Betting on a William Hill stock price recovery?

William Hill, the betting and gaming company, reported that net revenue declined 57% on year in the "Coronavirus-impacted" period from March 11 to April 28. The company said: "Furthermore, each additional month of shop closures will now lead to a reduced EBITDA impact of £12m to £15m. In light of the limited visibility regarding the nature and duration of COVID-19 related restrictions, we are withdrawing all future guidance."

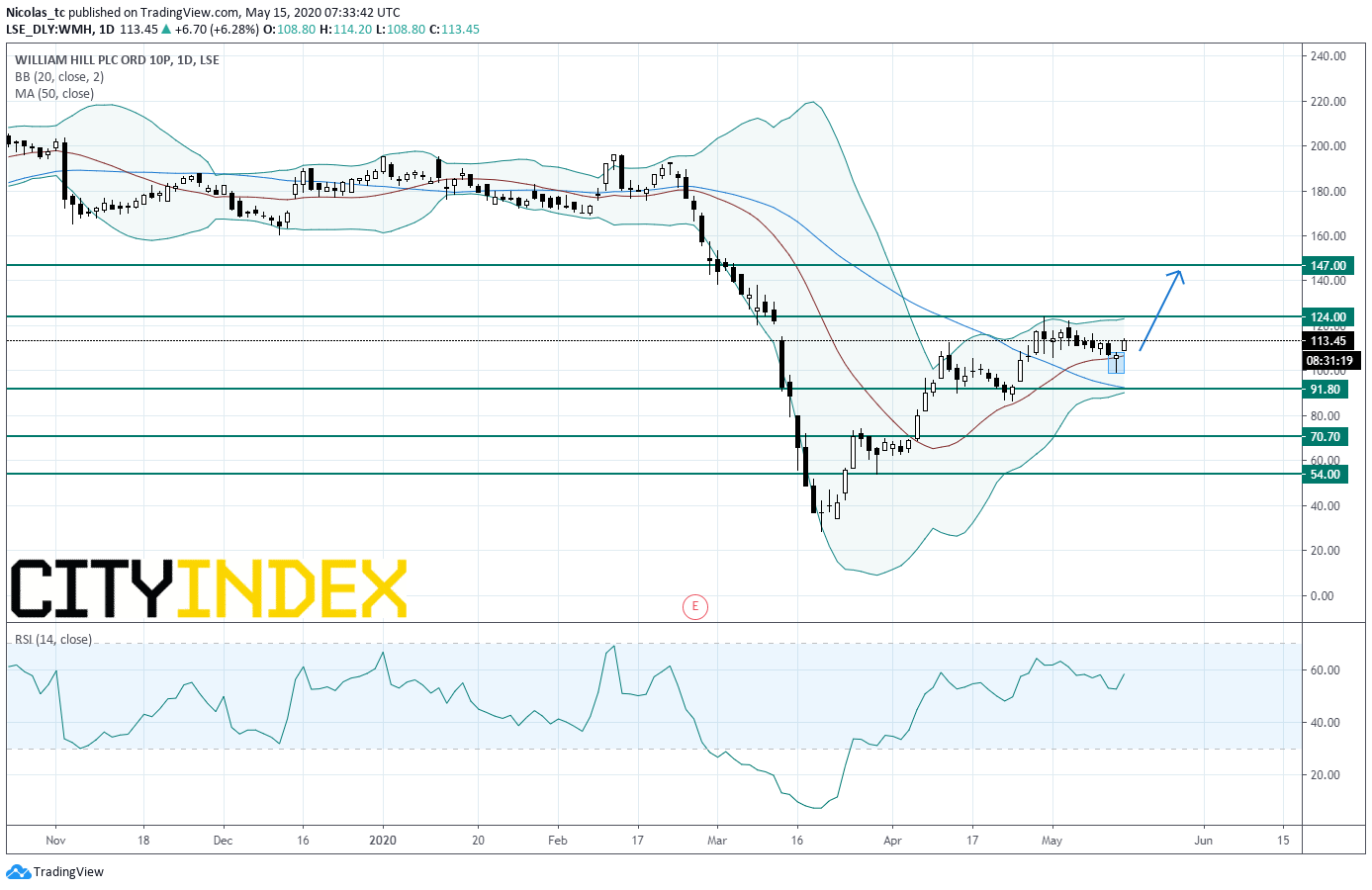

From a technical perspective, the stock price has landed on its 20-day simple moving average and is posting a rebound. The bullish gap opened this morning and the long lower shadow candlestick formed yesterday should maintain a bullish bias. The daily Relative Strength Index (RSI, 14) is above 50% and is not overbought (<70%).

As long as 91.8p is support, the bias remains bullish with 124p and 147p as next targets.

Alternatively, a break below 91.8p would call for a reversal down trend towards 70.7p and 54p.

Source: GAIN Capital, TradingView

Latest market news

Today 01:15 PM

Today 07:49 AM