Another sharp selloff in U.S. equities, a -7.6% fall in crude oil, and news that a leading potential vaccine candidate had been put on hold due to a suspected serious adverse reaction in a trial participant.

If we were to look a little deeper behind overnight moves and more broadly the events of September, it was in the currency markets that the moves commenced.

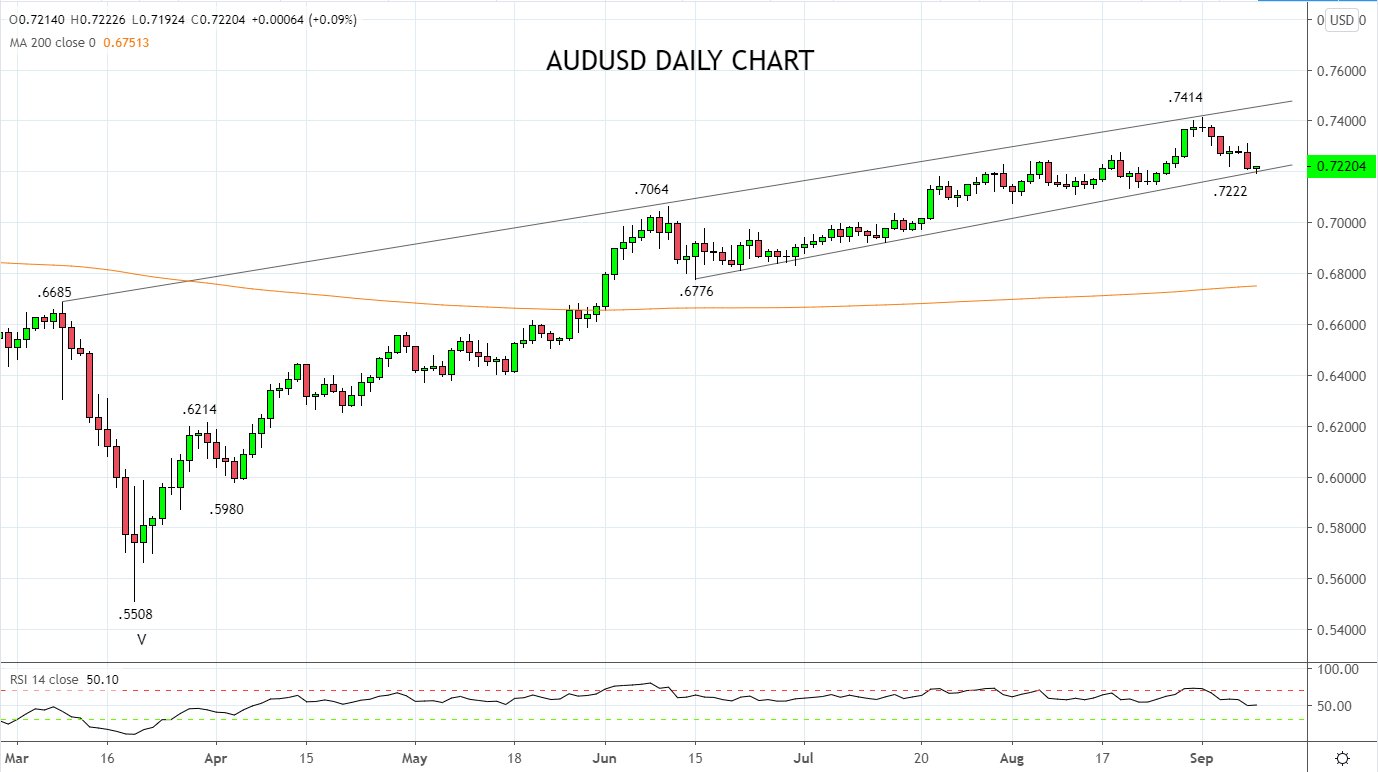

The EURUSD and the AUDUSD topped out and began to fall on September the 1st. U.S. equities started moving lower a few days later. It seems reasonable to turn to the currency market and specifically the AUDUSD to determine whether the moves of September continue or are reversed.

Importantly for the AUDUSD and despite ongoing stage 4 lockdowns in Victoria, there has been a significant and unexpected improvement in both business and consumer confidence.

Yesterday the NAB index of business confidence rose to -8 in August from -14 in July, moving further away from its March low of -66. This morning, the Westpac consumer confidence index improved by 18% to its highest level since before the onset of the pandemic.

Business and consumer confidence numbers are considered leading economic indicators and for that reason are closely watched by FX traders.

Following last Tuesdays textbook daily bearish reversal candle, from trendline resistance and the key .7400c resistance zone, the AUDUSD commenced a corrective pullback.

Supported by the better confidence data mentioned above, the AUDUSD has today held and commenced a tentative bounce from the trend channel support .7200/80c. Thus keeping the uptrend and positive bias intact and with scope for a retest of the September 1, .7415 high.

For the positive bias to remain in place, the AUDUSD should not break below the .7200/.7180 support level, as it would warn that a deeper pullback is underway towards medium term support .7075/65.

Source Tradingview. The figures stated areas of the 9th of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation