Full Year Earnings Preview:

Flight Centre Travel Group Ltd (FLT) is Australia’s largest travel agency and is one of the world’s largest travel agency groups with operations in more than 23 countries and a corporate travel management network that spans more than 90 countries. It is pencilled into report its full-year numbers on the 17th of August, although it could be as late as the 27th.

The travel industry has been decimated by the impact of the COVID-19 pandemic as borders slammed shut around the world and travellers cancelled or postponed trips.

More than half of Flight Centre’s 20,000 workforce has been affected, with most stood down and some let go. 800 stores targeted at leisure travellers have been closed or about half of its global network.

To remain afloat, Flight Centre raised $700 million in April and recently secured access to a debt facility of £65 million to assist its UK operations. However, with no end in sight to the virus and renewed lockdowns and border closures, a rocky road remains ahead.

Flight Centre is expected to cancel its dividend and report a consensus statutory EPS estimate of negative 86 cents per share.

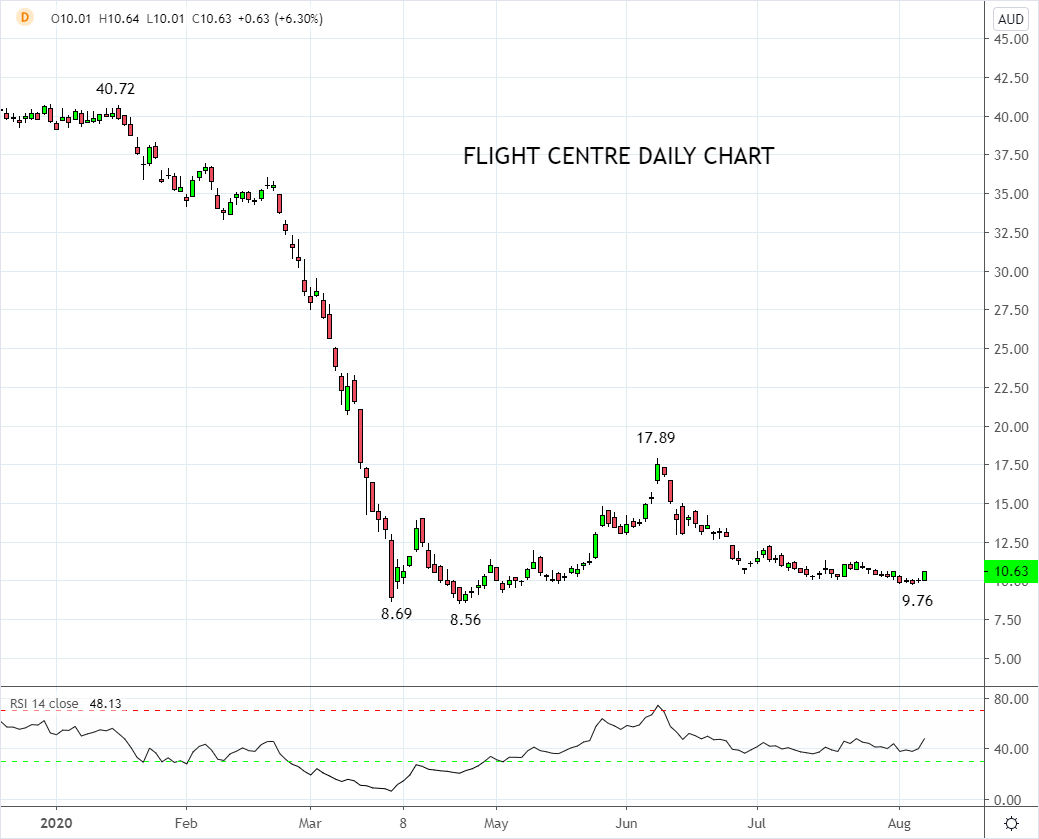

Technically, the decline from the year to date $40.72 high to April $8.56 low is impulsive. Dips below $10.00 have been well supported and short-lived and suggests buyers have been tempted back into the market, perhaps in hope of a vaccine-induced recovery. Whether this turns out to be a smart move, time will tell. On the topside, short term resistance is viewed $12.50/$13.00 region before the June $17.89 high.

Source Tradingview. The figures stated areas of the 7th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation