Full Year:

The A2 Milk Company Limited (A2M) produces and supplies milk and milk-related dairy products in Australia, New Zealand, U.S, China, Korea, and the United Kingdom. A2 Milk holds the mantle as the only fresh cows’ milk to contain the A2 and A1 proteins, which sets it apart from some of its competitors in the dairy market. A2 Milk is dual-listed in Australia and New Zealand and reports its full-year numbers on the 19th of August.

A2 Milk has been a beneficiary of the crisis unleashed by the COVID-19 pandemic. A2 Milk sales surged during the initial wave of panic buying and it has continued to experience strong demand and win market share. In response, A2 Milk upgraded its full-year earnings guidance in April 2020 by 32%.

Ironically, a delay in planned recruitment due to COVID-19 restrictions, currency movements, and lower costs for staff travel has also contributed to increased underlying earnings. Revenue for the year is tipped to be in the range of $1.7 billion to $1.75 billion.

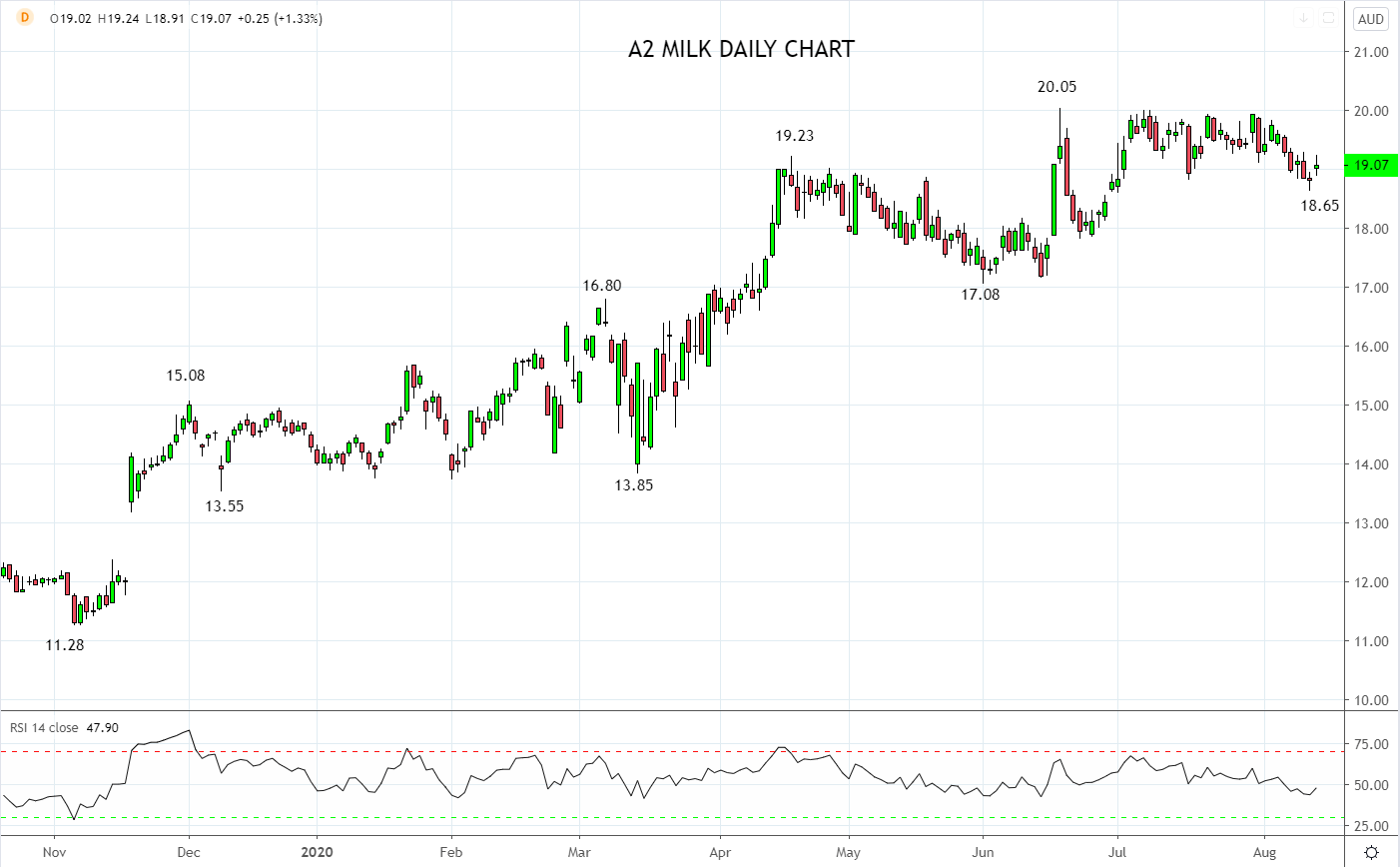

After making a fresh all-time high in June of this year at $20.05 the A2M share price has spent the past two months consolidating, reflecting the strong fundamentals outlined above.

It’s hard not to like this stock with the main short term risk to the uptrend being a “buy the rumour sell the fact” type reaction after it reports it’s full-year numbers next week. In this instance, we would look to buy dips back towards support $17.70/50, looking for a break above $20.05.

Source Tradingview. The figures stated areas of the 13th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation