Better US Markit Numbers Spike the US Dollar: DXY, Gold, USD/JPY

The US Markit PMI Flash data for November was much better than expected today. However, what seems to have caused the US Dollar to spike were the comments from IHS Markit Chief Business Economist Chris Williamson, who said:

“However, the surge in demand and hiring has pushed prices and wages higher. Average selling prices for goods and services rose at the fastest rate yet recorded by the survey, with shortages of supplies also more widespread than at any time previously reported.”

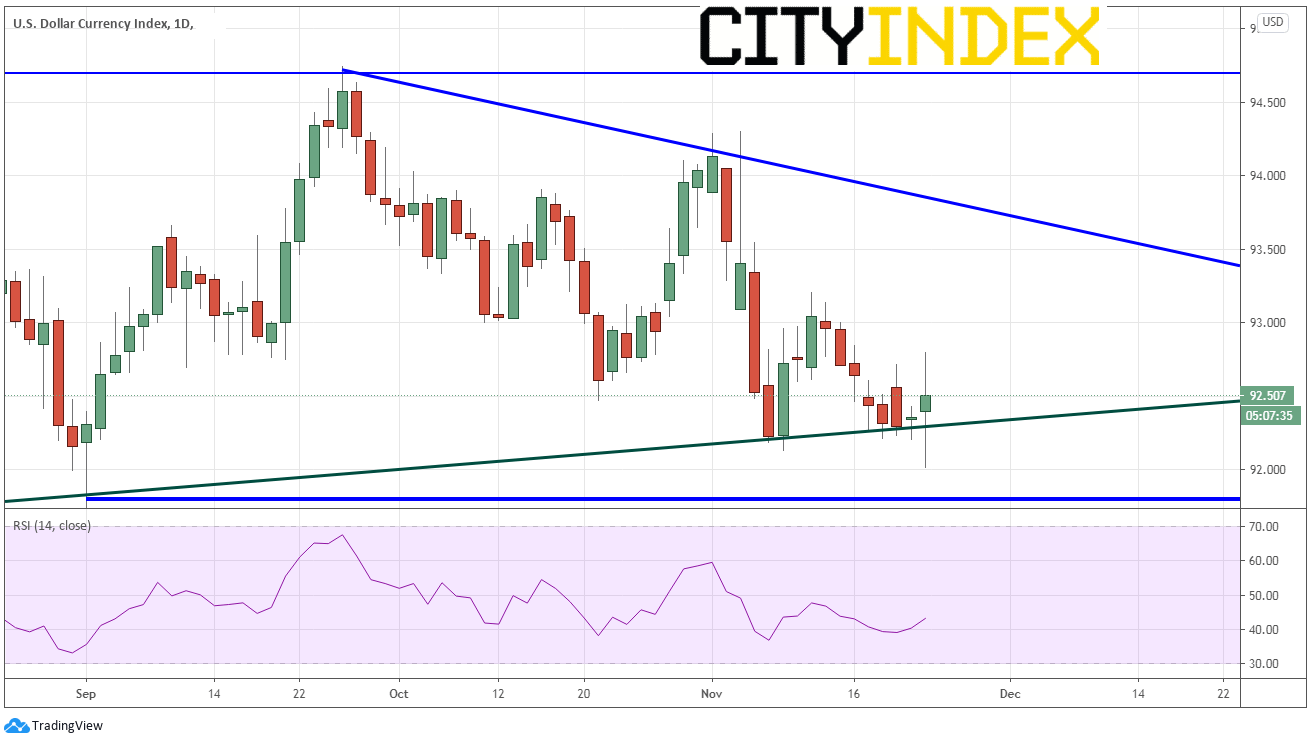

DXY

On a daily timeframe, the DXY has tried many times to close under the upward sloping trendline (green) dating back to 2011 near 92.20 yet has failed to do it. Today’s price action shows another attempt, but it has failed to do so.

Source: Tradingview, City Index

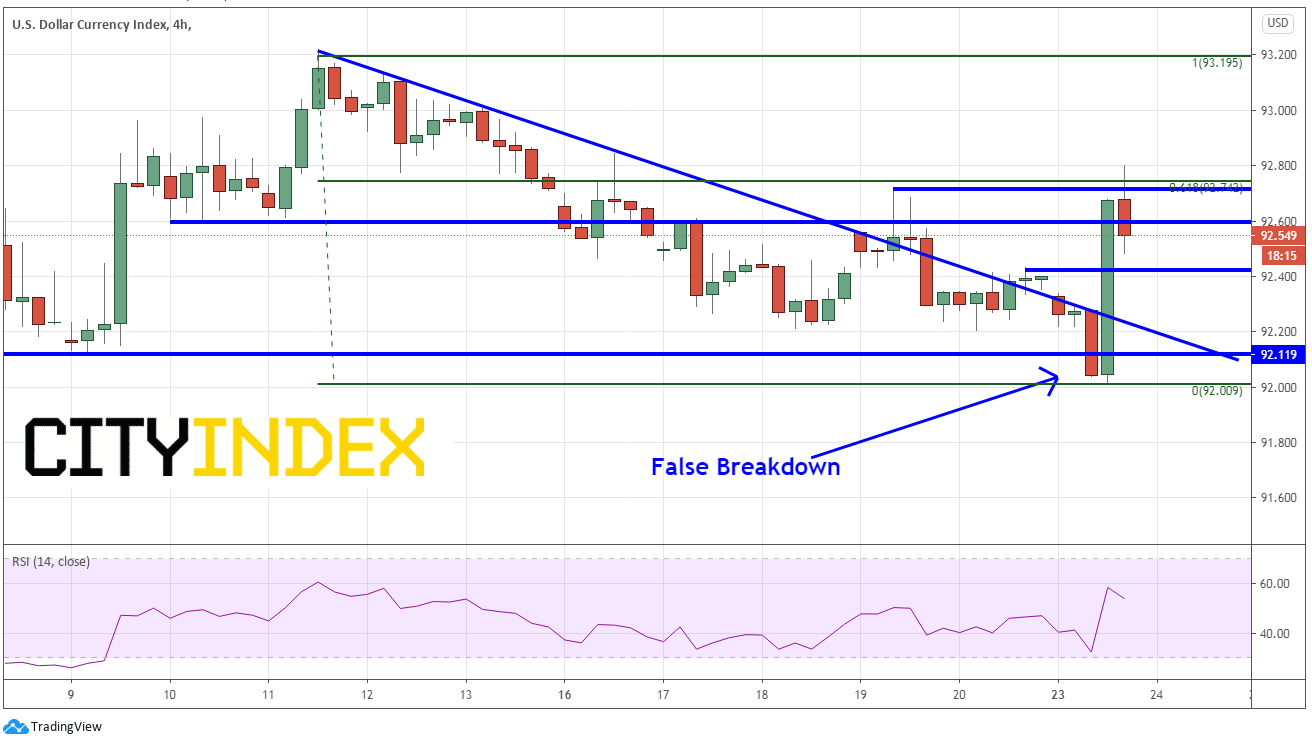

On a 240-minute timeframe, price posted a false breakdown below the November lows of 92.13, only to spike through the top of the descending triangle. The DXY was unable to hold horizontal resistance above the November 19th highs and the 61.8% Fibonacci retracement area from the November 11th highs to today’s lows, near 92.72. Horizontal support is now down at 92.43, and todays lows of 92.01.

