Bank of Canada - Last man Standing

The Bank of Canada is one of the only, if not THE ONLY, major Central Bank that has not come out and said they may cut rates. The last time the BOC moved on rates was on October 24th, 2018. You may recall that it was just a year ago when some Central Banks were still raising rates. And the BOC was no exception, raising rates from 1.50% to 1.75%.

Tomorrow Canada releases July CPI (YoY), expecting 1.7%. Canada also releases Existing Home Sales for July (expecting 5.38M), and on Friday Core Retail Sales will be released for June (MoM) expecting -0.1%. We may see the BoC jump on the bandwagon and turn more dovish at its next meeting on Sept 4th if the data comes out worse than expected.

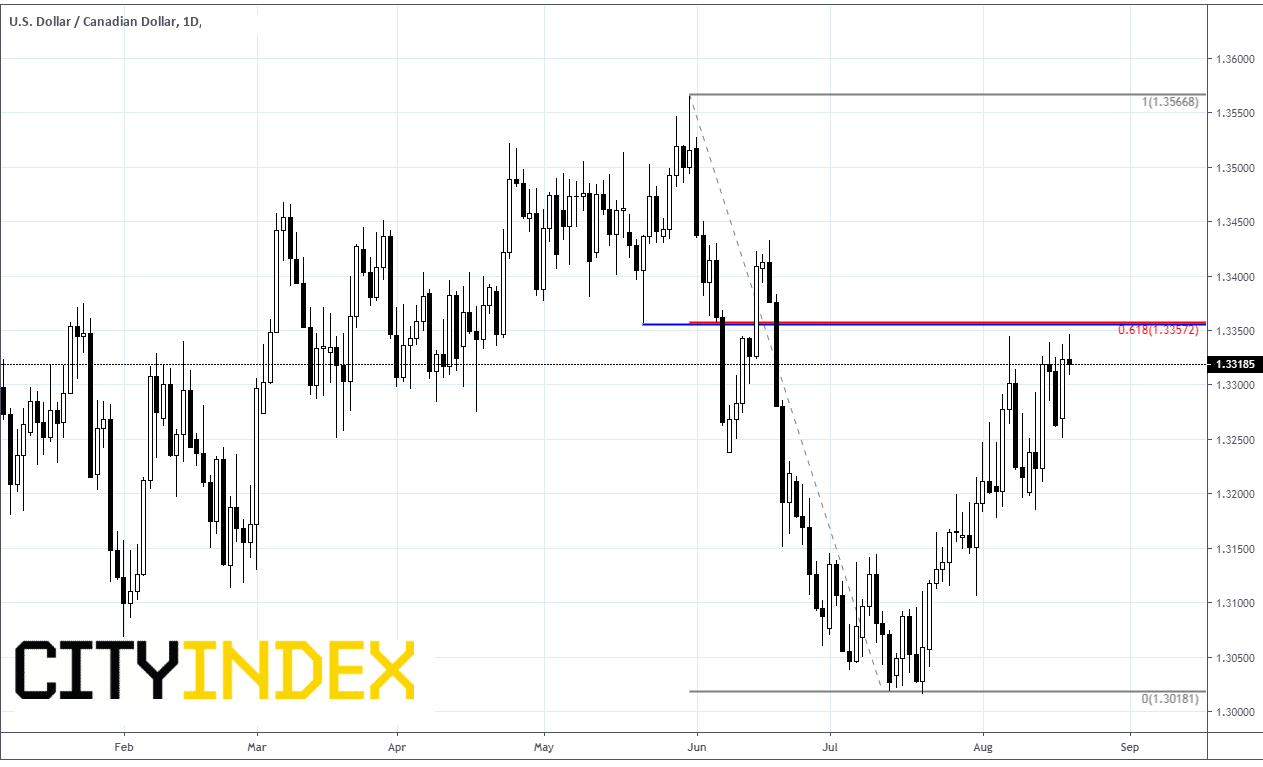

USD/CAD is currently banging up against previous support and the 61.8% retracement from the high on May 31st to the low July 12th near 1.3350.

Source: Tradingview, City Index

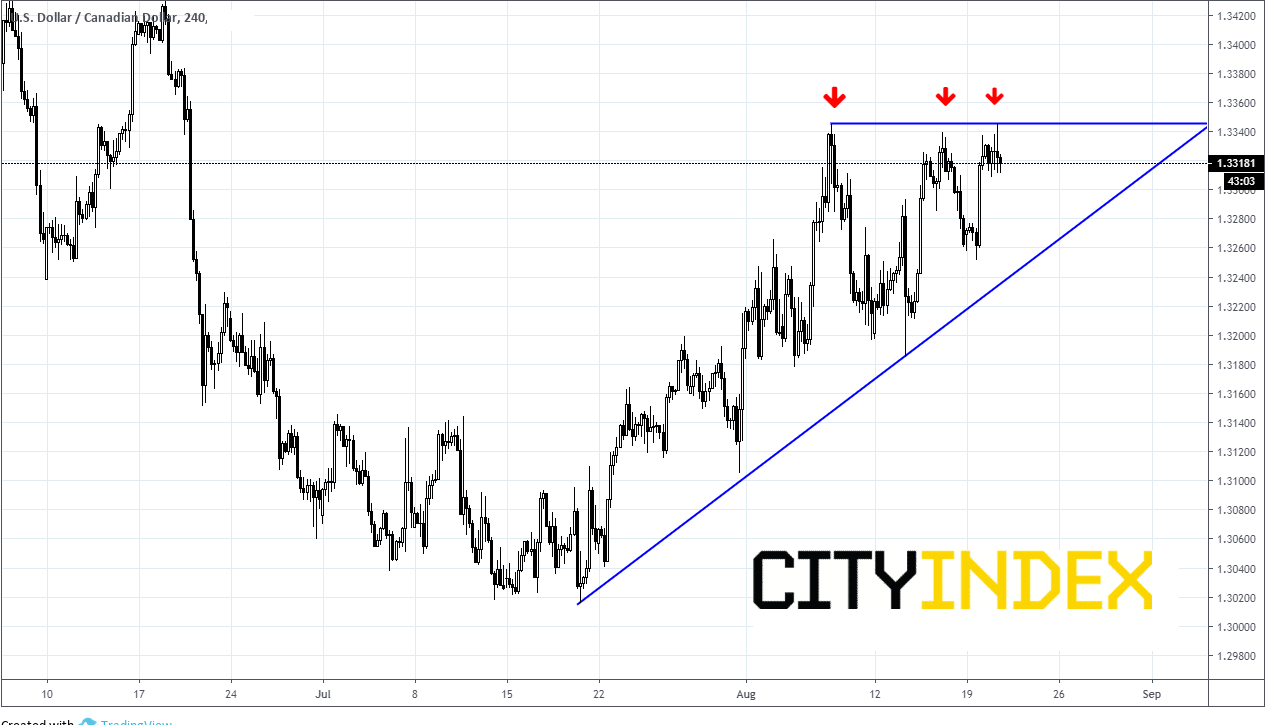

However, as we saw with USD/MEX on a shorter timeframe, USD/CAD is putting in higher lows and has hit this resistance level multiple times. It appears the market may be trying to get ahead of the BOC and weaken the CAD ahead of the data.

Source: Tradingview, City Index

If upcoming data from Canada comes out worse than expected, USD/CAD may push higher through resistance towards the May highs near 1.3665. Support comes in around the upward sloping trendline, near 1.3250. And if the upcoming data is worse, watch for the BOC to take a move dovish stance at its next meeting.