Full Year Earnings Preview:

Woolworths Group Ltd (WOW) is an Australian retail group operating primarily in the supermarket sector. Woolworths’ other operations include discount department stores, home improvement, petrol, and hotels. Woolworths along with Coles forms a near-duopoly of Australian supermarkets, accounting for about 80% of the Australian market. It reports its full year numbers on the 27th of August.

Woolworths is a defensive stocks that has benefitted from the Coronavirus impact. The panic buying of toilet paper and pasta in the early days of the pandemic and the social distancing measures which led to the dramatic shift to working from home have driven up both retail and online sales.

During the March quarter 2020, Woolworths posted the strongest quarterly sales growth in more than a decade with group sales rising 10.7% to $16.5 billion. This is despite the 12.9% fall in the hotels and pokies division and the standing down of 8000 workers following the government ban on pubs and clubs and hotels.

Despite the record sales growth in the coronavirus pandemic, earnings is expected to fall between 1.2 to 2.7% due to a cost blow from higher-than-expected costs in repaying underpaid staff, keeping stores safe, automation its supply chain, and restructuring its hotels and drinks business. Consensus statutory EPS estimate is around 130 cents per share.

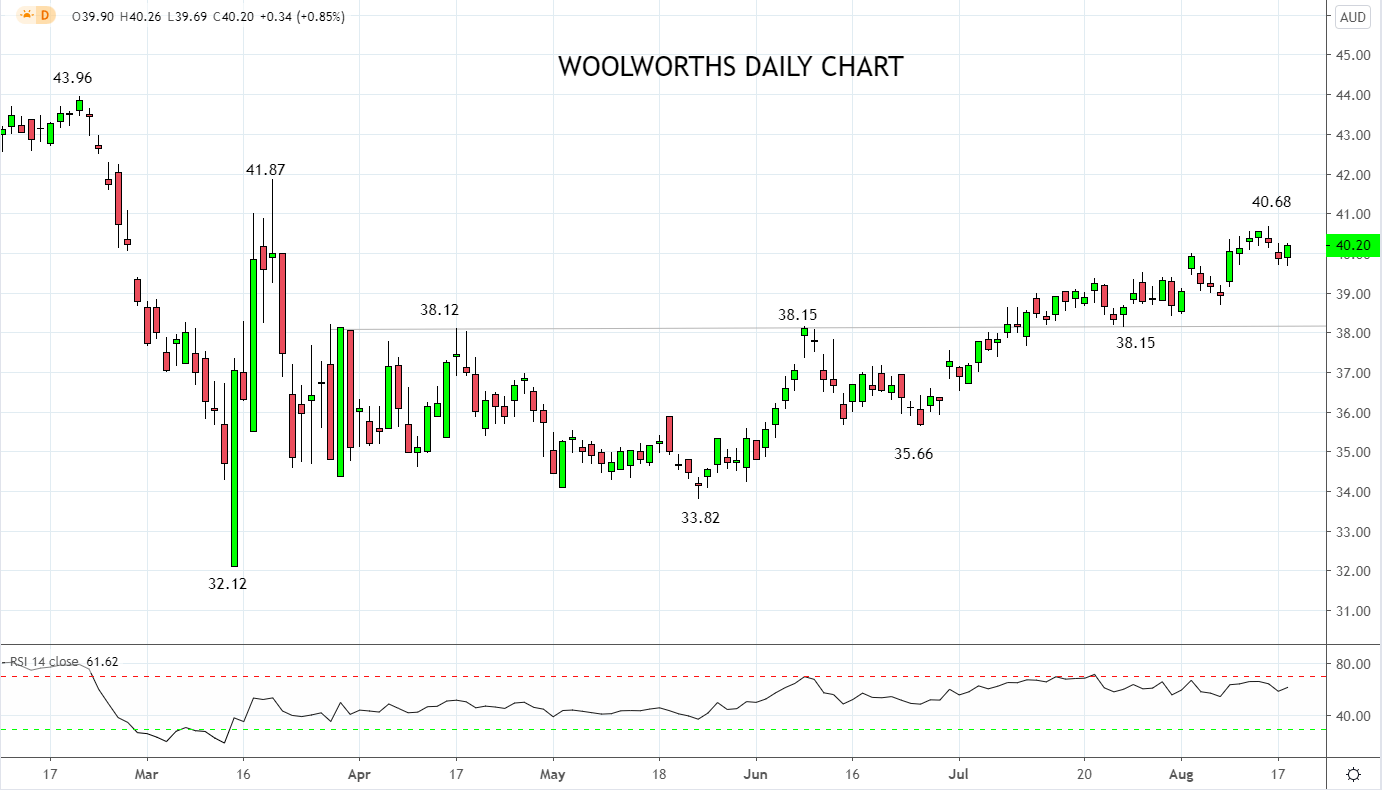

Technically, the share price of WOW has recovered about 25% from its March $32.12 low. However, it remains about 10% below its peak of $43.96 from earlier this year and appears comfortable within this range. Drilling down a little further, the $38.20/10 price region offers a confluence of horizontal support that is likely to attract buyers. On the topside, resistance comes from the March $41.87 spike high resistance, before the $43.96 all-time high.

Source Tradingview. The figures stated areas of the 19th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation