Barratt Developments shares boosted by cautious optimism

Barratt Developments, a residential property development company, posted full-year profit before tax dropped 45.9% on year to 492 million pounds on revenue of 3.42 billion pounds, down 28.2%. The company proposed a dividend of 39.4p per share, down from 73.2p per share in the prior year.

Regarding the outlook, the company stated: “We are pleased that since the start of the new financial year we have seen our production increase, constructing the equivalent of 347 homes in the week ending 23 August 2020 and we are on track to deliver our planned output. We expect to grow wholly owned completions to between 14,500 and 15,000 homes in FY21, and in addition around 650 completions from our joint ventures.”

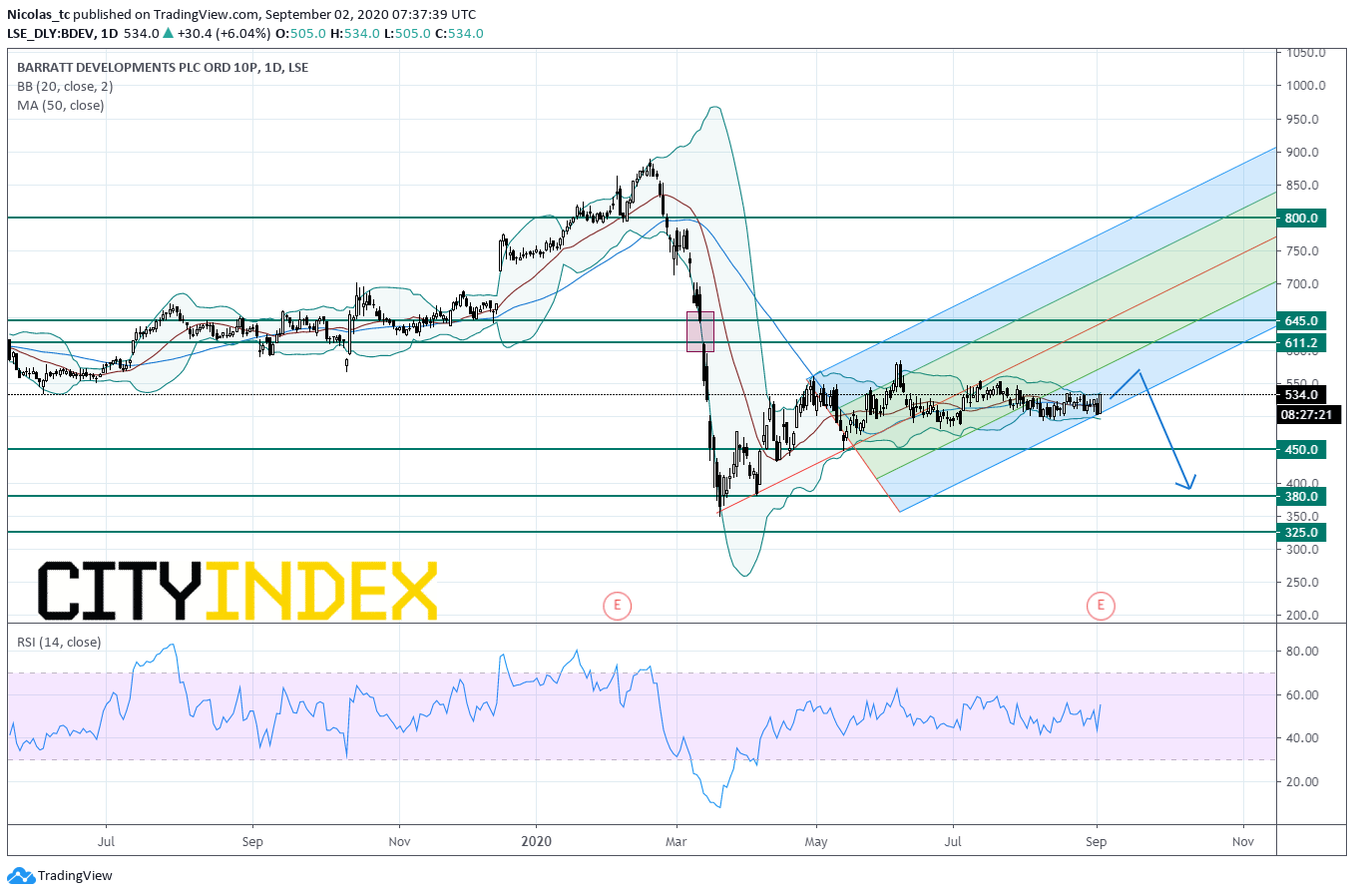

From a chartist’s point of view, the stock price remains stuck in low volatile trading range since May 2020. Bollinger bands are narrowing indicating a lack of momentum in the short term. The medium term trend remains bearish as long as the key resistance zone 611.2p – 645p is not bypassed. A slight recovery cannot be ruled out. Readers may want to consider the potential for opening short positions below the resistance zone 611.2p – 645p with 450p and 380p as targets. Alternatively, a push above the congestion zone 611.2 – 645 would call for a reversal up trend and would open a path to see 800p.

Source: GAIN Capital, TradingView

Latest market news

Today 08:33 AM

Yesterday 11:48 PM

Yesterday 11:16 PM