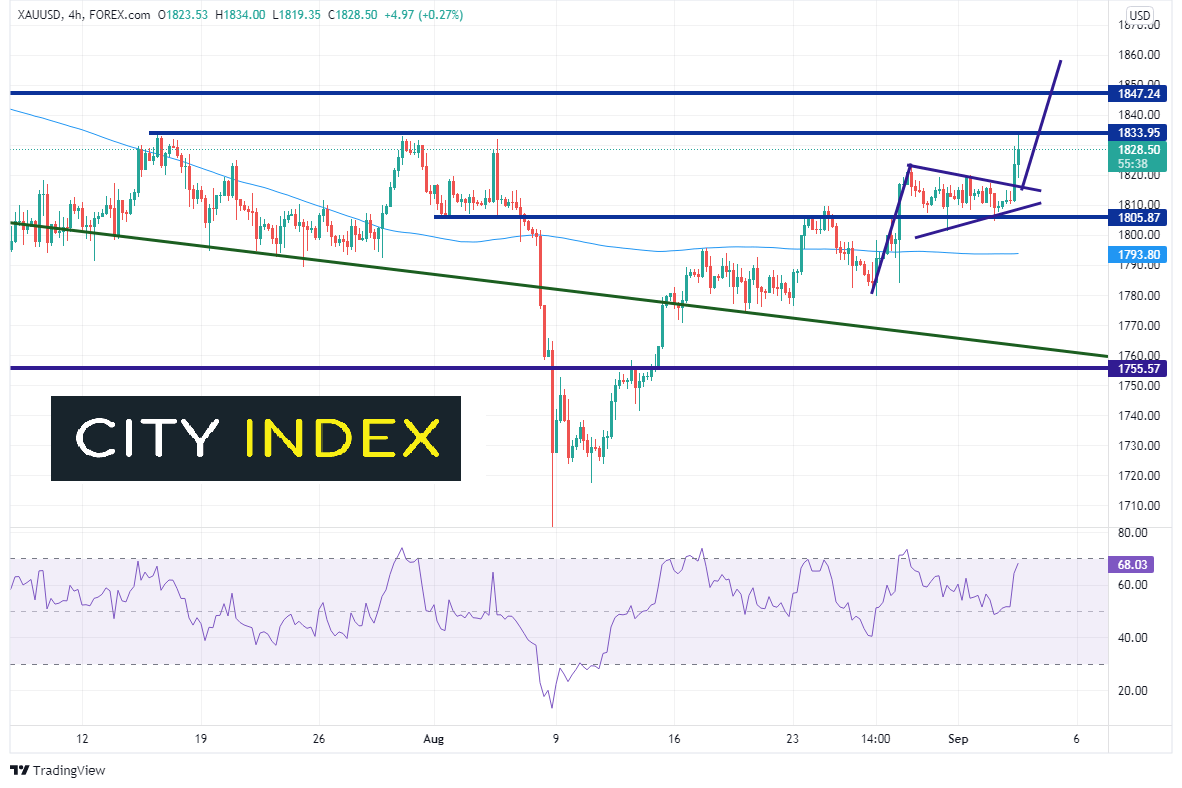

Although the weaker print is bad for the US Dollar, it was good for the price of Gold (XAU/USD). On a 240-minute timeframe, Gold broke higher out of a pennant formation on the release of the data. The target for the pennant is near 1857, however price must first get through strong horizontal resistance at 1834 and again at 1847.25. Support is at the top trendline of the pennant near 1818 and then the bottom trendline and horizontal support near 1805.

Source: Tradingview, Stone X

The Non-Farm Payroll print today was much weaker than expected. This may have dashed any hopes of a Fed taper announcement at the September 22nd meeting. It was also bad news for the US Dollar, however it was good news for Gold!

Learn more about forex trading opportunities.