Source: Tradingview, City Index

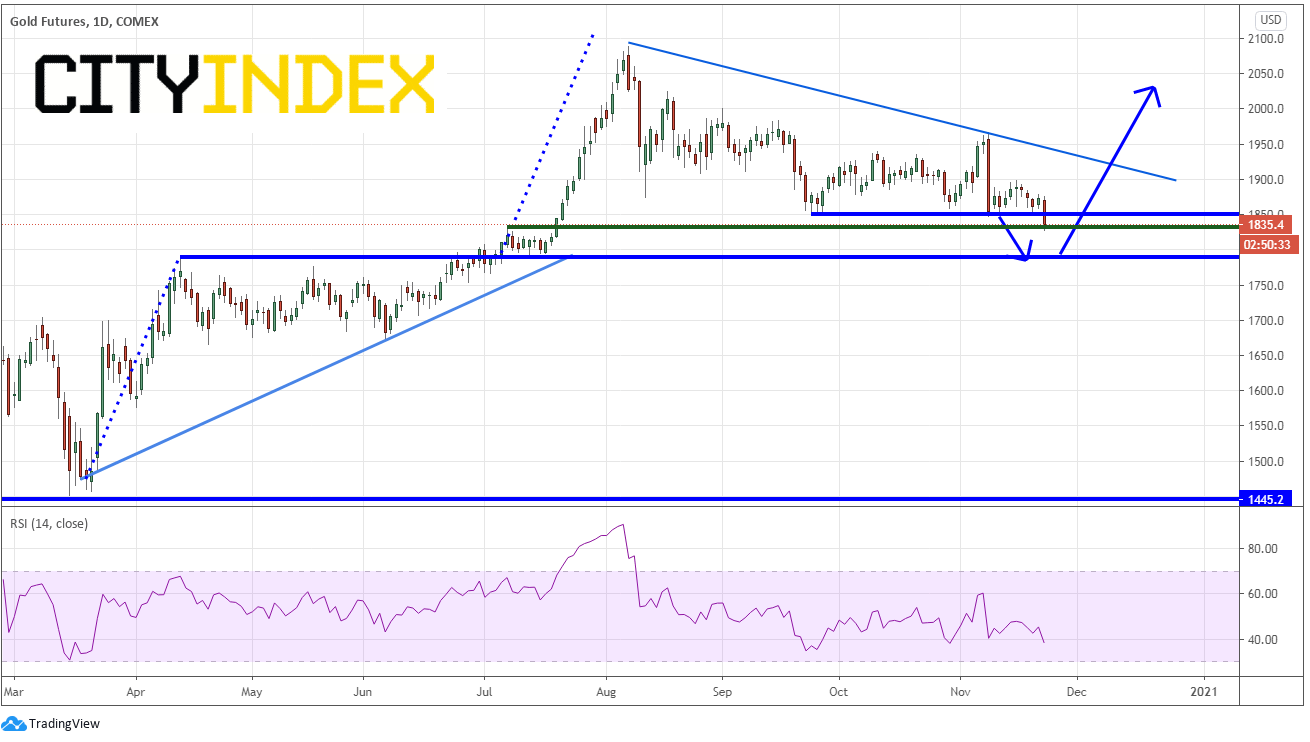

Gold

Although it may not have been what we have seen lately, Gold and the DXY traditionally trade in opposite directions. However, today as DXY broke higher, Gold broke lower. Gold futures broke lower below the first level of horizontal support at 1851, however it could not close below stronger support at 1828. If Gold does break through the horizontal support, watch for the precious metal to move as low as 1788, where it may bounce.

Source: Tradingview, COMEX, City Index

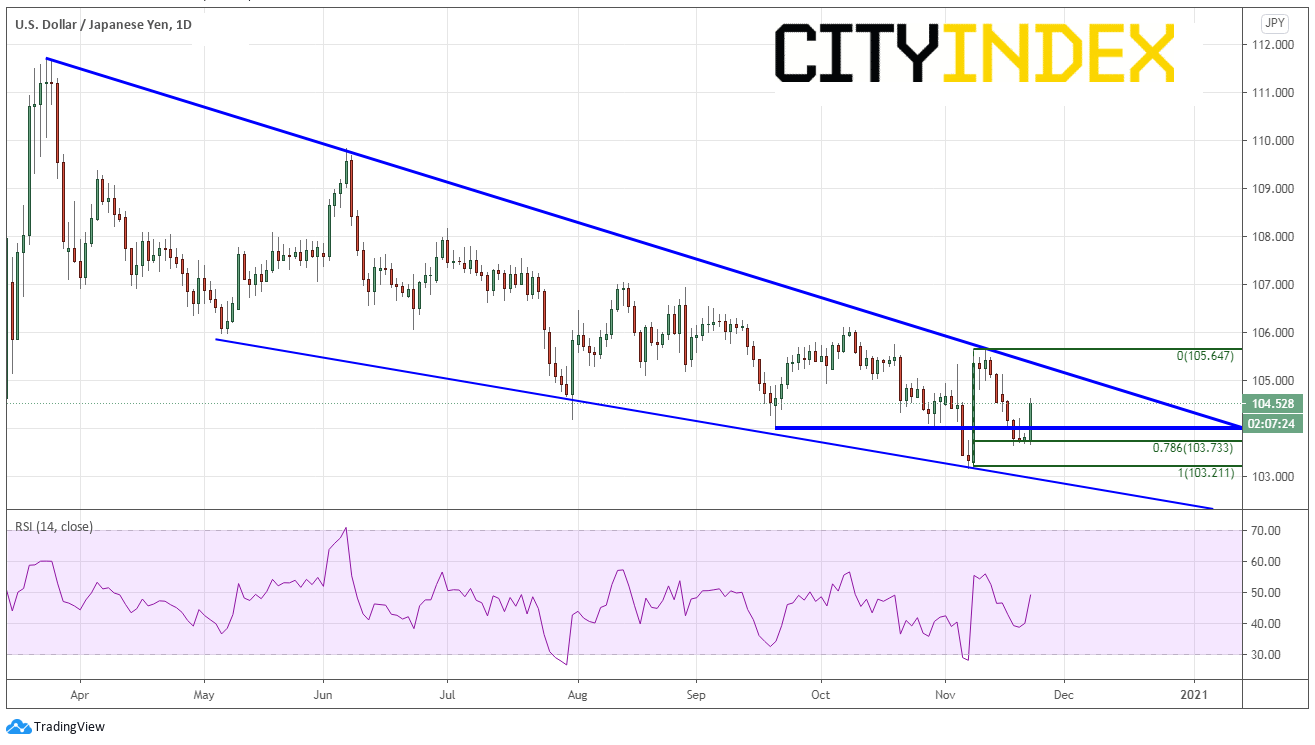

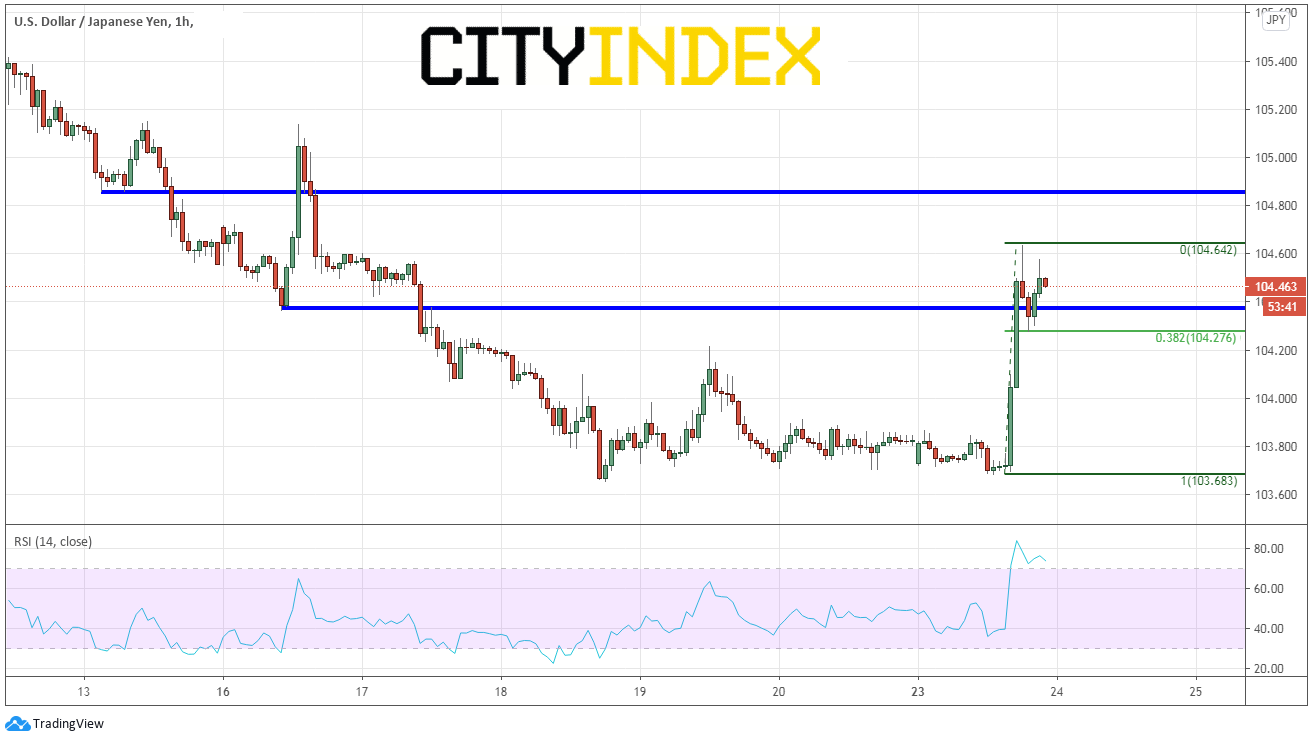

USD/JPY

The USD/JPY has been in a descending wedge since March 23rd. On November 9th, the pair spiked higher to the top of the wedge and began retracing. However, the pair could only move back to the 78.6% Fibonacci retracement level from the November 9th lows to highs (this was the date the Pfizer vaccine news was announced.) However today, USD/JPY spiked higher with the DXY.

Source: Tradingview, City Index

On a 60-minute timeframe, after today’s move higher, the pair could only pull back to the 38.2% Fibonacci retracement level from today’s lows to higher, near 104.27. If USD/JPY can take out today’s highs near 104.64, watch for a quick move to horizontal resistance near 104.85. If today’s highs hold, watch for the pair to continue its slow drift lower (as we have seen since March) towards today’s lows at 103.66.

Source: Tradingview, City Index

One more important item to note: Janet Yellen is the favorite to be Treasury Secretary under Joe Biden. Recall from her days at the Federal Reserve that she tends to be more dovish. Combine a dovish Treasury Secretary with a dovish Fed, and that may equally much more stimulus to come our way (more US Dollars, lower price!).