Barclays’ strategy to build a “transatlantic, consumer, corporate and investment bank with a global reach” might be “in very good shape” from CEO Jes Staley’s point of view, but investors will need to keep a dollop of vision to hand at the halfway stage of 2016, because the outline of the plan still looks blurred in places.

Group profit before tax fell 20.7% compared to H1 2015, weighed down by layers of badly performing assets. These have allowed non-core losses before tax—which would have been even larger if some items and a £372m impairment in France were included—to balloon to £1.9bn from £745m, even though core profit before tax advanced 19%. Again, the core figure was flattered by a £615m gain, from disposal of Barclays’ Visa Europe stake, £400m of which has immediately been set aside for potential customer compensation.

Barclays’ key financial gauges also give stronger readings on assets which the group now sees as core than for the entire business. Barclays overall return on tangible shareholders’ equity (ROtE) was 21 basis points lower year-to-year at 4.8% when the half-year snapshot was taken, though we know it generally looks even lower by year end. (Thomson Reuters’ data shows ‘Common Equity’ at -0.3% at the end of 2015.)

At Barclays’ Corporate & International business ROtE advanced 330 points to 14.3%, outperforming pure-play European investment banks. If only investors could buy separate shares in Barclays’ investment bank.

Slight dizziness among investors from the mental gymnastics required to decide if Barclays truly ‘won’ in the first half, or not, would be understandable. Once it wears off, today’s stock jump (which still leaves the shares 50% lower than prices in early August 2015) will moderate, because whilst the core performance has protected an (already reduced) dividend outlook this time, a slower pace of core growth is all but assured for the full-year, and quarters beyond.

For now, at least the core profit result has been enough to wind Barclays shares back over the halfway point of their post-Brexit collapse.

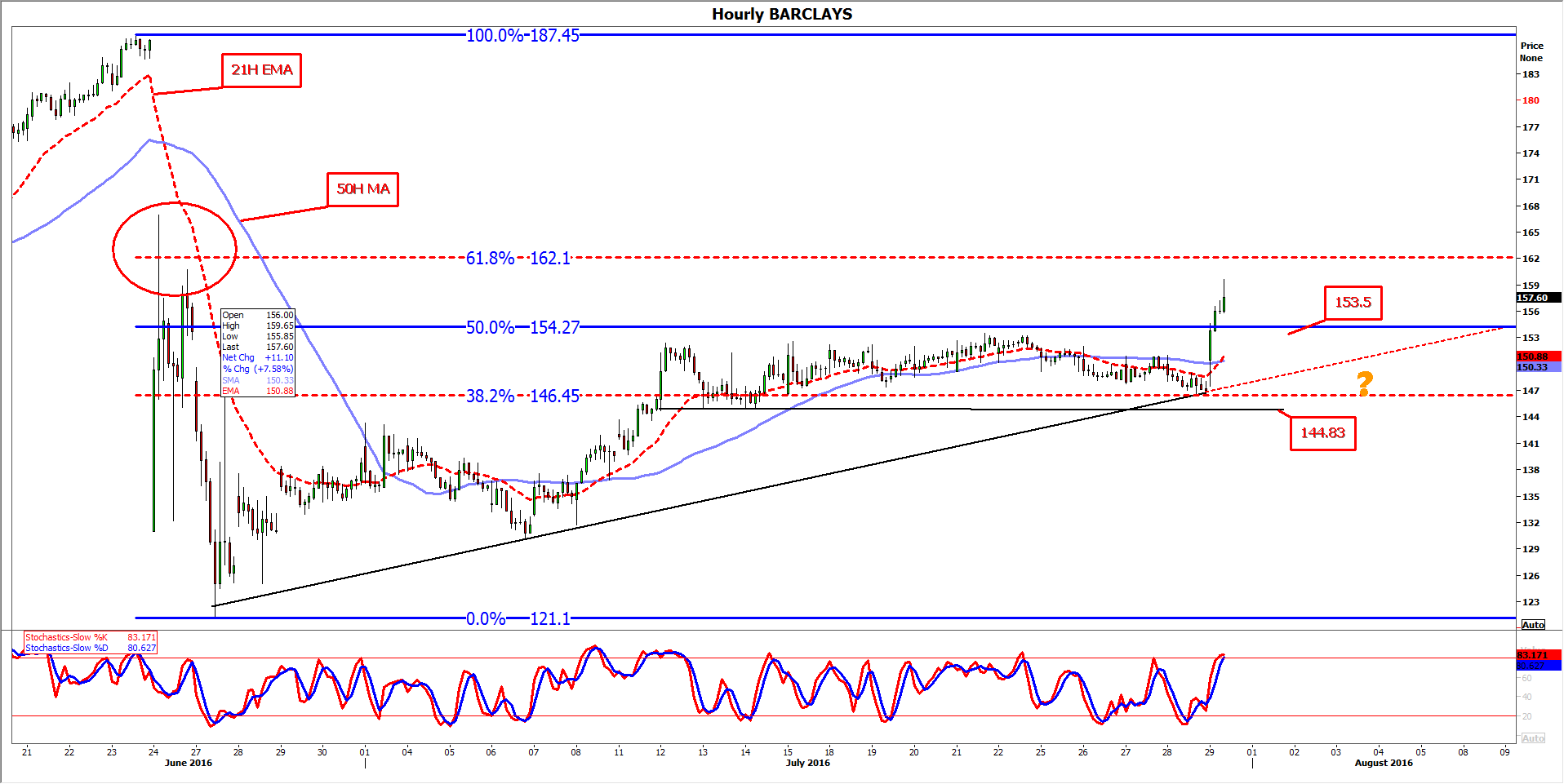

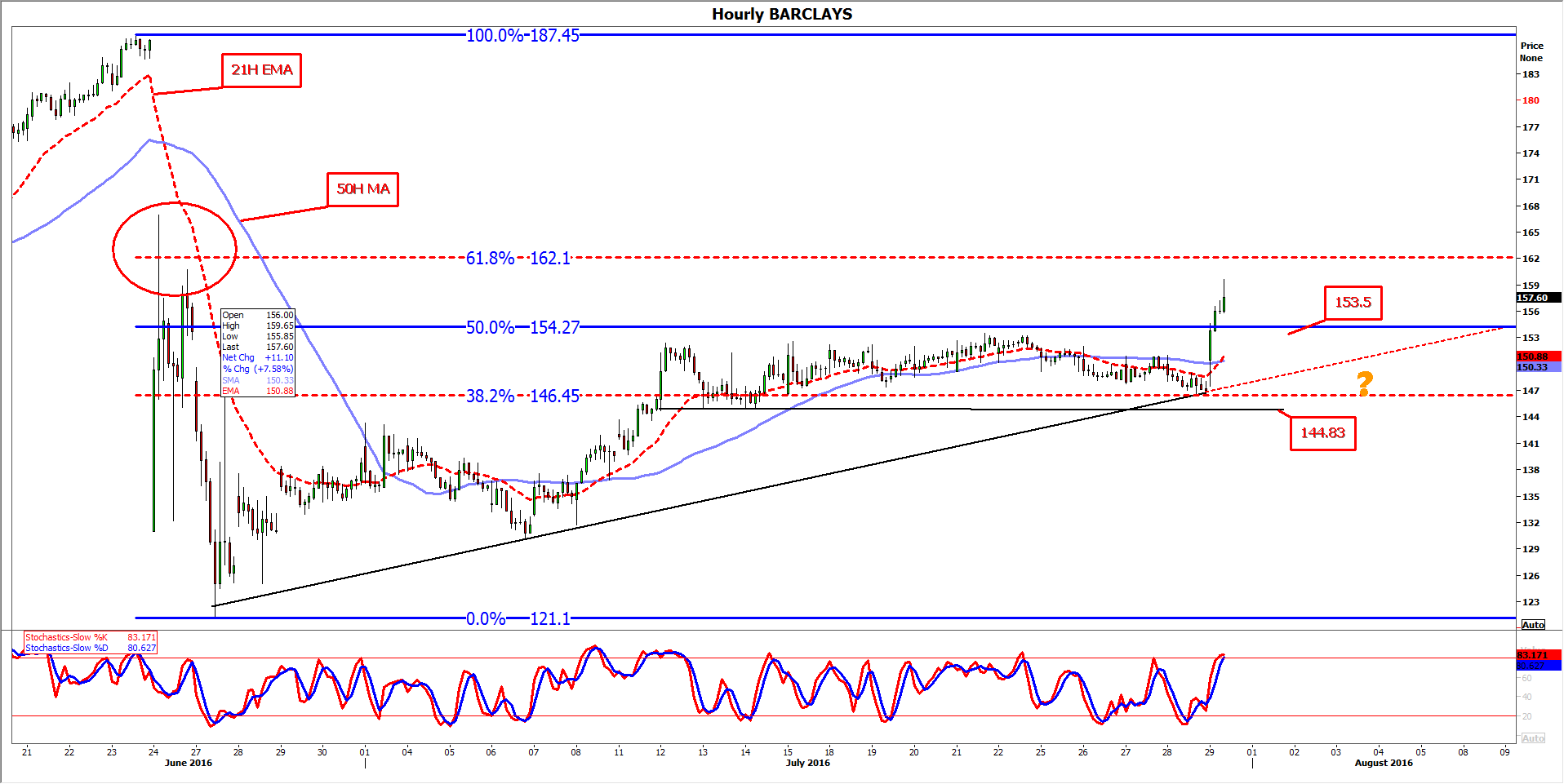

From a technical point of view, our hourly chart also shows the stock breaking above short-term averages (red dotted line: 21-interval exponential MA; lilac: 50-interval simple MA) for a second attempt at 61.8% of the Brexit vote slide. Stretched stochastic momentum is likely to make investors cautious though, lest next week’s Bank of England risk event springs surprises on the extent of easing. Barclays’ stock rebound can probably withstand a standalone Bank Rate cut of 25 basis points. Any BoE measures over and beyond a plain vanilla cut should call into question prices above 154p for BARC. Further out, without a remarkable acceleration in its turnaround, share price progress will be patchy for the foreseeable future.

Please click image to enlarge