Barclays posted strong Q1 results – watch 108p

Barclays reported strong 1Q results: "RoTE, excluding litigation and conduct, was resilient at 5.1% (Q1 19: 9.6%). EPS, excluding litigation and conduct, was 3.5p (Q1 19: 6.3p), while statutory EPS was also 3.5p (Q1 19: 6.1p). Profit before tax was £913m (Q1 19: £1,483m). Credit impairment charges increased to £2,115m (Q1 19: £448m). This increase reflects £405m in respect of single name wholesale loan charges in the quarter and £1.2bn net impact from a revised Baseline scenario (the COVID-19 scenario).

Chief Executive Officer Jes Staley said: “Given the uncertainty around the developing economic downturn and low interest rate environment, 2020 is expected to be challenging.”

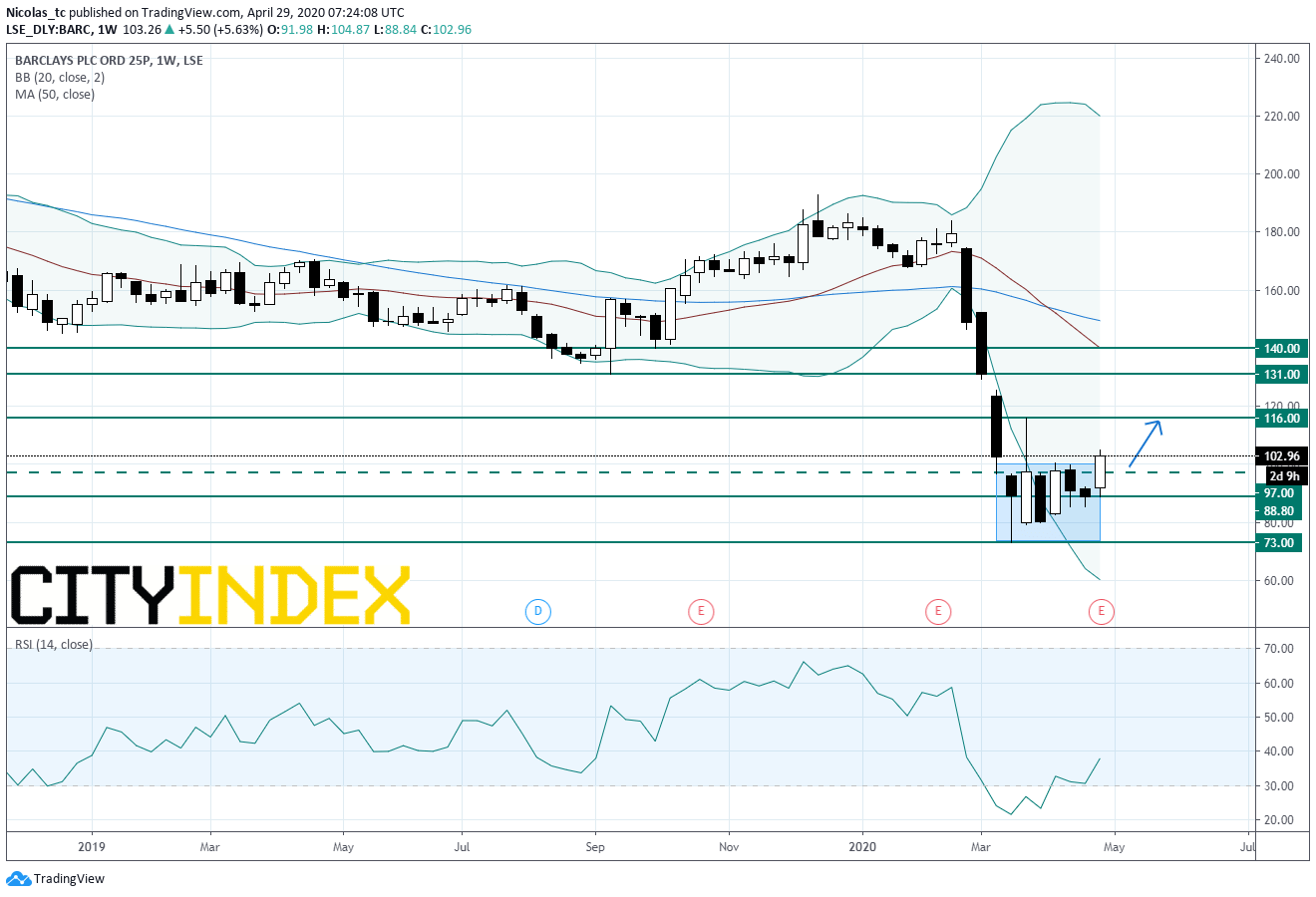

From a technical perspective, the stock price has broken above the upper Bollinger band. The daily Relative Strength Index (RSI, 14) is now standing above 50%. However, Barclays faces significant hurdle near 108p. A daily closing price above the horizontal resistance at 108p would call for a reversal up trend and would open the way to a further rise towards 116p and 140p.

Alternatively, a break below 88.8p would invalidate the bullish bias and would call for a test of March 19 low at 73p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM