Aveva Group to Buy US Software Maker OSIsoft

AVEVA Group, the software company, announced that it has agreed to acquire real-time industrial data software developer OSIsoft for an enterprise value of 5 billion dollars. Schneider Electric, which owns 60.2% of Aveva's capital, said it "fully" approved this transaction. The transaction will be funded to the tune of 600 million dollars in shares and 4.4 billion dollars in cash, of which 3.5 billion dollars will come from a capital raise. Schneider has committed to subscribe on a pro rata basis to its approximately 2.1 billion dollars stake. The acquisition is expected to be earnings accretive in Aveva's financial year ending March 31, 2022.

This transaction is part of the consolidation of the technology and semiconductor sector. In July, the American Analog Devices bought its compatriot Maxim Integrated for 20.9 billion dollars.

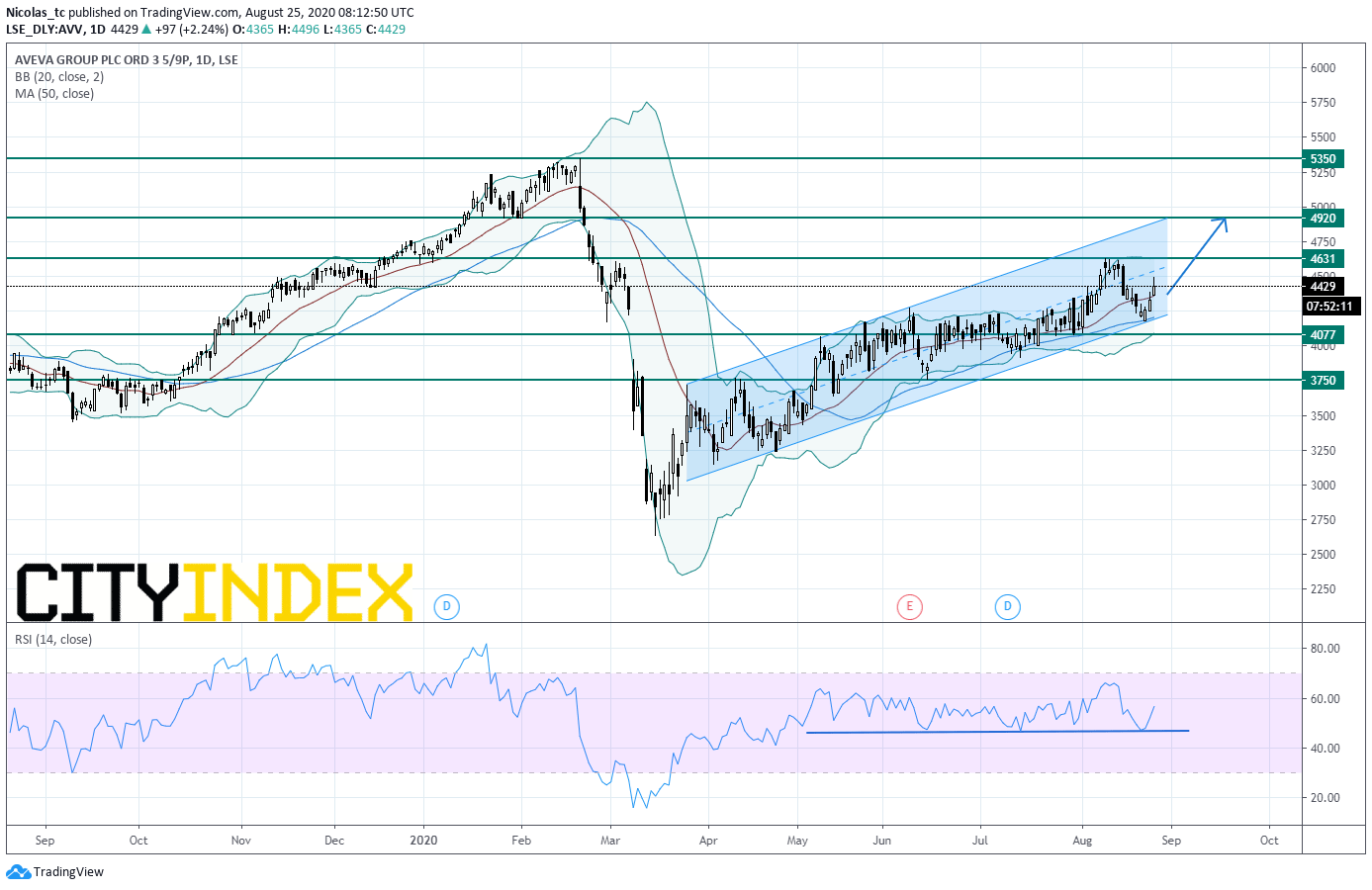

From a chartist point of view, the stock price remains in a short term bullish trend, within an upward-sloping channel, and is supported by the rising 50DMA. The Relative Strength Index (RSI, 14) is holding above a key horizontal support. As long as 4077p is support, the bias remains bullish with 4631p and 4920p as next bullish targets. Alternatively, a break below 4077p would call for a reversal down trend with 3750p as first bearish target.

This transaction is part of the consolidation of the technology and semiconductor sector. In July, the American Analog Devices bought its compatriot Maxim Integrated for 20.9 billion dollars.

From a chartist point of view, the stock price remains in a short term bullish trend, within an upward-sloping channel, and is supported by the rising 50DMA. The Relative Strength Index (RSI, 14) is holding above a key horizontal support. As long as 4077p is support, the bias remains bullish with 4631p and 4920p as next bullish targets. Alternatively, a break below 4077p would call for a reversal down trend with 3750p as first bearish target.

Source: GAIN Capital, TradingView

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM