Starting in late July, a handful of companies begin reporting earnings for the 12 months from July 1, 2020, to June 30, 2021, before reporting activity picks up a gear in the second week of August.

A feature of the 2021 financial year has been a remarkable economic turnaround supported by unprecedented central bank policy responses and government intervention, fostering a more robust rebound than even the most optimistic forecasters predicted.

This has ensured consensus expectations remain supported. Morgan Stanley has F2021e EPS growth now at 26.0% and F2022e at 18.7%. The 12-month forward market P/E is 17.25x, with Industrials ex-Financials at 30.2x.

However, the extended and deepening lockdown in NSW, along with snap lockdowns in other states and rising cost pressures, are threatening guidance. There is a risk of a more volatile than usual reporting season for companies with a domestic focus.

However, the outlook is not all dire. Vaccine supply and rollout is ramping up, a critical element in reaching the governments' vaccination targets to end this lockdown and prevent future lockdowns.

A second factor is increased financial support from the State and Federal Government, including the Disaster Payment of $750 per week for those who cannot work due to mobility restrictions.

Regarding the key dates to watch, Week 2 (August 9 – August 13) includes reports from the Commonwealth Bank of Australia (CBA), a company that will shortly be previewed in more detail.

Week 3 (August 16 to August 20), approximately 50 companies report, including three companies to be previewed in detail, BHP Group Ltd (BHP), Australia and New Zealand Banking Group Limited (ANZ), and CSL Limited (CSL).

Week 4 (August 23 – August 31), 47 companies report including three companies that will be previewed in detail, Qantas Airways Limited (QAN), A2 Milk Company Limited (A2M), and Woolworths Group Ltd (WOW).

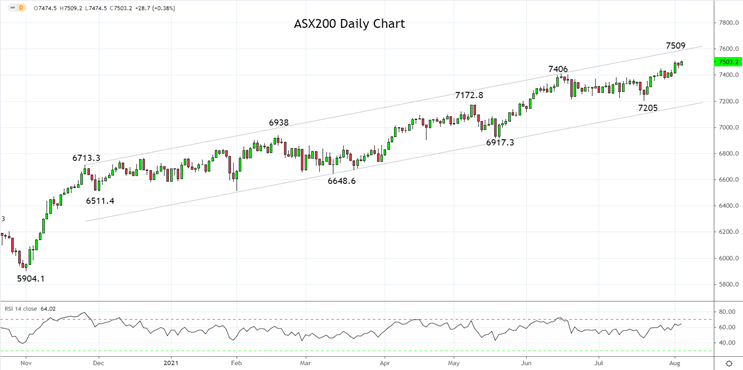

Australia's benchmark index, the ASX200, this week traded to fresh record highs above 7500 after large M&A activity involving Square Inc (US SQ) and Afterpay (APT) as well as Santos (STO) and Oil Search (OSH).

Technically there is scope for the index to extend its gains towards trend channel resistance near 7600, with dips likely to find support at the lower trend channel near 7200 in the coming weeks.

Source Tradingview. The figures stated areas of August 4, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation