With no action expected BoE is likely to play second fiddle to Brexit developments.

The Bank of England MPC will give its final rate decision for 2020 on Thursday at 12:00 GMT in what has already been a big week for GBP/USD.

Brexit & Covid

When the BoE meet there will almost certainly still be a lack clarity over Brexit, as post Brexit trade talks continue. At the time of writing there is a feeling that Brexit talks are firmly moving in the right direction which is being reflected in a surging pound. This is not the first time that we have been here and the base case is still that a deal is more likely to be agreed than not.

When the BoE meet there will almost certainly still be a lack clarity over Brexit, as post Brexit trade talks continue. At the time of writing there is a feeling that Brexit talks are firmly moving in the right direction which is being reflected in a surging pound. This is not the first time that we have been here and the base case is still that a deal is more likely to be agreed than not.

The turn of the year will almost certainly bring disruptions. Brexit even with a deal will be a seismic change and covid restrictions could well tighten again after Christmas as well. In short, the need for the central bank to remain accommodative isn’t going anywhere fast, in fact it may even grow.

Hold steady for now

After expanding the QE programme by £150 billion in November and extending it until the end of 2021 the broad expectation is that the BoE will hold steady on rates and monetary policy for now. Instead Andrew Bailey and co. could provide signals of what they are willing to do should conditions deteriorate come the new year – increasing the pace of purchases could be an option. Should the BoE signal to additional QE, next year, this could drag on the pound, although any sell off could be quickly overcome if a Brexit deal is in sight.

After expanding the QE programme by £150 billion in November and extending it until the end of 2021 the broad expectation is that the BoE will hold steady on rates and monetary policy for now. Instead Andrew Bailey and co. could provide signals of what they are willing to do should conditions deteriorate come the new year – increasing the pace of purchases could be an option. Should the BoE signal to additional QE, next year, this could drag on the pound, although any sell off could be quickly overcome if a Brexit deal is in sight.

Negative rates

This year has also seen significant speculation and discussion surrounding negative interest rates. However, right now a move into negative rates looks unlikely. This final quarter of the year hasn’t seen the same level of economic slowdown that was experienced in Q2 despite covid restrictions and lockdown measures hitting output in the service sector. The service sector PMI at 49.9 was just shy of expansion in December according to the preliminary PMIs a far cry from April’s 13.4.

This year has also seen significant speculation and discussion surrounding negative interest rates. However, right now a move into negative rates looks unlikely. This final quarter of the year hasn’t seen the same level of economic slowdown that was experienced in Q2 despite covid restrictions and lockdown measures hitting output in the service sector. The service sector PMI at 49.9 was just shy of expansion in December according to the preliminary PMIs a far cry from April’s 13.4.

Patience

In Q1 next year the BoE will have more clarity over vaccination roll outs and how Brexit is shaping up meaning the need to base monetary policy on guess work declines. For now the central bank’s hands are tied by the Brexit endgame.

In Q1 next year the BoE will have more clarity over vaccination roll outs and how Brexit is shaping up meaning the need to base monetary policy on guess work declines. For now the central bank’s hands are tied by the Brexit endgame.

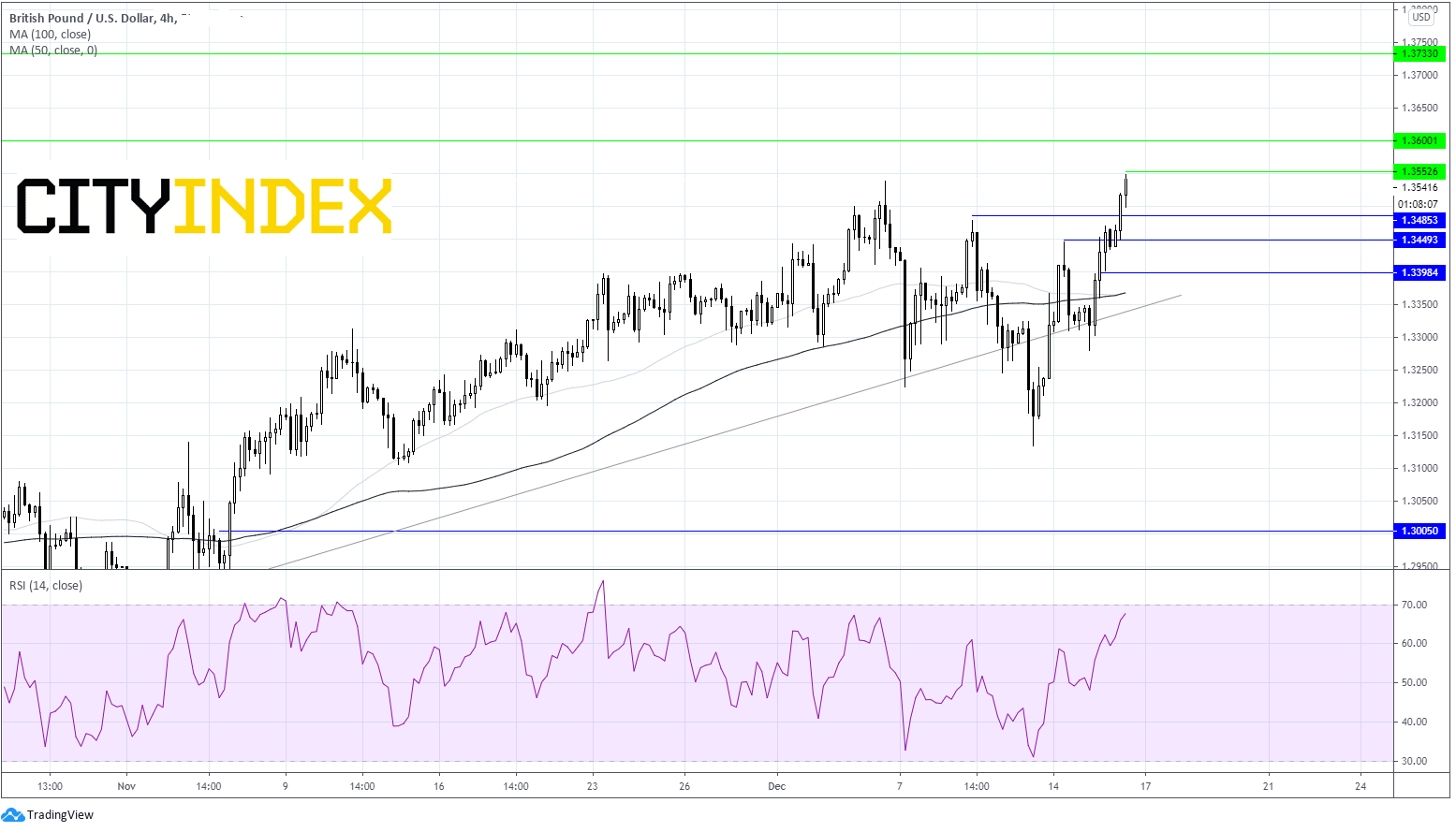

GBP/USD chart thoughts

GBP/USD trades at fresh yearly highs as it rallies towards 1.3550. It trades above its 50 & 100 sma on 4 H chart and above the ascending trend line dating back to early November. However the RSI is approaching overbought territory which should warrant caution. Although a Brexit deal could overshadow a move over 70 on the RSI.

Immediate resistance is at today’s high 1.3550, prior to 1.36 and 1.3730 levels from 2018. On the downside immediate support is seen at 1.3480, 1.3450 key levels from this week, prior to 1.34.

Learn more about forex trading opportunities.

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM