Total completions rose 9.1% in H1, up from 3.7% the previous year. The average selling price declined -0.9%. When you strip out London, the average selling price actually increase 2.6%.

Favourable times

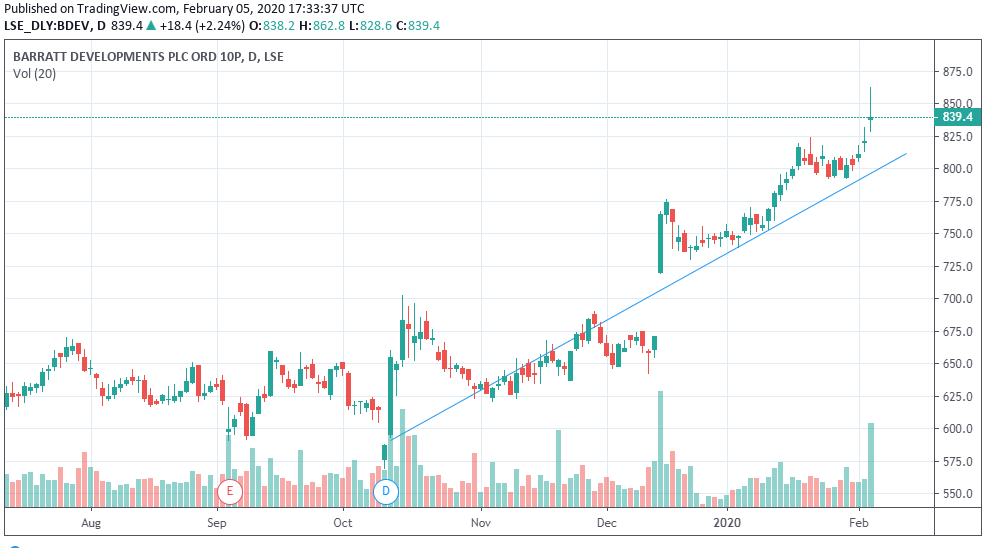

Recent times have been favourable for housebuilders. Interest rates continue at historically low levels, which supports mortgage affordability. Mortgage approvals hit a 29-month high this month. Then let’s not forget, the UK’s well documented housing shortage which keeps demand bubbling. Add into the mix the government’s extremely successful help to buy scheme and it’s easy to why house builders have done so well across 2019. Barratt’s share price has soared 55% over the past year.

But the story doesn’t end there. There has been plenty of upbeat talk surrounding the housebuilders following the decisive Conservative win in the December election. The improved political landscape could unleash a mass of pent up demand, with rebounding confidence expected to drive volumes. Crucially it also means that the Help to Buy scheme will remain in its current for another 2 years. The share price has jumped 20% since the election.

Confidence in outlook

The key now, will be seeing how the post-election bounce continues going forward and whether it can be sustained. Barratt Developments demonstrated its confidence by extending the capital return plan for another year. Special returns of £175 million are anticipated for both November 2020 and 2021, in addition to normal dividend awards.

Trading in January was also encouraging with sales per site up 12%, prompting speculation that Barratt’s could be on track for the upper end of its full year growth of 3% -5%.

Chart thoughts

Barratt Development trades above its 200, 100 and 50 sma on a clearly bullish chart. It has just edged into overbought territory according to the relative strength index, so a slight pull back could be on the cards before gains are extended.