Half-year earnings preview:

The Commonwealth Bank of Australia (CBA) is Australia’s largest bank and provides a variety of financial services including retail, business, and institutional banking, funds management, insurance, investment, and broking services. It reports its half-year numbers next Wednesday the 10th of February.

The banking industry was particularly hard hit by the impact of the coronavirus last year. To minimize the risks associated with the economic slowdown banks froze payments on personal, home, and business loans.

It was also forced to made large COVID-19 provisions for bad debts and slashed dividends in line with the APRA’s recommendations that the banks should “cap dividends at 50% of earnings”. This resulted in the dividend payments for CBA shareholders falling from 431c pre-Covid, to 298c last year.

In recent months, encouraged by the sharp drop in the number of bank customers on repayment deferrals APRA dropped their dividend restrictions. As a result of this, banks are expected to return to paying a more attractive dividend of approximately 70% -75% of earnings (down from a pre-Covid high of 80-90%).

Learn how to trade shares here

As a guide, if CBA were to declare dividends at 70-75% of earnings this will imply a dividend of around 310c for FY21, increasing to 370c in FY22, putting CBA on a prospective yield of 3.7% and then 4.4% for FY22. In the second half of the year, there appears a reasonable prospect of the bank undertaking a share buyback and exploring other “capital initiatives” to return cash to shareholders.

Partially offsetting the brighter outlook outlined above demand for credit remains subdued and very low-interest rates are likely to keep margins under pressure. This will be mostly offset by lower funding costs.

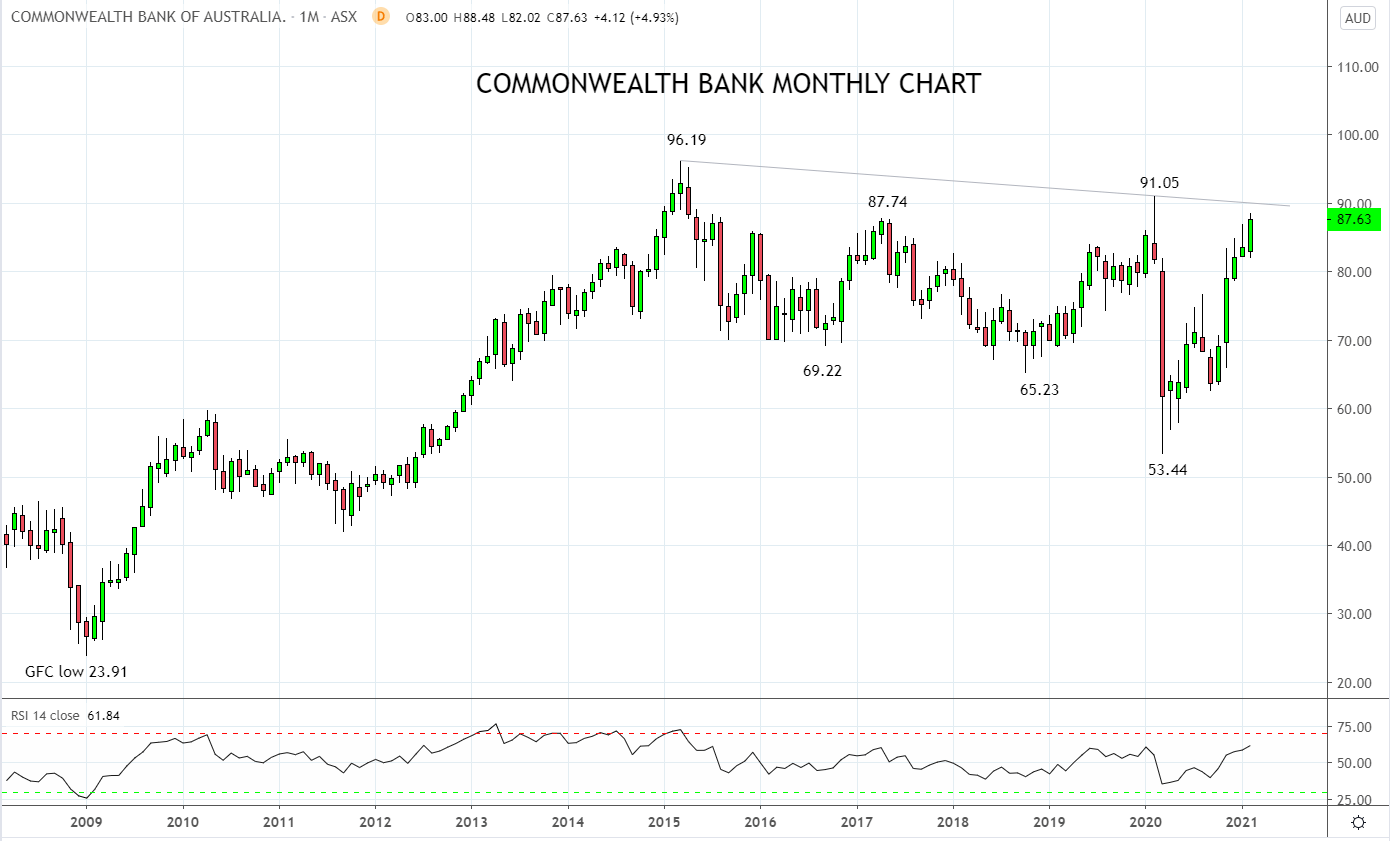

As the chart below illustrates, CBA has spent the past 11 months slowly but surely reclaiming most of the losses it experienced during the 6-week COVID-19 crash. Trendline resistance near $90.00 coming from the all-time high of $96.19 from 2015 is expected to cap the current rally in the initial instance.

On the downside, dips are likely to find buyers ahead of horizontal near term support near $82.00, before a band of medium-term support between $78.00 and $76.00.

Source Tradingview. The figures stated areas of the 4th of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation