Like a high schooler procrastinating on starting his term paper until the night before its due, President Biden finally announced his long-awaited nomination for the next Federal Reserve Chair. Assuming he can pass an increasingly inflation-sensitive Senate confirmation, incumbent Fed Chairman Jerome Powell will be appointed to another 4-year term as leader of arguably the planet’s most important financial institution.

In retrospect, it’s clear why Biden delayed for so long: There was little upside regardless of who he chose. From a political perspective, some members of his own party (prominently including Senator Elizabeth Warren) came out strongly against re-appointing Powell, a Republican who was initially appointed by former President Trump. However, nominating the Democrat’s alternative candidate, Lael Brainard, risked further politicizing the Fed and arguably would have exacerbated inflationary pressures through her more dovish outlook at a time when the voting populace is growing increasingly frustrated with the “transitory” rise in prices (As it turns out, Brainard’s consolation prize was to be nominated Vice Chair).

Ultimately, President Biden decided that reappointing Powell served the President’s own “dual mandate” to maintain continuity of monetary policy and protect the political independence of the Fed. With inflation still running well above the central bank’s target, traders will now turn their eyes to the December Fed meeting and whether the central bank will accelerate its tapering pace.

Market reaction

In any event, Powell’s reappointment was always the market’s “base case” (though far from a done deal), so market movements have been relatively limited on the official announcement. The benchmark 10-year treasury bond yield is effectively unchanged at 1.58%, though US stock index futures have bounced back toward their morning highs.

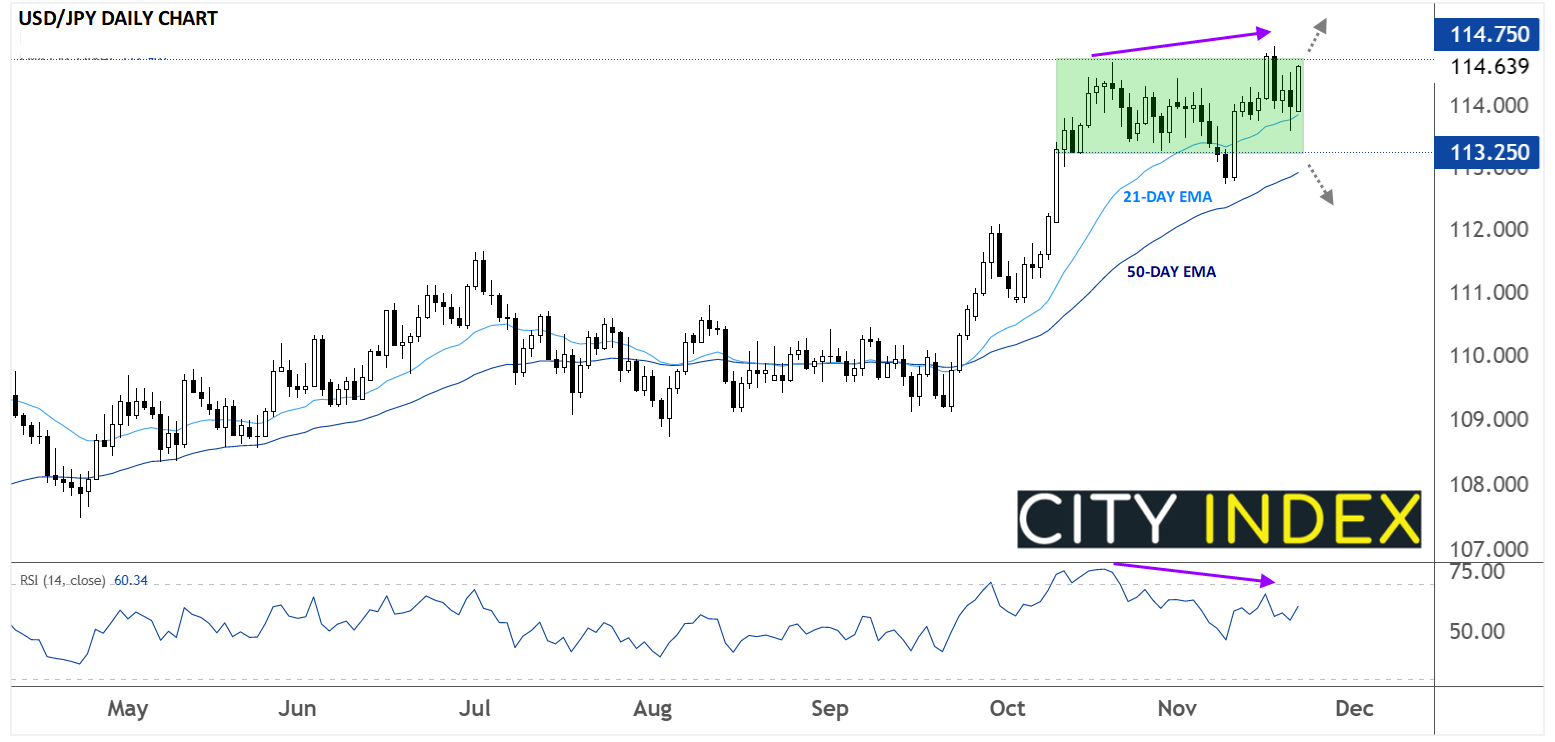

The more interesting move is in the world’s reserve currency. The US dollar is gaining against most of her major rivals on the day, with USD/JPY in particular seeing a sizable rally. As the chart below shows, the pair is approaching key previous resistance at the 114.75 level, the highest rate the unit has hit since Q1 2017:

Source: StoneX, TradingView

Looking ahead, the 114.75 barrier will be absolutely critical. USD/JPY is still technically showing a bearish divergence with its 14-day RSI, suggesting a higher risk of a bearish reversal off this resistance level, but a strong rally through that level later this week could quickly shift the bias back in favor of the bulls after the unit spent its last five weeks consolidating in a “high base” pattern.

As it stands, USD/JPY’s near-term outlook is neutral, but a confirmed break either above 114.75 or below 113.25 could set the technical bias for the rest of the year.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade