After surprising markets at their last meeting by ending their Quantitative Easing Program, the Bank of Canada left rates unchanged at 0.25%, as expected. Although the BOC was encouraged by the Unemployment Rate, which is near pre-pandemic levels at 6%, they maintained their forward guidance as they wait for more economic data and information from the Omicron variant of the coronavirus. They expect inflation data to remain elevated in the first half of 2022 and ease back towards 2% in the second half of 2022. At the same time, the Bank of Canada said they will “provide the appropriate degree of monetary stimulus to support the recovery and achieve inflation goals.” The next BOC meeting is scheduled for January 26th, at which time the Bank will publish its full outlook for the economy and inflation.

Everything you want to know about the Bank of Canada (BOC)

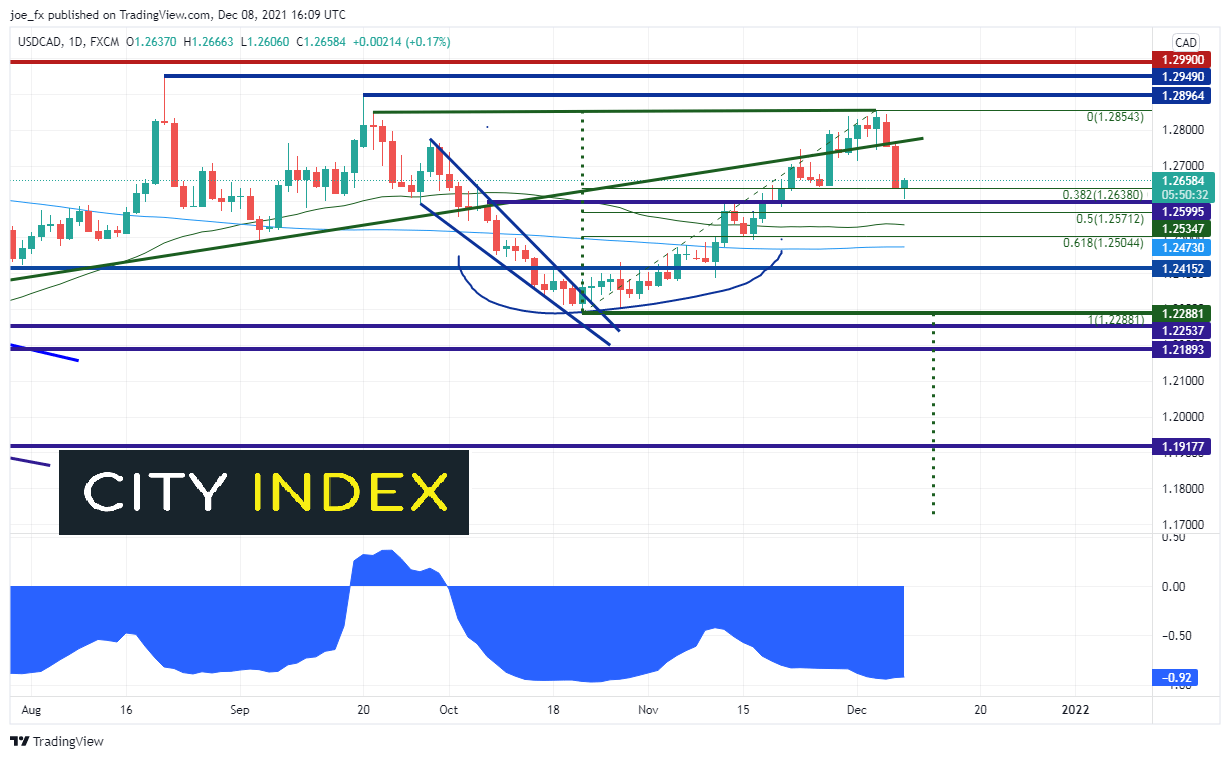

USD/CAD had recently retraced 100% of the descending wedge when the pair broke out on October 21st near 1.2288. Price traded all the way back up to 1.2854, testing the highs from September 21st. USD/CAD is heavily correlated with Crude Oil. The current correlation between the two assets is -0.91. A reading of -1.00 indicates that there is a perfect negative correlation, meaning the assets move in opposite directions 100% of the time. -0.92 is a STONG negative correlation. As crude oil was moving lower into the recent OPEC meeting and the coordinated release of oil from the SPRs, USD/CAD was moving higher. On Tuesday, USD/CAD lost nearly 1% as price from 1.2754 to 1.2635 as Crude Oil went bid and traders took profits on USD/CAD longs ahead of the meeting. Price retraced to the 38.2% Fibonacci level from the move from the October 21st lows to the December 3rd highs, near 1.2638. Resistance is at Tuesday’s highs and trendline resistance near 1.2767 and then the December 3rd highs at 1.2854. Horizontal resistance above there is at 1.2896 and 1.2949.

Source: Tradingview, Stone X

Trade USD/CAD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

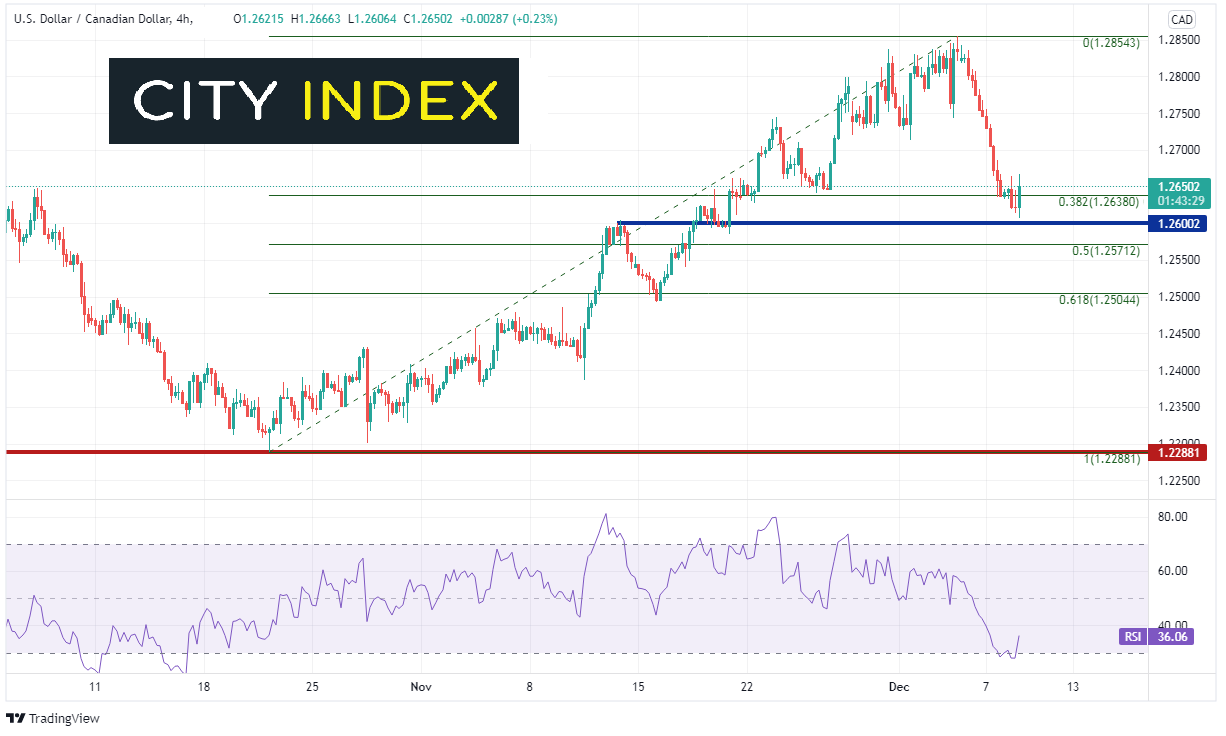

On a 240-minute timeframe, USD/CAD has held horizontal support at 1.2600 thus far today. Below there, immediate support is at the 50% retracement level near 1.2571, the 50 Day Moving Average at 1.2534 (see daily), and the 61.8% Fibonacci retracement near 1.2504.

Source: Tradingview, Stone X

Note on the daily timeframe, that if price falls below the October 21st lows, USD/CAD will have broken the neckline of a double top formation from the 1.2854. The target is the height of the pattern added to the break of the neckline, which would be near 1.1730! (A move such as this would probably have crude near $40!)

If the Bank of Canada continues to believe that the economic recovery will continue through 2022, they may try to stay ahead of it by hiking rates sometime around mid-year. Much will depend on the direction of the Omicron variant. Thus far, economic data is looking good for Canada!

Learn more about forex trading opportunities.