Full Year:

Wesfarmers Ltd (WES) is a conglomerate with broad business operations including home improvement and outdoor living, apparel and general merchandise, office supplies, and an industrials division with businesses in chemicals, energy, and fertilizers, and industrial and safety products. It reports its full-year numbers on the 20th of August.

Wesfarmers is well diversified to weather the coronavirus pandemic; its retail operations such as Bunnings and Officeworks have gone from strength to strength during the pandemic due to the working from home environment. On the other hand, its discount department stores Kmart and Target have struggled.

While the Victorian shutdown will continue to affect 168 stores in that state, it only impacts 17% of all Wesfarmers retails sales. Its online sales growth of 89% this calendar year from its retail stores and its specialty store Catch will provide significant offset.

Wesfarmers has a strong balance sheet, boosted by the successful sale of Coles last year which provides significant flexibility and support to the group's operating businesses. The consensus statutory EPS estimate is around 180 cents per share.

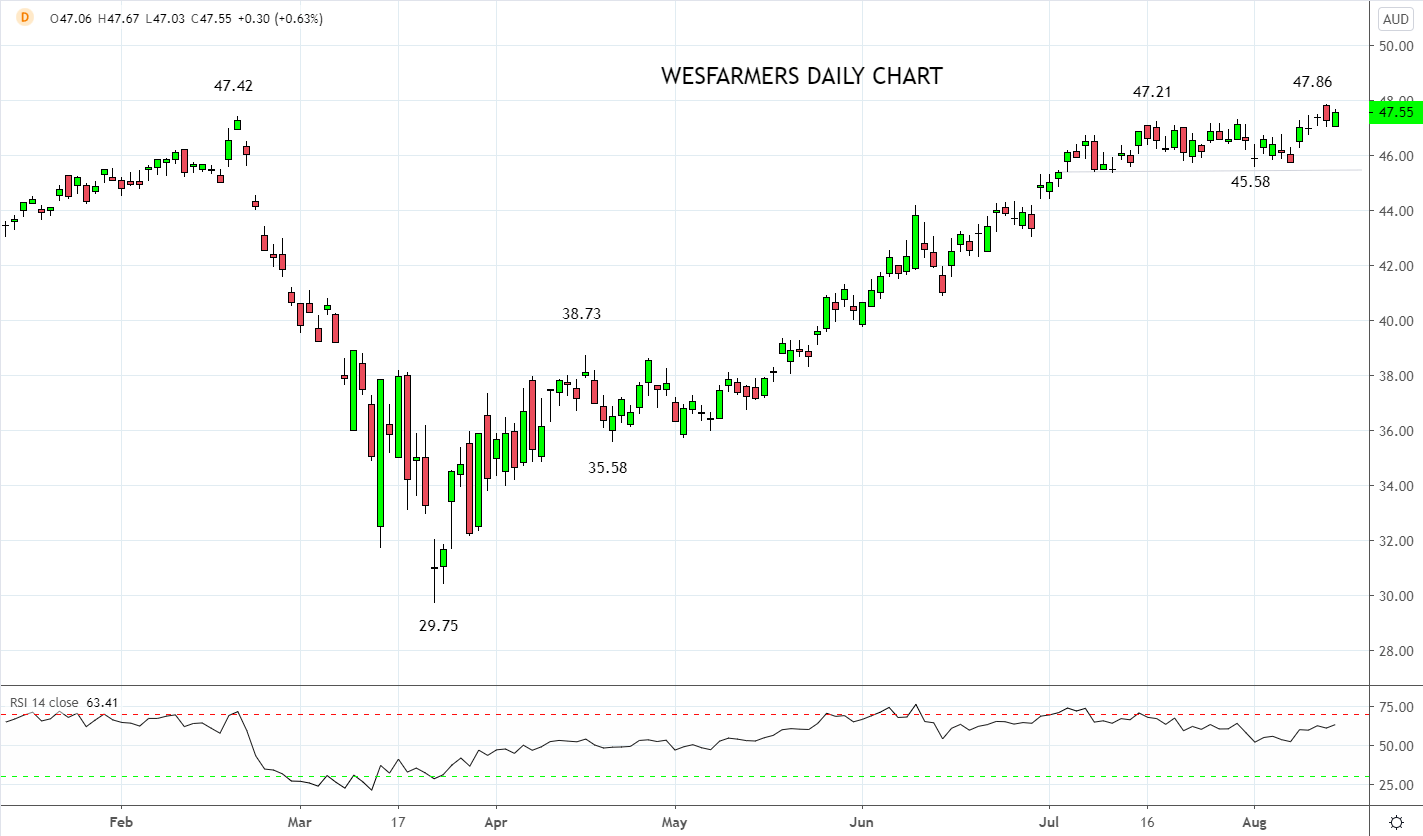

After suffering a ~35% fall during the Covid-19 crash, the share price of Wesfarmers recently traded to new all-time highs. Technically, the next layer of resistance comes from the big psychological round number at $50.00. While on the downside, dips over the past 6 weeks have been well supported towards $45.50.

Source Tradingview. The figures stated areas of the 14th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation