While global markets continue to closely monitor developments in China and the spread of the Coronavirus, a breath of relief this morning for the local economy after the Westpac Consumer Sentiment Index defied fears of a more serious decline.

As Westpac Chief Economist Bill Evans pointed out the 1.8% fall to 93.4 in January was less than expected given the catastrophic bushfires that have swept the country in recent months and in light of the -5.8% fall the index experienced during the 2011 Queensland floods, albeit from much higher levels.

The survey was conducted last week, during a period of heavy rainfall that helped bring some of the major bush fires under control. The much needed rain, a booming start to the year for equities and a continued recovery in the housing market, helping to limit the fall in the headline index.

Notable within the details of the report, housing-related sentiment remains strong, with the number of respondents thinking it is the right time to buy a house up 5.7% to 118.8, near the long-run average of 120. The House Price Expectations Index also rose strongly and is up an astonishing 58% over the year!

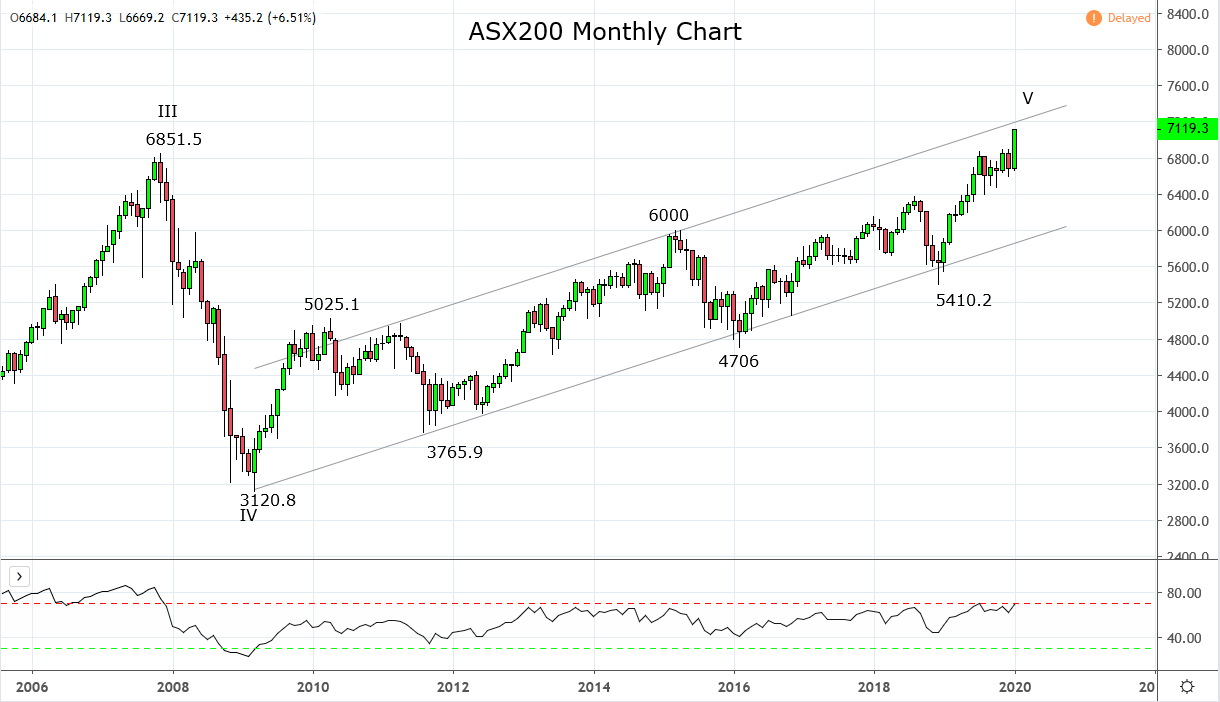

After enjoying a breather yesterday, the ASX200 has been emboldened by the prospects of today's data being week enough to justify an RBA rate cut in February but not weak enough to suggest the economy will stall. The ASX200 is trading at 7119.1 up 0.75% at the time of writing and rapidly closing in on the trend channel resistance from the 2009 GFC low that comes in currently around 7150 on the monthly chart +/- 50 points.

When taking into account the magnitude of the 2020 rally (+6.50%) compared to the historical yearly returns for the ASX200 and the possibility that the ASX200 turns lower from the trendline resistance mentioned above, there is reason to consider moving to a more market-neutral position in coming sessions and waiting for a pullback of approximately 5% to re-enter.

Source Tradingview. The figures stated areas of the 22nd of January 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation