Bank of Canada Leaves Rates Unchanged, Lowers Guidance

The Bank of Canada (BOC) today left overnight interest rates unchanged at 1.75%, as expected. However, the market was more concerned as to if the BOC was planning on changing their guidance. Although they said policy was appropriate and made no mention of any kind of future cuts, they lowered their 2020 growth outlook to 1.7% from 1.9% and their 2021 growth outlook to 1.8% from 2.0%. The BOC cited weaker global growth, foreign demand and lower government spending as reasons for lowering their growth outlook. Note that Canada is still one of the few major powers that have not begun easing policy, even as the Fed continued cutting rates today by 25bps, to 1.75%.

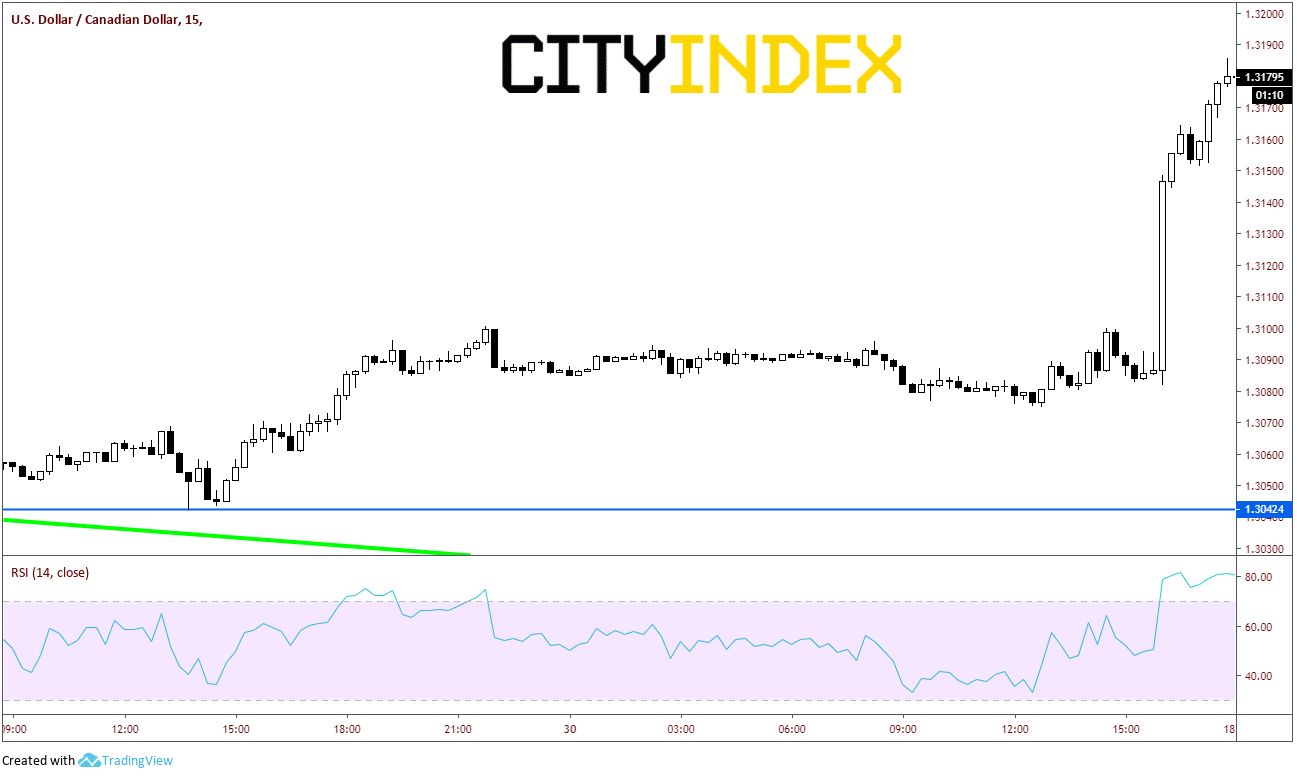

Upon release of the BOC interest rate decision and the policy statement, USD/CAD shot up 100 pips from 1.3085 up to 1.3185, as seen on a 15-minute chart. The pair then consolidated until the release of the FOMC decision, and upon it’s release, moved as high as 1.3207.

Source: Tradingview, City Index

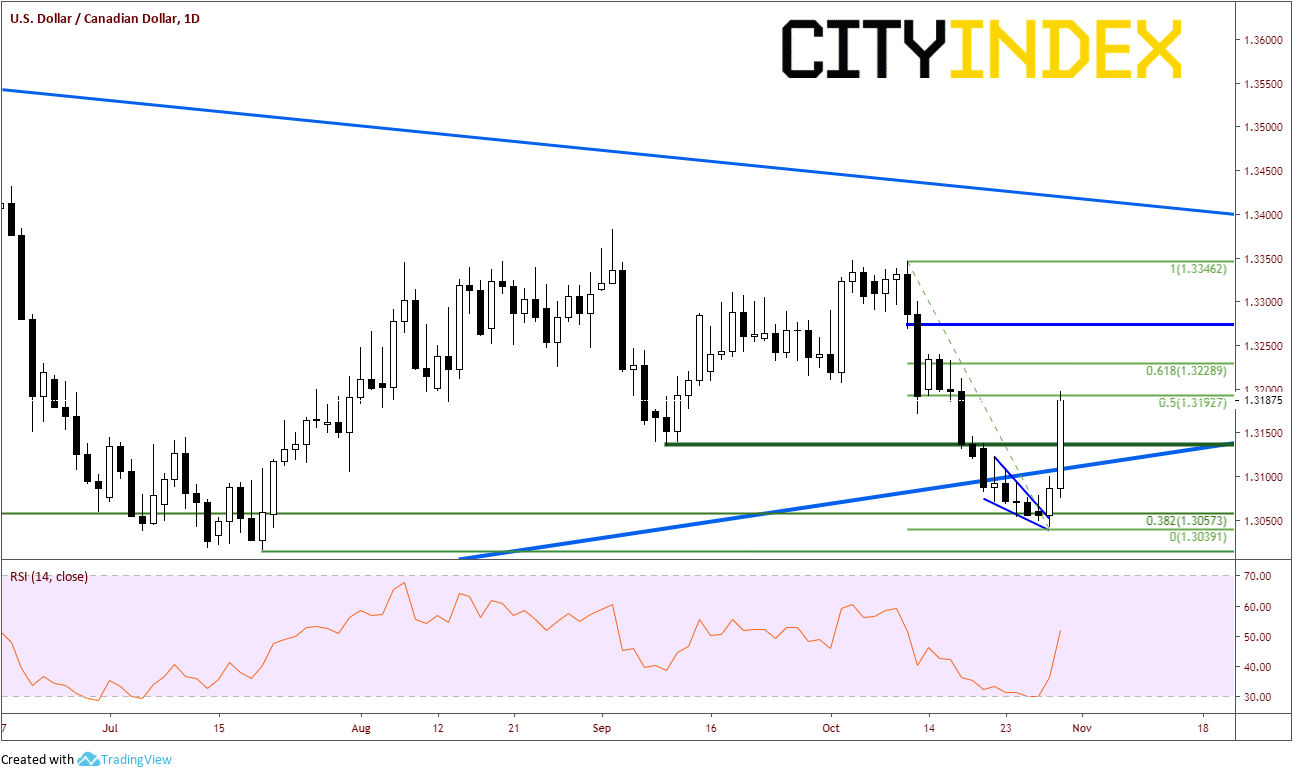

On a daily chart, USD/CAD traded higher, back into the long-term triangle and out of the descending wedge pattern. Between yesterday and today, the pair has retraced 50% of its move from the highs on October 10th to the lows yesterday. There is also horizontal resistance at the 50% retracement level, near 1.3200. Above there, resistance comes in at the 61.8% retracement level of 1.3230.

Source: Tradingview, City Index

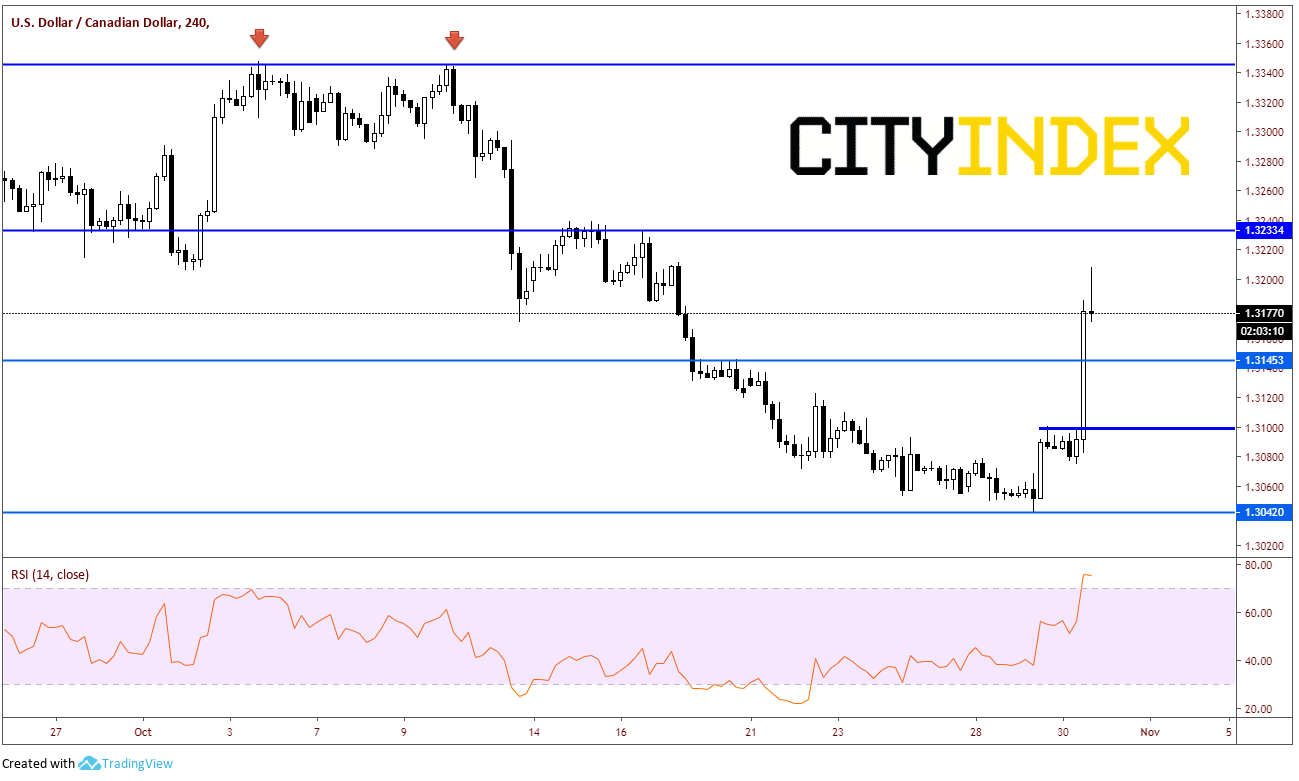

On a 240-minute chart, there is room for USD/CAD to drop 100 pips back to 1.3100 before hitting support. If price closes near current prices, it will form a shooting star candle, an indication prices may reverse. Also note that RSI as moved into overbought conditions, another sign the pair my pullback. Below there, support comes across at yesterday’s lows of 1.3042. We can also see support on the daily at the lows from July 19th at 1.3016 and the psychological support at 1.3000.

Source: Tradingview, City Index

It seems as if both the BOC and the FED are on a “data dependent” mode towards policy. Continue to watch for comments from both bank committees. Also, keep an eye on the USMCA. If the agreement gets ratified, that should be a positive for the Canadian Dollar.