BHP: increases oilfield stake

BHP Group, a giant metal mining group, announced that it has agreed to acquire an additional 28% working interest in Shenzi, a six-lease development in the deepwater Gulf of Mexico, from Hess Corporation for 505 million dollars. The company said the acquisition would bring its working interest to 72% and immediately add approximately 11,000 barrels of oil equivalent per day of production.

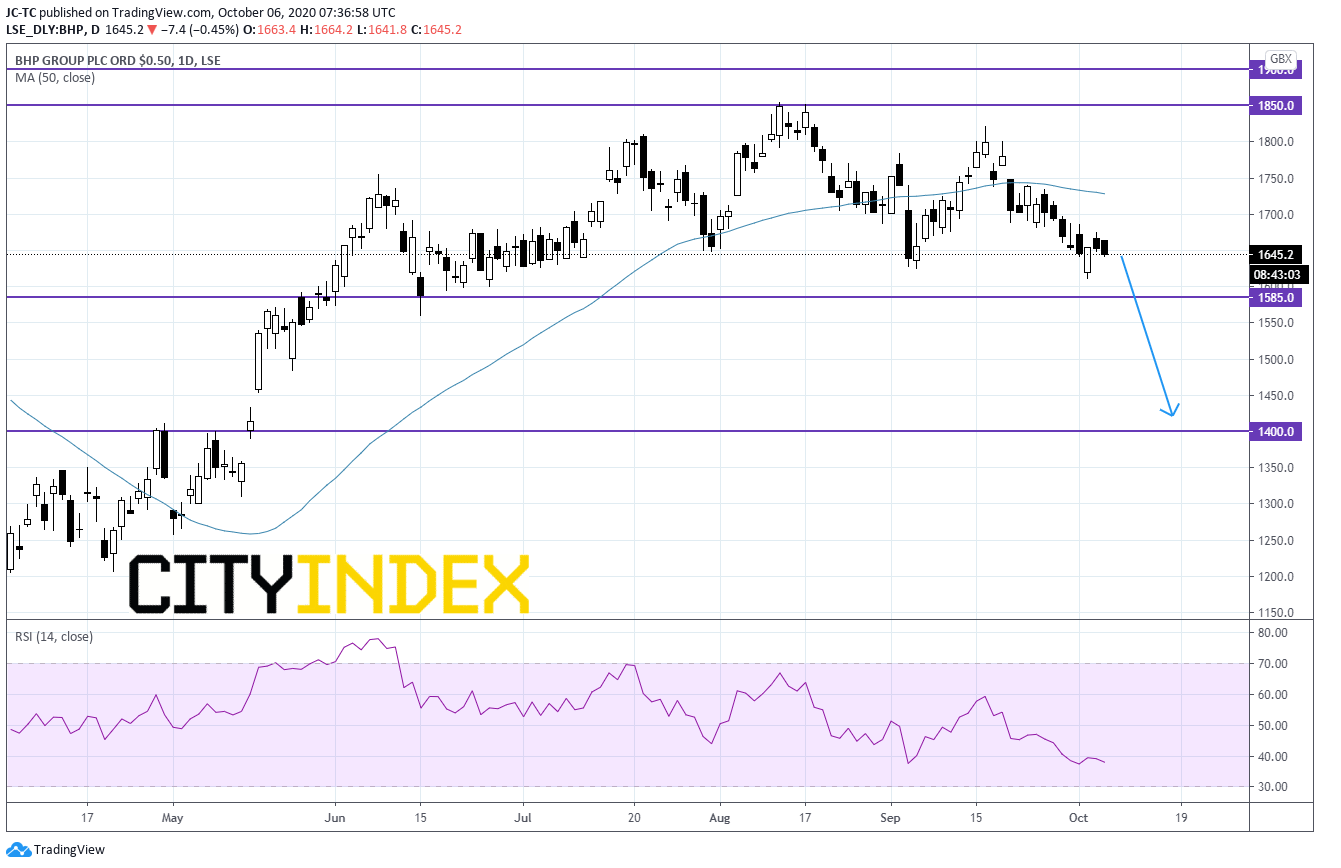

From a chartist point of view, on a daily chart, prices remain stuck below their 50 day MA, negatively oriented above prices while the RSI is still in bearish territory. As long as the 8848 resistance is not broken, readers may therefore consider a new test of the 1585 support. A break below that level would call for further downside towards 1400.

From a chartist point of view, on a daily chart, prices remain stuck below their 50 day MA, negatively oriented above prices while the RSI is still in bearish territory. As long as the 8848 resistance is not broken, readers may therefore consider a new test of the 1585 support. A break below that level would call for further downside towards 1400.

Source : TradingVIEW, Gain Capital

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM