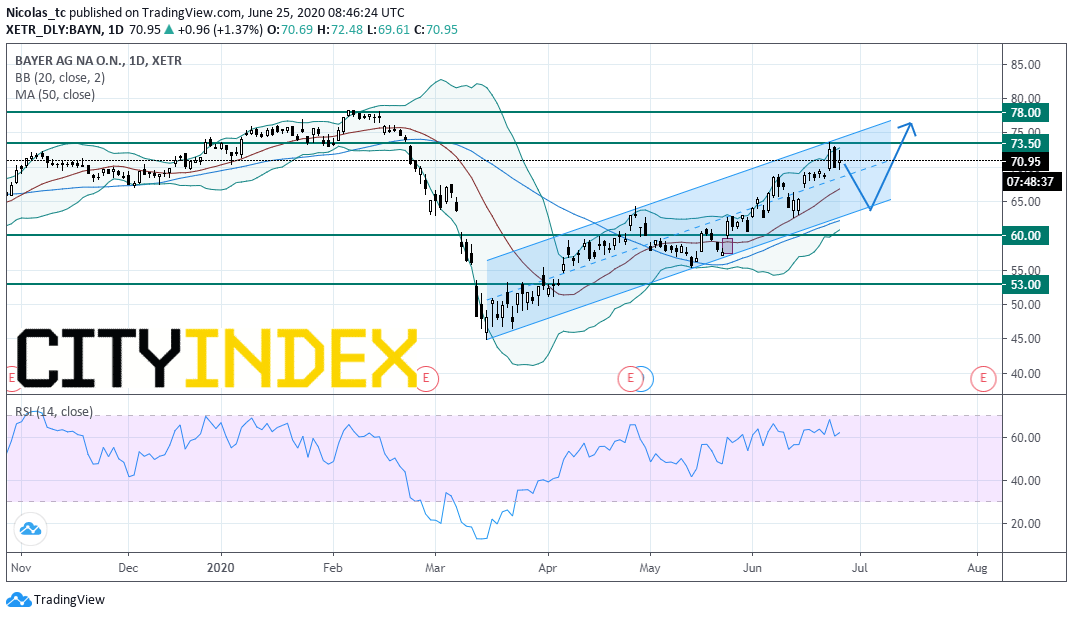

Bayer Agreement | Bullish channel

Bayer, a pharmaceutical group, announced that it has agreed to pay 10.1 - 10.9 billion dollars to resolve major outstanding Monsanto litigation, including U.S. Roundup product liability litigation, dicamba drift litigation and PCB water litigation. The company said: "The main feature is the U.S. Roundup resolution that will bring closure to approximately 75% of the current Roundup litigation involving approximately 125,000 filed and unfiled claims overall."

From a chartist’s point of view, the stock price is nearing the upper end of a short term bullish channel. The daily Relative Strength Index (RSI, 14) struck against its overbought area at 70% and is posting a consolidation move. The 20/50DMAs are ascending and should play a support role. The configuration is mixed. Investors have to remain cautious as these levels may trigger profit taking. Pullbacks to 65E can occur before prices can resume their up trend. A break above 73.5E would open a path to see 78E. Alternatively, a break below 60E would invalidate the short term bullish bias.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM