The stock has dropped like a brick on the latest Brexit crunch day

Barratt Developments’ biggest one-day stock price drop of the year has raised the question of whether its mix of robust margins, advantageous strategic partnerships and market share can continue to shield it from the worst Brexit blow-back.

Shares in the group that builds most residential homes in large swathes of Britain have ground 73% higher since a post-referendum day bottom in July 2016. With the FTSE up a measly 12% since then, it is clear Barratt rode the housing market’s resilience to the kind of impacts widely feared in the wake of the Brexit vote.

Now, the group sees volume growth “towards the lower end” of its medium-term target range in the current financial year, causing the stock to lose as much as 5% at one point on Wednesday. Operating and revenue results for the 2018/19 year also suggest estimates have got somewhat ahead of current Barratt capacity, despite efficiency continuing to improve.

- Revenue: £4.76bn, up 2.3% year-on-year vs. average estimate of £4.82bn

- FY operating profit £901.1m, up 4.5% year-on-year vs. average estimate of £908.8m

- Operating margin 18.9% vs. 17.7% in 2018/19 full-year

(Consensus forecasts compiled by Bloomberg)

Barratt’s proven ability to withstand housing market volatility has rested on stable margins, and a dominant sector position garnered from decades of above-average volume gains that reaped strong market share growth. Britain’s historically robust residential property market has also played a part in providing the group with a leading cash-generation profile and rising net income each year since 2012.

Yet Barratt’s key multiples against itself and close rivals are mostly tracking near medium-to-long-term highs. Guidance towards the lower end of forecast ranges might well turn out to be strategic caution, particularly as “housing market fundamentals remain attractive, with a long-term undersupply”, according to the group. The more immediate investor worry then is sentiment. This year alone, the stock crushes the Bloomberg UK Homebuilder Index’s 11.6% gain, rising 29%. As fears of a potential Brexit chill gain immediacy, Barratt shares could be more vulnerable to reduction than more modestly performing rivals. And if Brexit’s bite matches its bark after all, an enriched valuation will have a similar, longer-lasting effect.

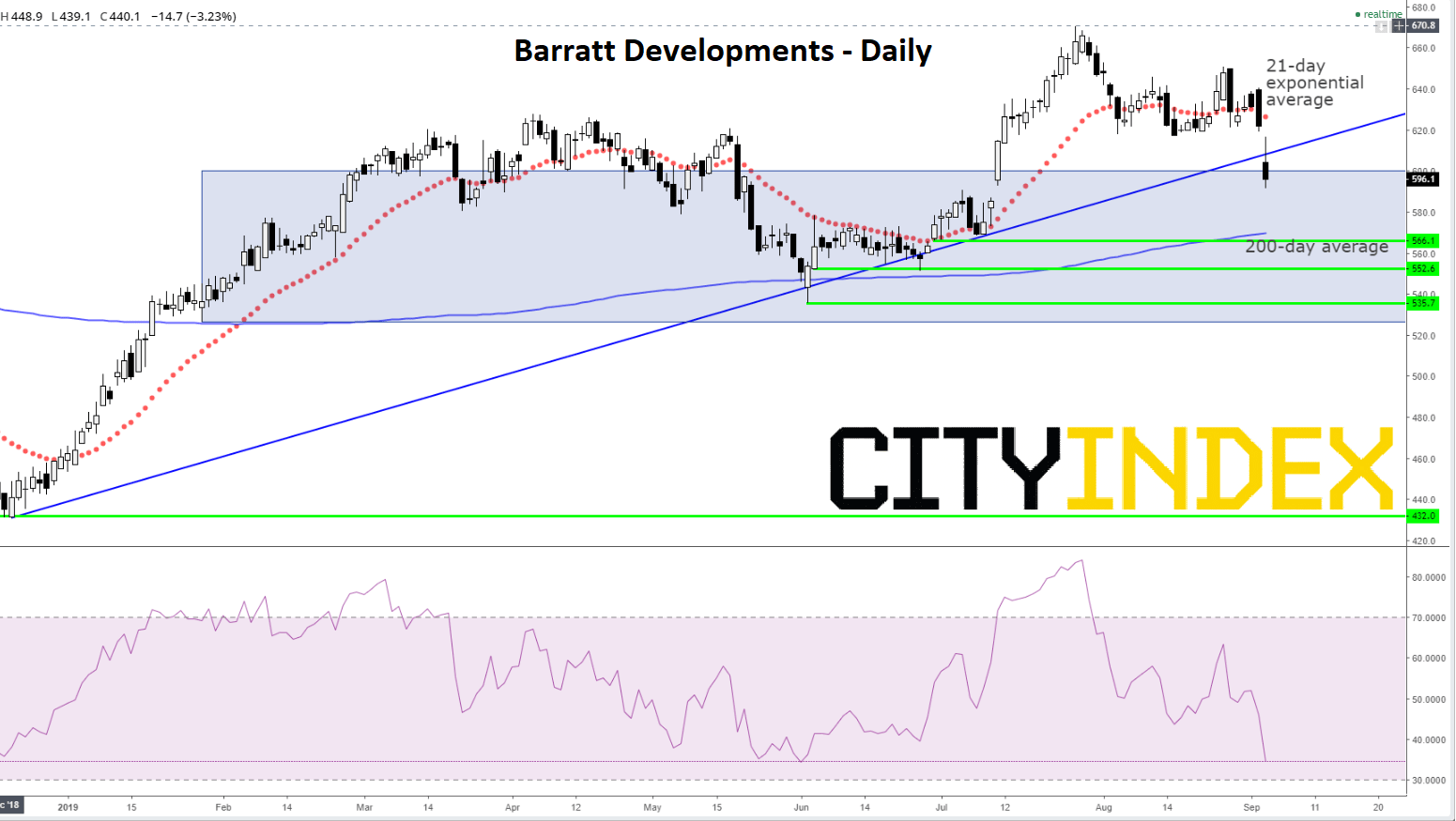

Chart thoughts

BDEV sellers’ ‘warning shot’ is the broken 2019 uptrend. The most immediate question buyers now need to assess concerns the sturdiness of the region that mostly encapsulated the stock between January and July. It’s an almost binary case of fight vs. flight. Above sure-footed kick-back lows of 535.7p, 552.6p and 566p (note the confluence of closest support with the 200-day average) defence would be holding. But the zone would appear hollower if those levels proved to be fragile, opening the way for a look back at the base of the year’s vault, 432p.

Barratt Developments CFD

Source: City Index