Q3 Update:

Westpac Banking Corp (WBC) is Australia’s oldest banking and financial services group, with branches and operations throughout Australia, New Zealand, and the Pacific region as well as offices in key financial centres around the world. Westpac provides a variety of financial services including retail, business, and institutional banking, funds management, insurance, investment, and broking services. It is due to give a third-quarter trading update on the 18th of August.

Westpac has like the other “big 4” banks been heavily impacted by the Coronavirus. It has made a $1.9 billion provision to cover loan losses from the pandemic and has made an additional $1 billion provision for legal costs and penalties for breaching anti-money laundering laws in a case being brought by the financial crimes regulator, AUSTRAC.

Credit rating agencies have downgraded the outlook for the big 4 banks, while the banking regulator APRA recently confirmed banks should “cap dividends at 50% of earnings”. This comes as a relief to investors after APRA previously suggested banks should defer dividend payments entirely.

As a guide, if Westpac were to declare dividends at 50% of consensus statutory EPS estimates of 100 cents per share then the FY20 dividend will come in around 53.5 cents per share or 3% fully franked.

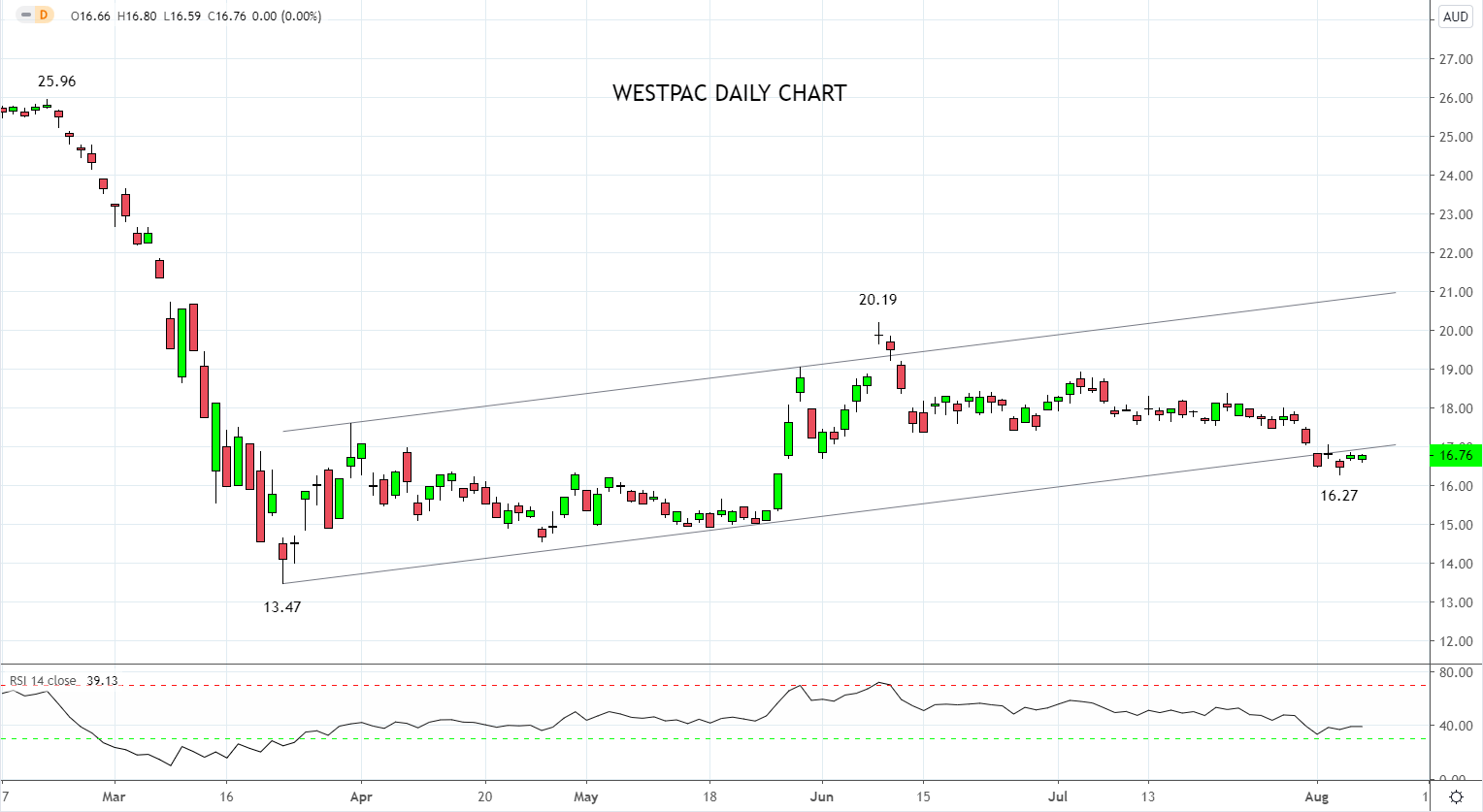

Technically, the rally from the March $13.47 low, displays corrective characteristics after an impulsive fall from the $25.96 February high. The recent break and close below trend channel support $16.70 area was a negative development and should Westpac see a sustained break below $16.00 the next level of support is not until $14.80/50.

To negate the weak technical outlook, the Westpac share price needs to return to the safety of the trend channel and then break/close above the resistance coming from recent lows $17.50/$17.60 area.

Source Tradingview. The figures stated areas of the 10th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation