Shares signal underlying shareholder support

CEO Jes Staley’s prized IB has managed to outdo itself on the downside, again, with revenues 29% lower on the year, contributing to net operating income that’s 2.6% short of unchallenging consensus. To be sure, those low expectations cushion the extent of disappointment. Barclays shares were down little more than 3% a little earlier. More positively, it even showed further signs of building a consistently defended markets franchise. FICC outshone Wall Street for a second consecutive quarter with a 4% rise to $902m, mostly on bonds. Unfortunately, Markets retreated 6% overall as Equities tanked 21%. Even with a 9% return on equity, Markets still cost more than it made.

Staley is less culpable for deterioration elsewhere. Consumer lending softened in line with Brexit and Europe’s slowdown. But he’s still more likely to burnish Barclays’s capacity for greater efficiency, than to suggest an IB turnaround anytime soon. A 4% drop in expenses might turn out to be Barclays’s best defence at next week’s AGM showdown. Shareholders will vote on whether to grant activist Edward Bramson a board seat. All signs suggest it’s too close to call. Yet after a lacklustre quarter, a cushioned share price fall suggests quieter investors remain reasonably patient.

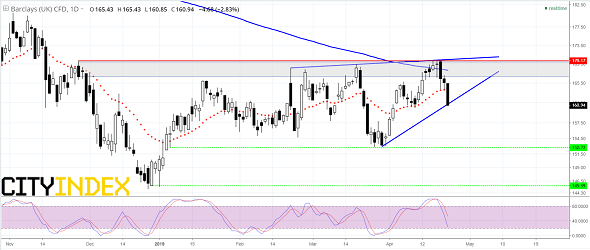

BARC’s end-2018 annual low of 145p is well defended by c. 152p January-March lows, but price still faces structural challenges. The 200-day trend weighs heavy and it’s little wonder last week’s attempted breach failed. That confirmed 170p (28th November failure high) as key resistance, echoing tops over the last couple of months. A break below the wedge forming since March seems inevitable. After that, 152p will be tested again.

Barclays CFD – Daily [4/25/2019]

Source: City Index