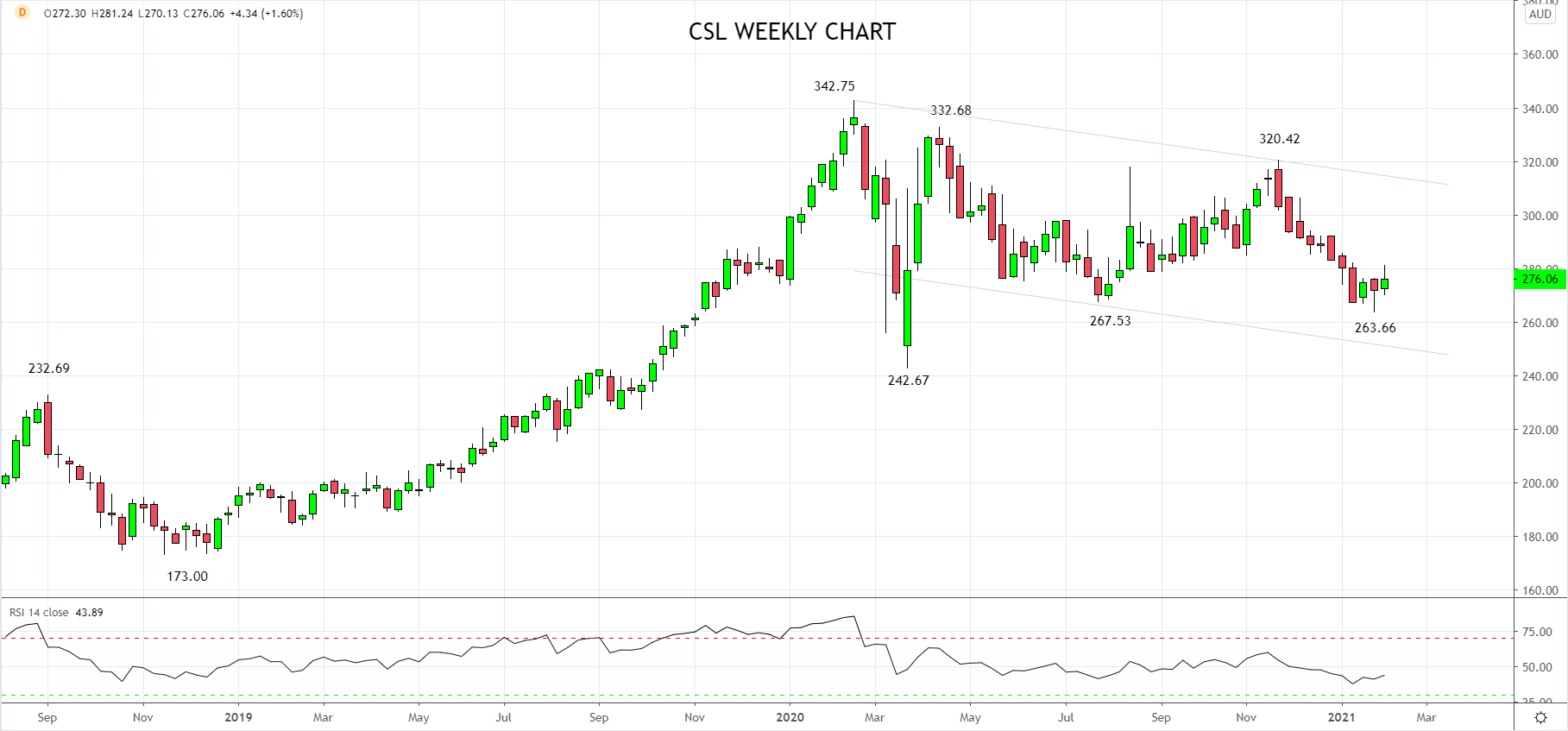

CSL is renowned as a quality company, however, unlike the broader market, its share price is trading about 20% below its 2020 high of $342.75. The source of this underperformance is a sequence of negative developments and a lack of positive catalysts to help the share price recover lost ground.

Learn how to trade shares here

CSL’s plasma collection operations have been hampered by Covid-19 restrictions, limiting its ability to collect plasma. Plasma is an essential ingredient in some of CSL’s immunoglobulin therapies which account for almost half of CSL’s sales. The company is continuing to work on ways to mitigate this issue.

The Covid-19 vaccine CSL was working on with the University of Queensland was scrapped in December after it delivered misleading results regarding HIV diagnoses in trials. Despite signing contracts to produce other vaccines including 51 million doses of AstraZeneca’s vaccine, CSL does not expect the production of vaccines to see a material lift in revenues.

Finally, the company is faced by the headwind of a rising AUD/USD, as a significant portion of its revenues are earned offshore in US dollars.

At its Annual General Meeting in December, CSL said it expects NPAT to grow at between US$2.17 billion to $2.265 billion implying growth of between 3% and 8%. Not overly exciting for a company trading on a price/earnings ratio of more than 40.

Technically, the decline from the $342.75 high of February 2020 appears to be countertrend after a stunning multi-year rally. Once the correction is complete, the uptrend is expected to resume.

As such, we would consider buying a dip into support offered by the trend channel and the March low, $250/240 area. Keeping in mind, a sustained break above trend channel resistance $315 area, would be confirmation the uptrend has resumed.

Source Tradingview. The figures stated areas of the 5th of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation