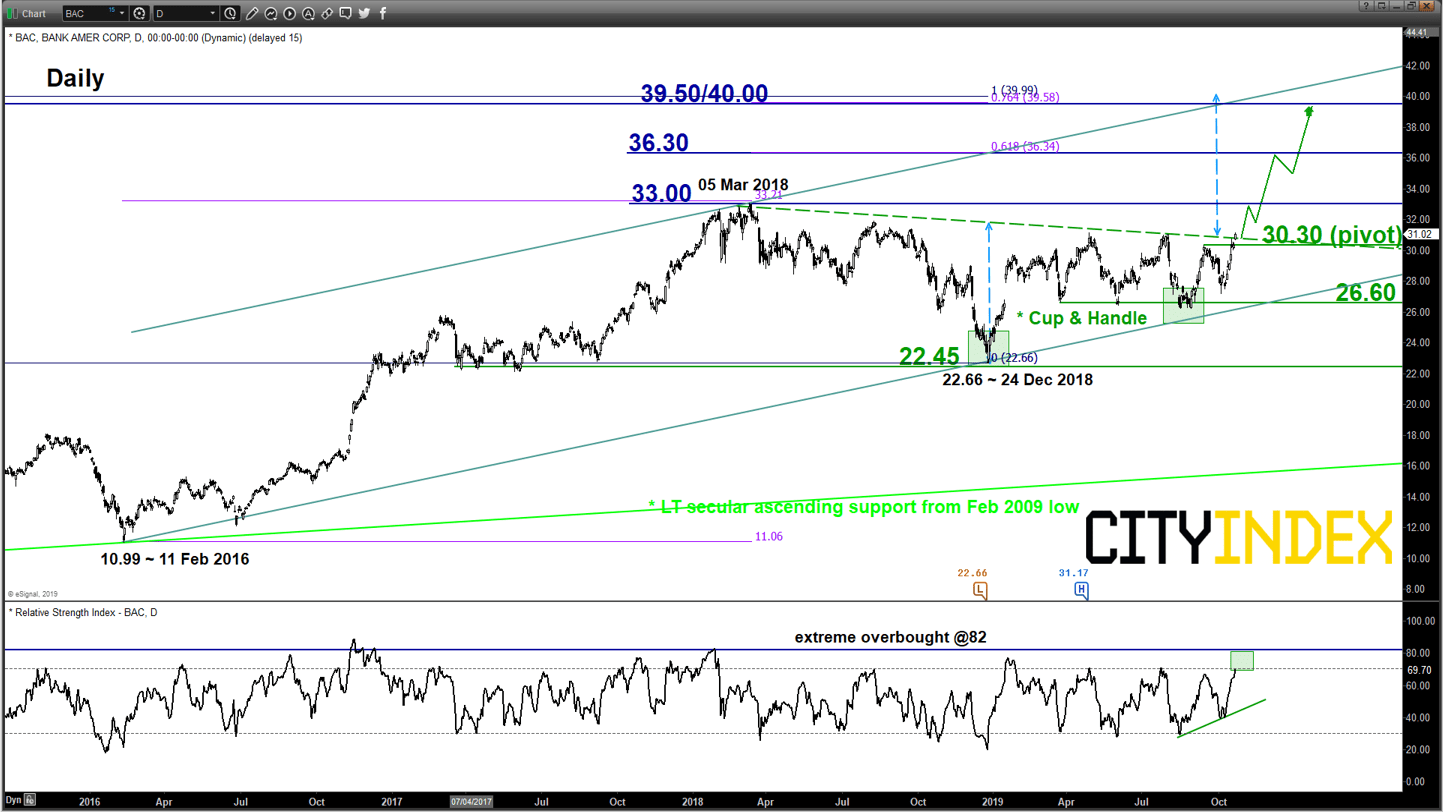

Bank of America Corp (BAC)

click to enlarge charts

Key Levels (1 to 3 weeks)

Pivot (key support): 30.30

Resistances: 33.00, 36.30 & 39.50/40.00

Next support: 26.60

Directional Bias (1 to 3 weeks)

Bullish bias above 30.30 key medium-term pivotal support for a further potential upleg to retest the 05 Mar 2018 swing high area of 33.00 before targeting the next medium-term resistances at 36.30 and 39.50/40.00 next.

On the other hand, a daily close below 30.30 invalidates the bullish breakout for a choppy slide back to retest the range support of 26.60.

Key elements

- BAC has managed to stage a bullish breakout from a 10-month bullish continuation “Cup & Handle” range configuration in place since 24 Dec 2018 low with the neckline resistance of the “Cup & Handle” now acting as a pull-back support at 30.30.

- The “Cup & Handle” range configuration tends to indicate a potential bullish consolidation phase after a prior uptrend and a break above the “Cup & Handle” range resistance triggers the start of another up-trending phase.

- The potential bullish exit target of the “Cup & Handle” stands at 39.50/40.00 with confluences with the upper boundary of a major ascending channel from 11 Feb 2016 low, Fibonacci expansion cluster and 15 Sep 2008 major swing high.

- Medium-term momentum remains positive as indicated by the daily RSI oscillator which still has further room to manoeuvre to the upside before it reaches an extreme overbought level of 82.

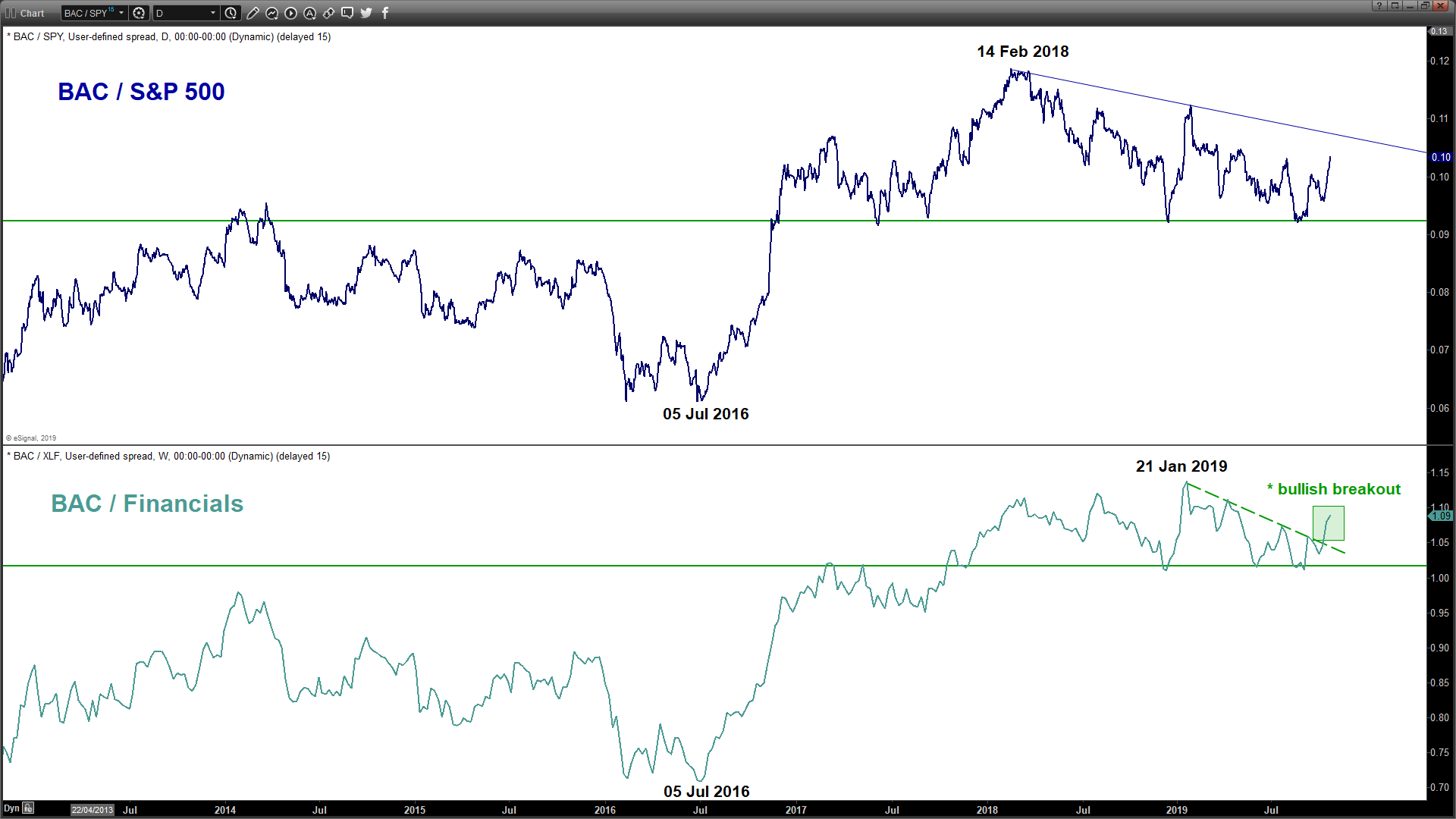

- Relative strength analysis against sector (Financials) as seen from its ratio chart is suggesting further potential outperformance of BAC

Charts are from eSignal