Q3 Update:

The Australia and New Zealand Banking Group Limited (ANZ) more commonly call ANZ, is one of the five largest financial institutions in Australia and the largest in New Zealand. ANZ provides a full range of banking and financial services to retail, institutional and corporate customers and is scheduled to deliver a third-quarter trading update on the 19th of August.

While Coronavirus has impacted most sectors, the Australian banking industry has been particularly hard hit. In April, ANZ confirmed a 51% fall in profits in the first half of the financial year and a $1 billion credit provision for bad debts from the economic slowdown.

Credit rating agencies have downgraded the outlook for the big 4 banks. Providing some relief to investors, the banking regulator APRA recently confirmed banks should “cap dividends at 50% of earnings” after initially suggesting they should be axed.

As a guide, if ANZ were to declare dividends at 50% of consensus statutory EPS estimates then the FY20 dividend will come in around 65 cents per share or 3.5% fully franked, compared to the $1.60 a share it paid in 2018/19.

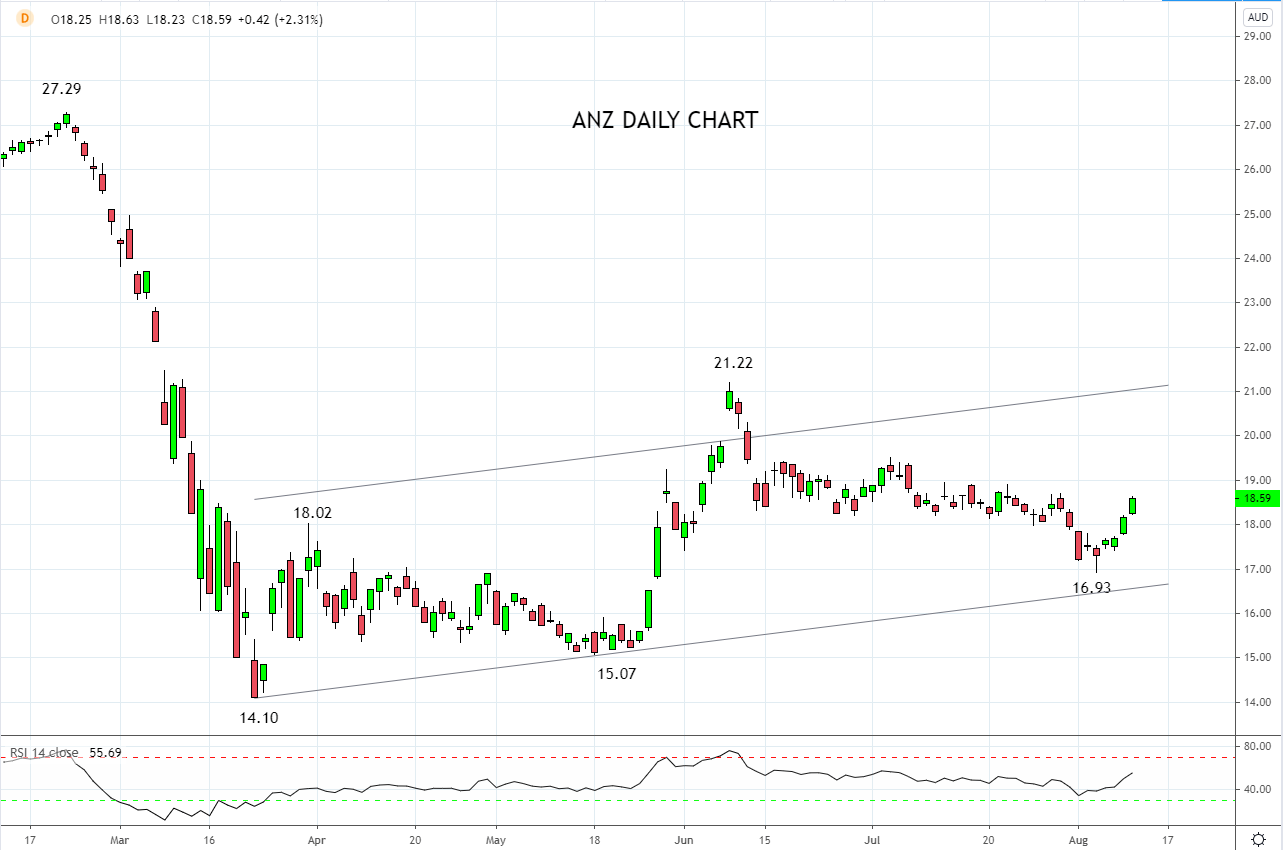

Technically, the medium-term backdrop is negative as the fall from the year to date high at $27.29 to the March $14.10 low is impulsive. The rally from the $14.10 low displays corrective characteristics.

The recent bounce from $16.93 has confirmed the importance of trend channel support currently viewed $16.90/$16.70 area. On the topside, initial resistance comes from the early July high, near $19.50, before medium term resistance $21.20/50, from the top of the trend channel, the June high, and the March breakaway gap.

Source Tradingview. The figures stated areas of the 11th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation