The recession turned out to be less severe than forecast. Aided by a strong rebound in the housing market and demand for home loans, the share price of CBA broke above the $100 barrier for the first time in May.

CBA has historically traded at a premium to its peers, and this remains the case. It is currently trading on a P/E of 22.1x above the group average of 20.0x, despite offering a lower dividend yield of 2.50%. The price premium is based on the belief that CBA has a more loyal shareholder base, is better managed than its peers, and holds a superior distribution franchise.

The strong demand for home loans has boosted earnings, while the robust housing recovery means that CBA can reduce its cash buffer. This is expected to result in CBA increasing its dividend and it may announce a $5 billion share back, although the buyback may be delayed until after the NSW lockdown ends.

The consensus is for CBA to report cash earnings of $8,459 million and declare a final dividend of 189 cents per share.

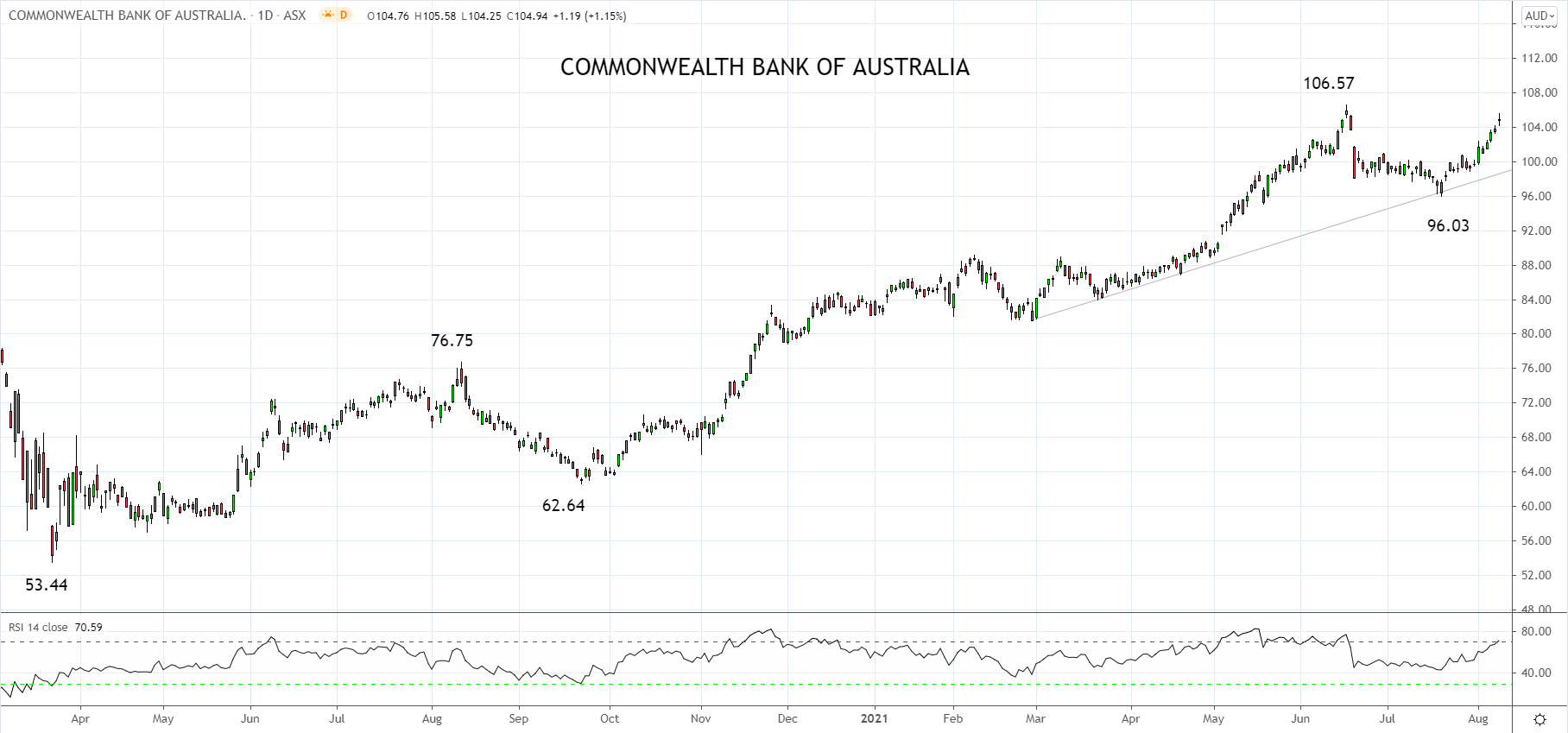

In the lead up to tomorrows report, CBA is trading just below its June high of $106.57, almost 29% above where it started the year. Support is viewed ahead of uptrend support coming in at $100.00 with the next level of resistance coming in at $110/$112.00.