Beyond Meat (BYND)

click to enlarge chart

Key elements

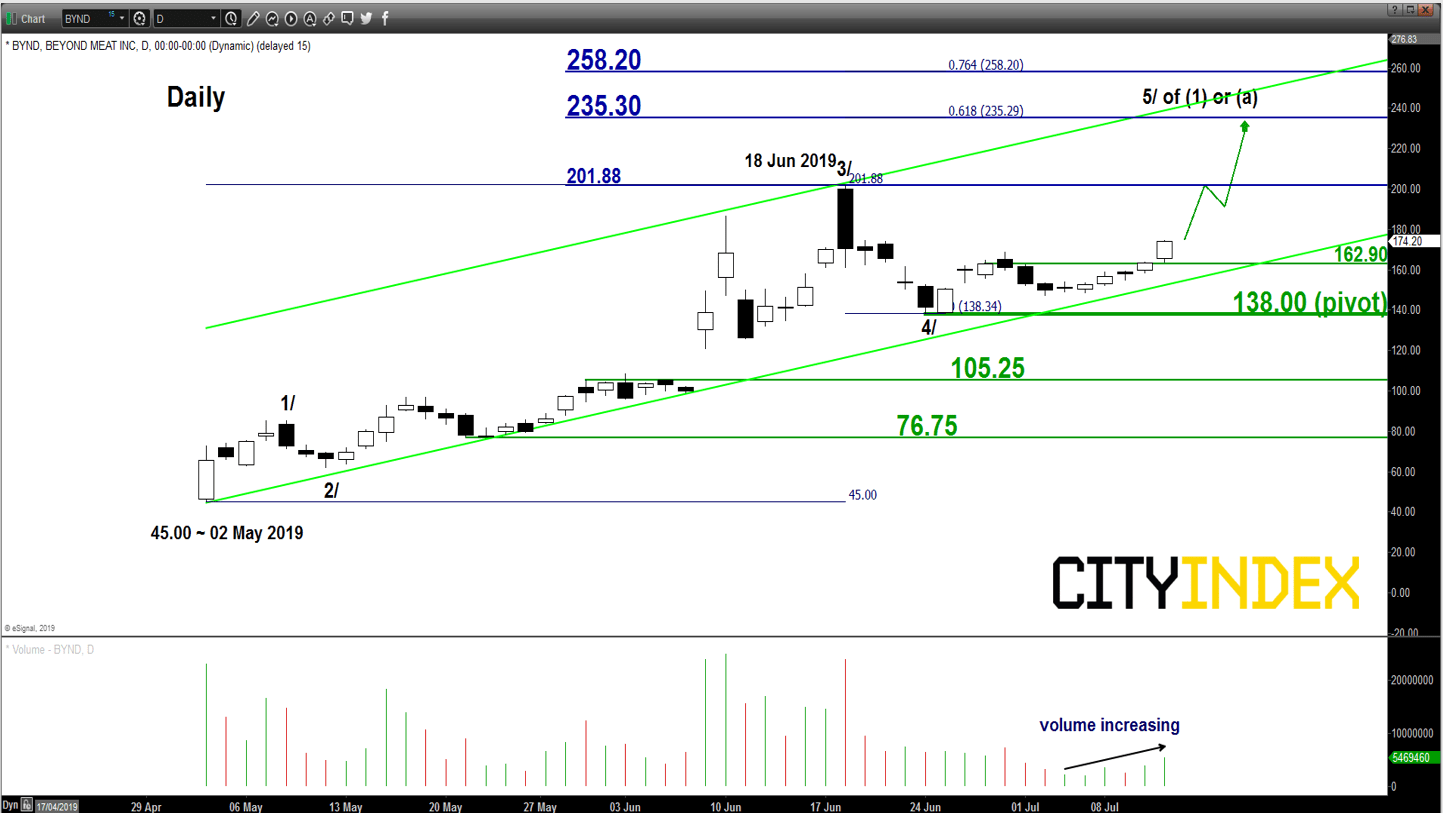

- Since Beyond Meat (BYND) IPO on 02 May 2019, it has soared by a whopping 340% to print a recent high if 201.88 on 18 Jun 2019. Its current stellar performance has made BYND the best IPO so far this year.

- Its share price has continued to evolve within a medium-term ascending channel since 02 May 2019 low of 45.00

- Elliot Wave/fractal analysis suggest that it may have completed the corrective pull-back, wave 4/ from 16 Jun high of 201.88 to 24 Jun low of 138.00 (around 38.2% retracement of the prior steep impulsive up move from 10 May low to 18 Jun high). Thus, the recent push up of 26% to yesterday, 11 Jul high of 174.24 is likely to start of the 5th wave, labelled as 5/ on the chart to complete the entire medium-term bullish cycle in place since 02 May 2019 before a significant correction of approximately 30% to 40% materialises.

- The aforementioned 5/wave target stands at 235.30 (0.618 Fibonacci expansion of the up move from 02 May low to 18 Jun high projected from 24 Jun low) which also confluences with the upper boundary of the ascending channel.

Key Levels (1 to 3 weeks)

Intermediate support: 162.90

Pivot (key support): 138.00

Resistances: 201.88 & 235.30

Next support: 105.25

Conclusion

If the 138.00 pivotal support holds, BYND is likely to continue its upleg to retest the recent all-time high of 201.88 before targeting the significant medium-term resistance at 235.30.

On the other hand, a break with a daily close below 138.00 invalidates the bullish trend to kickstart a corrective down move sequence towards the next support at 105.25 in the first step.

Chart is from eSignal

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM