Half Year Earnings Preview:

Mining and metals giant BHP Group Ltd (BHP) is a diversified natural resources company that sits among the world’s top producers of major commodities, including iron ore, metallurgical coal, and copper. BHP also has substantial interests in oil, gas, and coal.

A multinational and dual-listed company, BHP is headquartered in Melbourne, and is the second largest listed company on the ASX. BHP is due to report its half-year numbers on the 16th of February at 8.30 am AEDT.

Learn how to trade shares here

BHP has continued to benefit from strong demand for its key exports following the Chinese government’s sizeable post-COVID-19 stimulus measures and supply disruptions in Brazil. The price it receives for its key exports has increased significantly since the end of FY 2020, and include a 35% rise in the average realized price of iron ore and a 39% rise in the copper price.

BHP recently provided a guidance update for its flagship Australian iron ore division. During the December half, BHP produced 144 million tonnes of iron ore and is aiming for between 276 and 286 million tonnes for the full financial year to June 30.

BHP also confirmed stronger than expected output from its Escondida copper mine in Chile, offsetting news it is planning to announce a $US1.15-1.25 billion write down on its Mt Arthur coal mine in NSW. A casualty as the world moves to cleaner energy sources and a Chinese ban on Australian coal exports.

BHP is expected to announce NPAT for the first half of the year of approximately $US4.1 billion along with an attractive dividend.

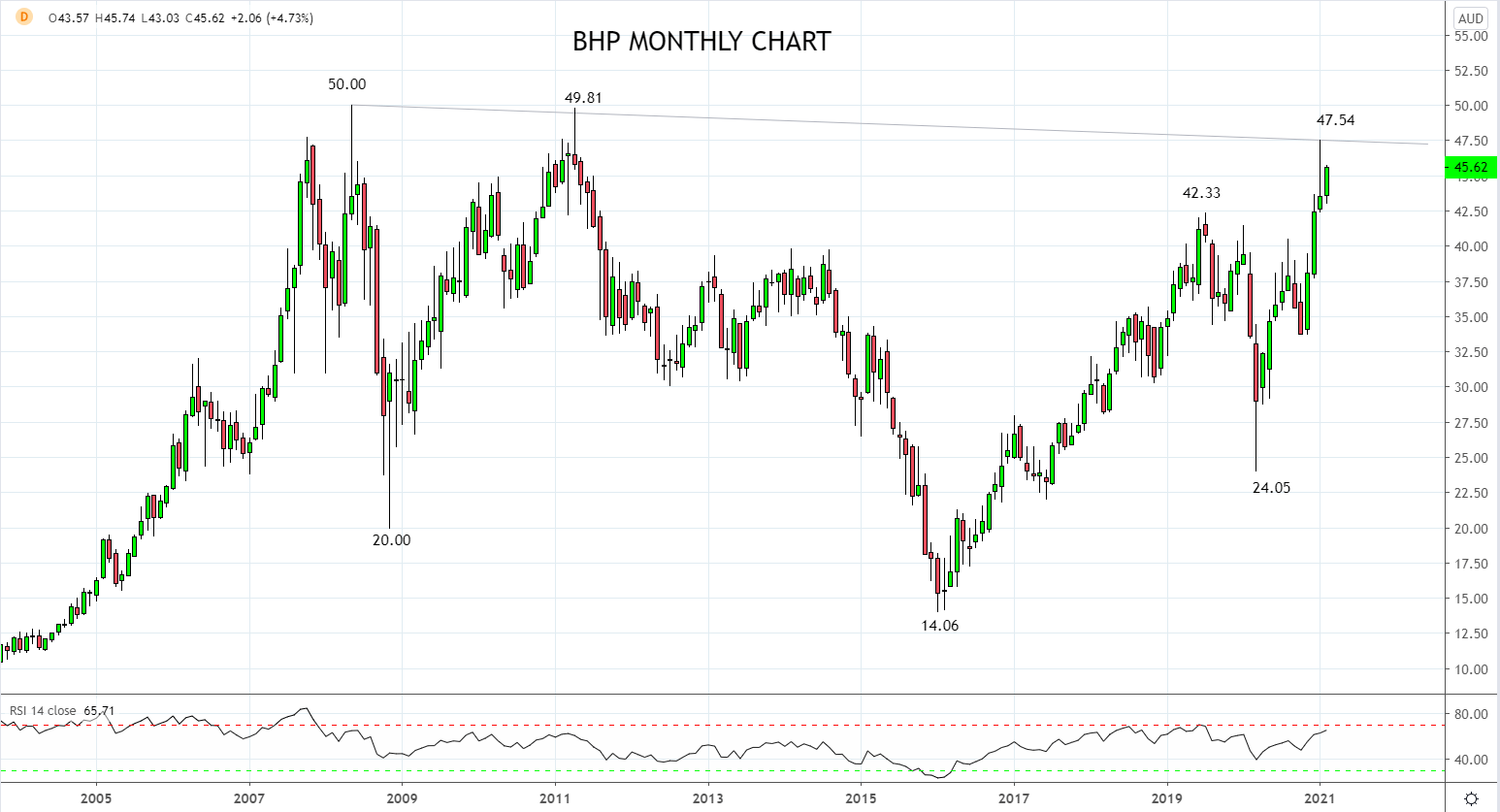

Technically, BHP has overhead trendline resistance coming in near $47.00, drawn from the pre GFC high in 2008 of $50.00. On the downside, dips are likely to be well supported towards a band of horizontal support $42.00/$40.00 region.

Given the strong reflation thematic that continues to run through markets, should the BHP price dip into the aforementioned band of support, it would be viewed as a buying opportunity.

>Source Tradingview. The figures stated areas of the 11th of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation