Bayer 1Q earnings rose – Short term trend bullish

Bayer, the German pharmaceutical and life sciences company, reported that 1Q net income rose 20.0% on year to 1.49 billion euros and adjusted EBITDA grew 10.2% to 4.39 billion euros on revenue of 12.85 billion euros, up 4.8% (+6.0% on a currency and portfolio adjusted basis). The company added: "Bayer anticipates that, following the positive start to the year, COVID-19 will continue to impact its business over the course of 2020. It will not be possible to reliably assess the positive and negative effects until later in the year."

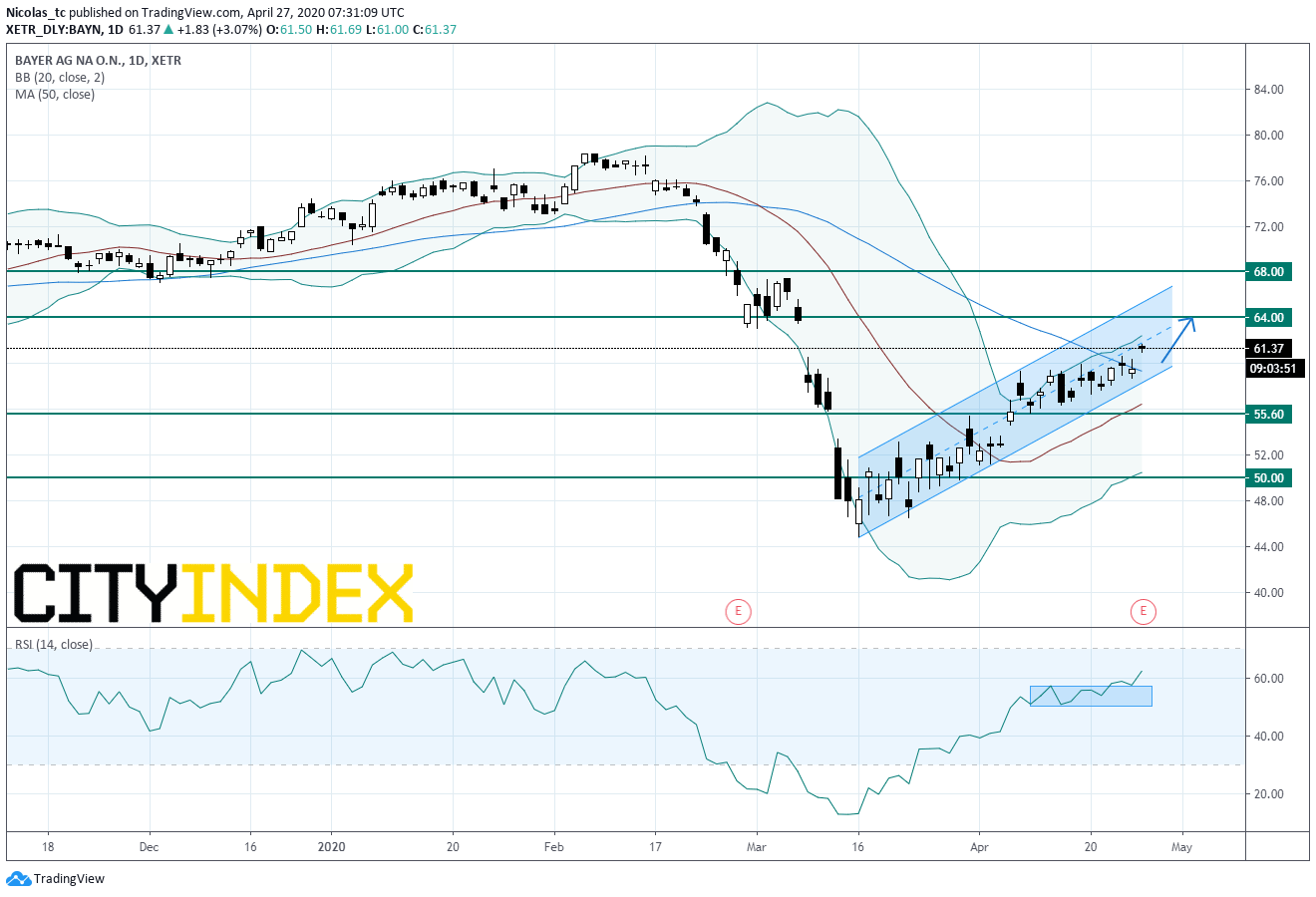

From a technical perspective, the stock price remains in a short term up trend within a bullish channel. Prices have broken above the declining 50-day simple moving average thanks to a bullish gap. The daily Relative Strength Index (RSI, 14) is bullish and not overbought. The bias remains bullish as long as 55.6E is support. Next resistance thresholds are set at 64E and 68E.

Alternatively, a break below 55.6E would call for a reversal down trend with 50 as target.

Source: GAIN Capital, TradingView

Latest market news

Today 08:33 AM