Full Year Earnings Preview:

Newcrest Mining Limited (NCM) is Australia’s leading and the world’s sixth-largest gold producer, according to the World Gold Council. NCM has its assets spread across Australia, the Pacific region, Asia, and Africa. It reports its full-year numbers on the 14th of August.

Gold has benefited enormously from the economic uncertainty created by the coronavirus pandemic as well as by the huge amount of monetary and fiscal stimulus that has undermined confidence in fiat currencies. Gold recently traded to new all-time highs near U.S$1986 and is up almost 30% year to date.

Newcrest has been a significant beneficiary of this environment and importantly its operations have remained COVID-19 free, enabling Newcrest to produce 2,1717,118 ounces of gold during FY 2020, in line with guidance.

While most companies are preserving cash due to concerns over economic uncertainty, Newcrest raised $1.1B to fund future growth at its mine sites in May. Although Newcrest traditionally pays only a modest dividend, it plays an important defensive role within portfolios. The consensus statutory EPS estimate is around 104 cents per share.

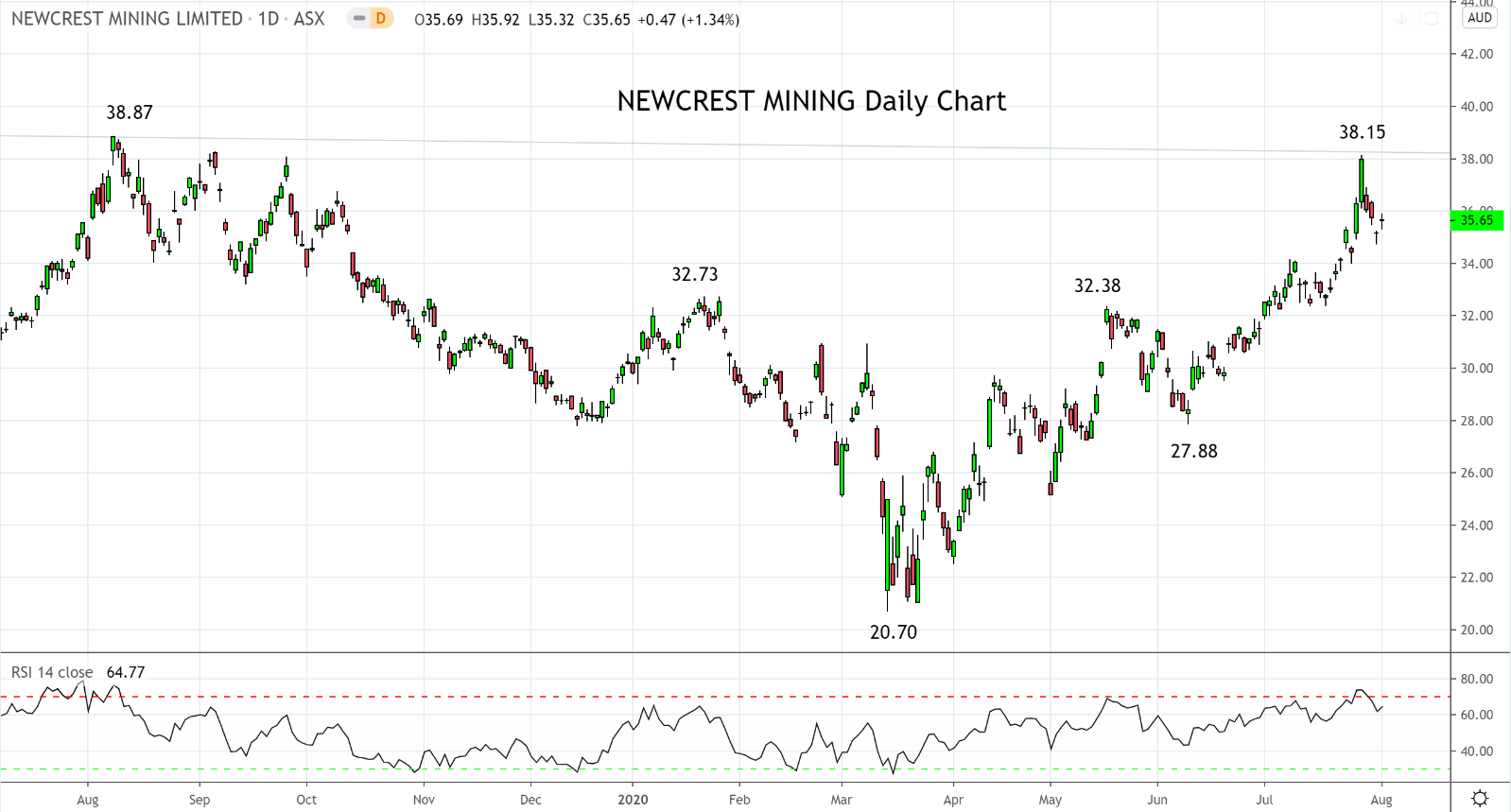

The Newcrest share price has enjoyed a strong rally from its March $20.70 low. However, it has been unable to break the trendline resistance (pictured below) coming from the November 2010 $43.70 high that also connects with the August 2019, $38.87 high.

On the downside, dips into the confluence of horizontal support $33.00/$32.00 are likely to be well supported and offer a possible buying opportunity, providing the gold price remains resilient.

Source Tradingview. The figures stated areas of the 4th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation