Full Year Earnings Preview:

The Afterpay Touch Group Ltd (APT) is an Australian incorporated technology company that makes up one of the ASX’s highly sought-after WAAAX tech stocks. A pioneer of “buy now, pay later” technology, Afterpay delivers an innovative payment platform that enables consumers to purchase and receive goods and spread the cost of their purchase out over equal payments, without having to pay interest. It reports its full-year numbers on the 26th of August.

The onset of the coronavirus pandemic tested Afterpay as credit markets tighten, retailers closed their doors and many of Afterpays millennial customers faced job losses.

However, Afterpay applied a "surgical" approach to modifying its complex lending algorithm in a bid to shelter the business from the downturn. Its proprietary algorithm now assesses "hundreds" of different attributes about a consumer and their intended purchase, providing them with a score that determines their spending limit and credit risk.

Afterpay also tightened spending limits across the board and requires all customers in Australia to cover the first instalment of their payment upfront. Additionally, transaction approvals for higher-risk products, such as luxury goods, receive greater scrutiny, with a particular focus on limiting high-risk purchases from new customers.

The company's underlying sales for the March quarter almost doubled when compared to the same quarter last year, up 97% to $2.6 billion, driven largely by a billion-dollar contribution from Afterpay's nascent US division. Chinese internet giant Tencent, which owns social media and payments app WeChat also took a strategic 5% stake for $300 million.

Management is expecting FY20 revenue to surge 112% to $11.1 billion although underlying earnings before interest, tax, depreciation, and amortization (EBITDA) are expected to fall to between $20 million to $25 million.

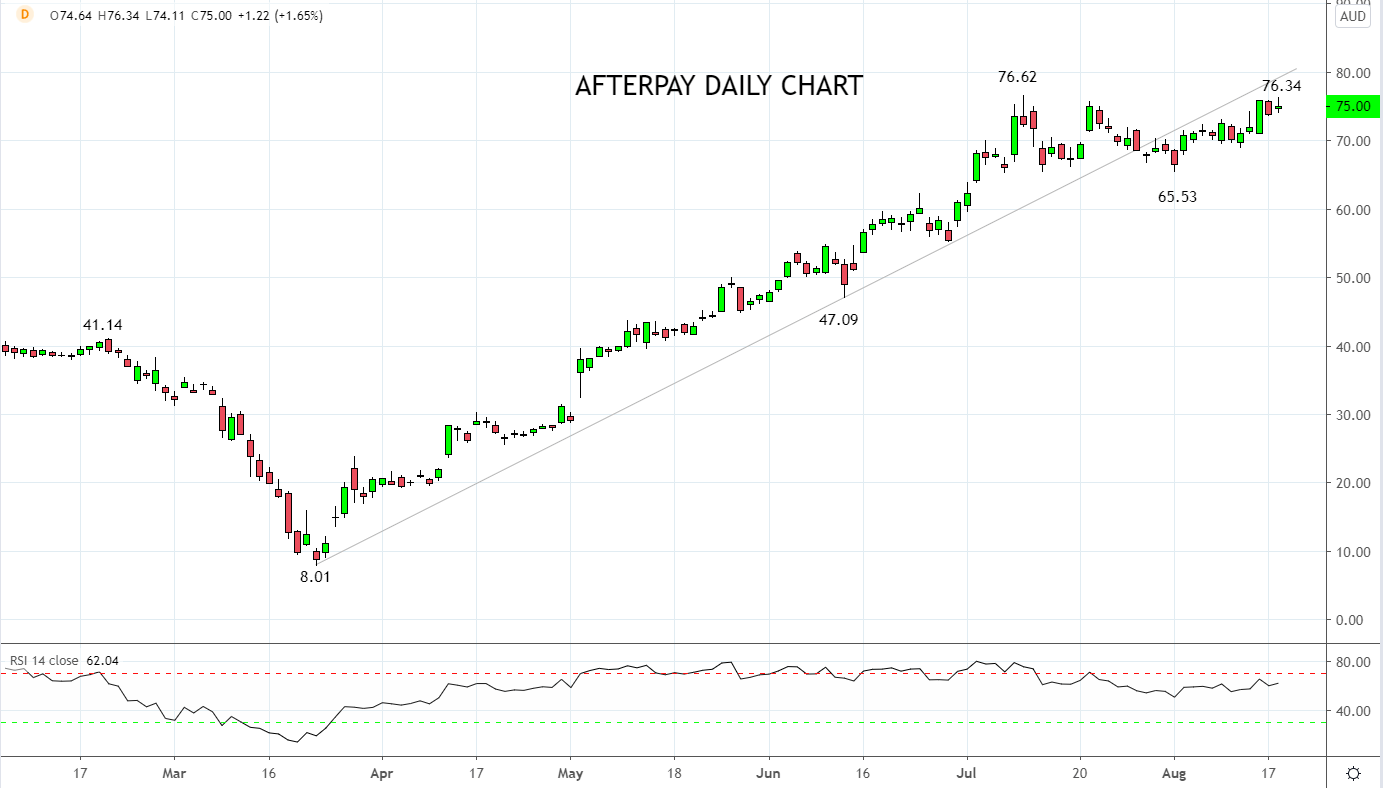

Following its 78% fall to its $8.01 low in March, the Afterpay share price has since recovered all lost ground and much more, recently trading to a new all-time high of $76.62. On the topside, resistance comes from the broken uptrend line near $80.00. On the downside keep in mind, the confluence of horizontal support ahead of $65.00.

Source Tradingview. The figures stated areas of the 19th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation