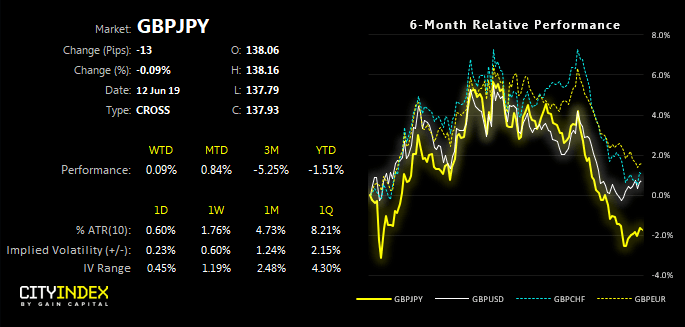

With the recent bouts of risk-off sentiment along with political woes and Brexit concerns for the UK, it’s no major surprise to see GBP/JPY under such heavy selling pressure. And, as noted in Monday’s COT report, the British pound has seen a pickup of short bets and closure of longs, whilst traders are now the least bearish on the Japanese yen in 3-months. So whilst some could argue that GBP/JPY is technically oversold, traders remain positioned for further downside and headline risks could still cap any upside.

We can see on the daily chart that GBP/JPY has fallen over 8% from its year to date high and broken out of a topping pattern early May. After reaching 136.53, its lowest level since the flash-crash, the bears have been kind enough to allow GBP/JPY to consolidate for 8 sessions and drift higher within a potential bear-flag. Whilst this allows for another cycle higher, we’re on the lookout for bearish momentum to return the cross to its dominant, bearish trend.