Few industries were as devastated by the impact of the Covid 19 as the airline industry. Australia's successful containment of the virus provided welcome relief during the first half of 2021 and fostered a domestic travel boom.

In an update in May, based on the boom in domestic travel continuing and the assumption of no other significant lockdowns, Qantas forecast underlying earnings of between A$400 million ($309 million) and A$450 million for the 12 months ending June 30, and said net debt had peaked.

Unfortunately, events since then have taken a sharp turn for the worst. In late June, an outbreak in Sydney of the highly contagious Delta strain has forced a series of lockdowns across Australia, including the Greater Sydney region, for the past nine weeks.

With State borders and mobility restrictions likely to remain in place until the end of the year, Qantas recently furloughed an additional 2,500 workers on top of the around 7,000 workers already furloughed on the airline's international business.

The economic impact of the current lockdowns is more of a story for FY2022. Analysts expect the airline to report a loss of $1.2 billion for the 12 months to June 30.

To help deal with the virus and its implications in 2022, Qantas has demanded all staff get fully vaccinated or risk being fired. It has also launched a campaign offering rewards and incentives to travelers who are fully vaccinated.

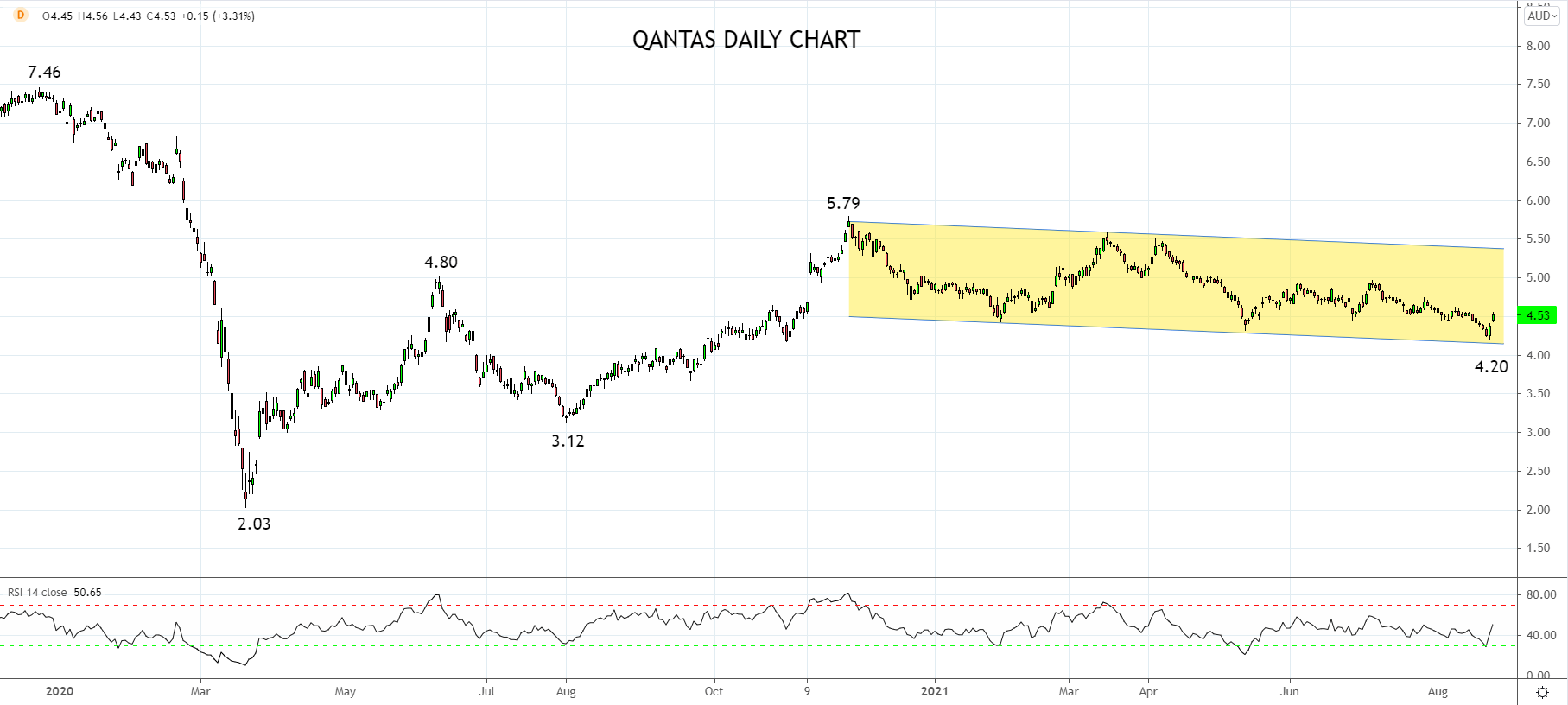

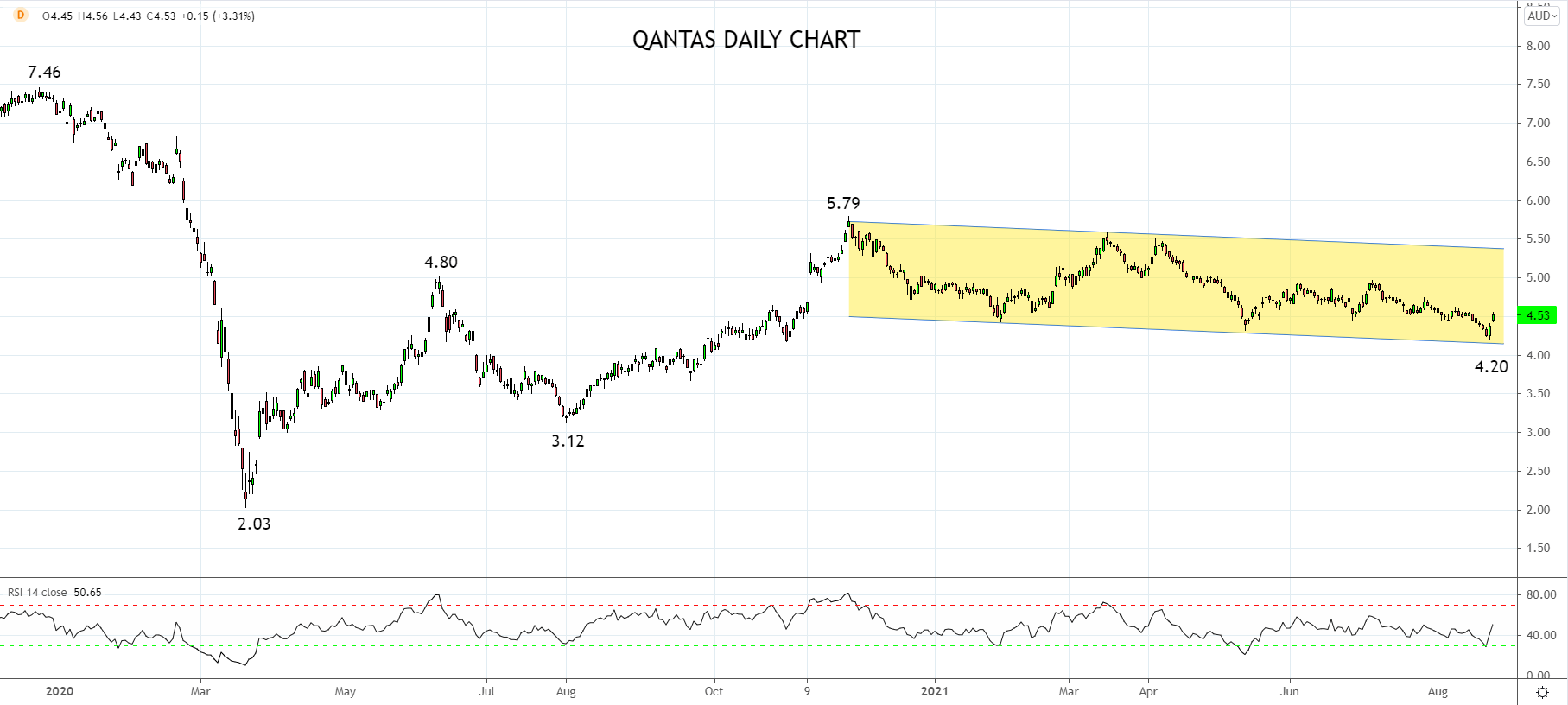

After touching a low of $4.20 yesterday, the share price has rallied back above $4.55 this morning, confirming the validity of the trend channel support highlighted below.

Therefore, while above the trend channel support there is room for the share price to rally back to the July $4.97 high, with a break and close above here opening a test of trend channel resistance near $5.50.

Source Tradingview. The figures stated areas of August 24, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM