A multinational and dual-listed company, BHP is headquartered in Melbourne and is the second-largest listed company on the ASX behind CBA. BHP is due to report its full-year numbers tomorrow, the 17th of August at 5.00pm AEST.

Expectations for BHP are running high after Rio Tinto posted a record first-half profit of $US12.1 billion and a $US9.1 billion dividend in late July, boosted by record prices for iron ore.

Although iron ore accounts for only 60% of BHPs earnings, other parts of the business have benefited from booming commodities prices prompting analysts to increase their profit and dividend expectations for BHP.

Consensus expectations are for BHP to pay a final dividend of US 204c or A$2.75 per share. With the interim dividend of A$1.31, this would take the full-year payout to A$4.06 per share, putting BHP on a yield of 7.6% based on the current price of $53.42.

In terms of guidance, most analysts expect the iron ore price to fall further as the world’s largest producer, Brazilian miner Vale, boosts supply back towards pre-Covid levels, and second and third-tier miners add to global output.

While on the demand side of the equation, China, the buyer of 98% of Brazilian and Australian iron ore, continues to pressure steel makers into limiting production and is tackling an outbreak of Covid19.

Longer-term, Chinese-driven investment in new iron ore mines in West Africa and rising scrap metal supplies that reduce demand for iron ore will be a handbrake to the fortunes of BHP, Rio, and Fortescue as the price of iron ore slides back towards $140 p/t.

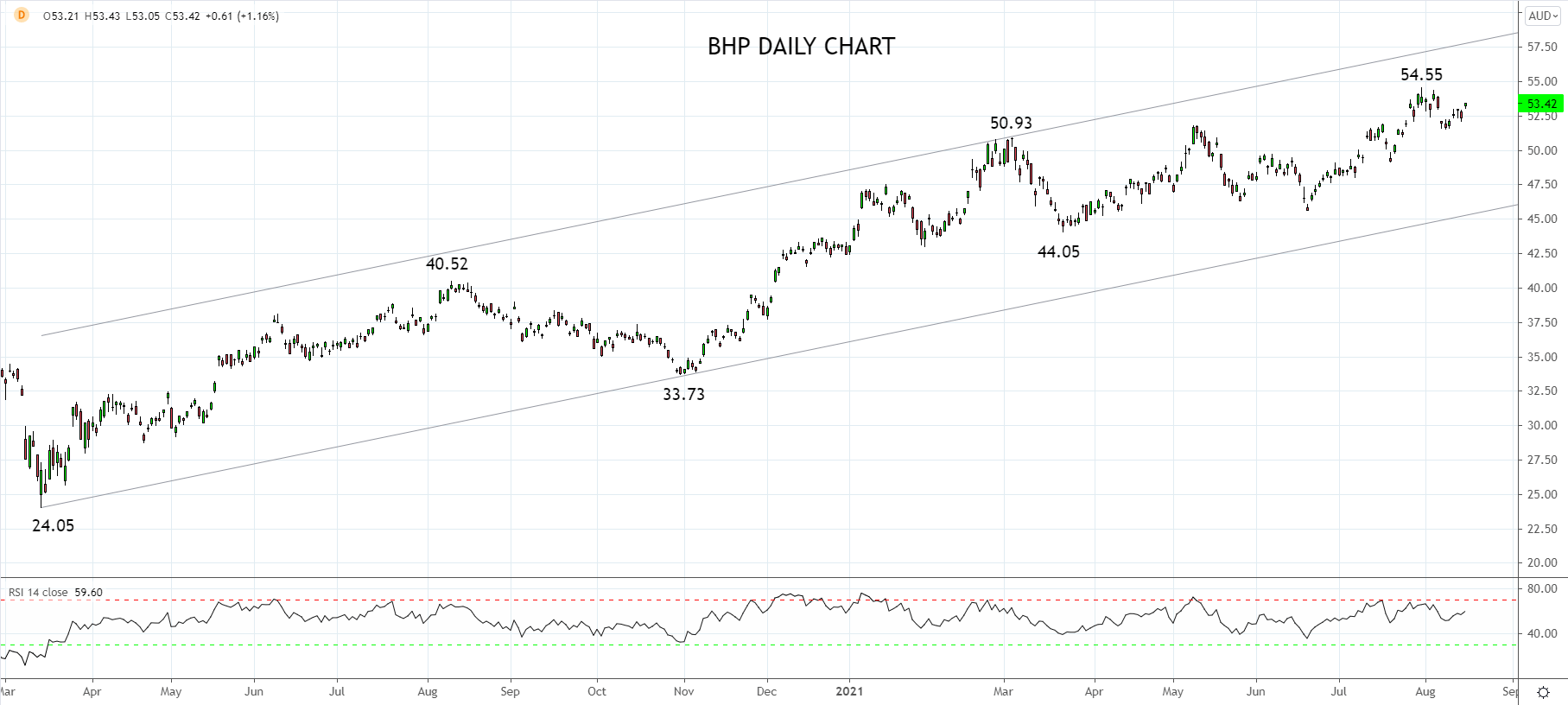

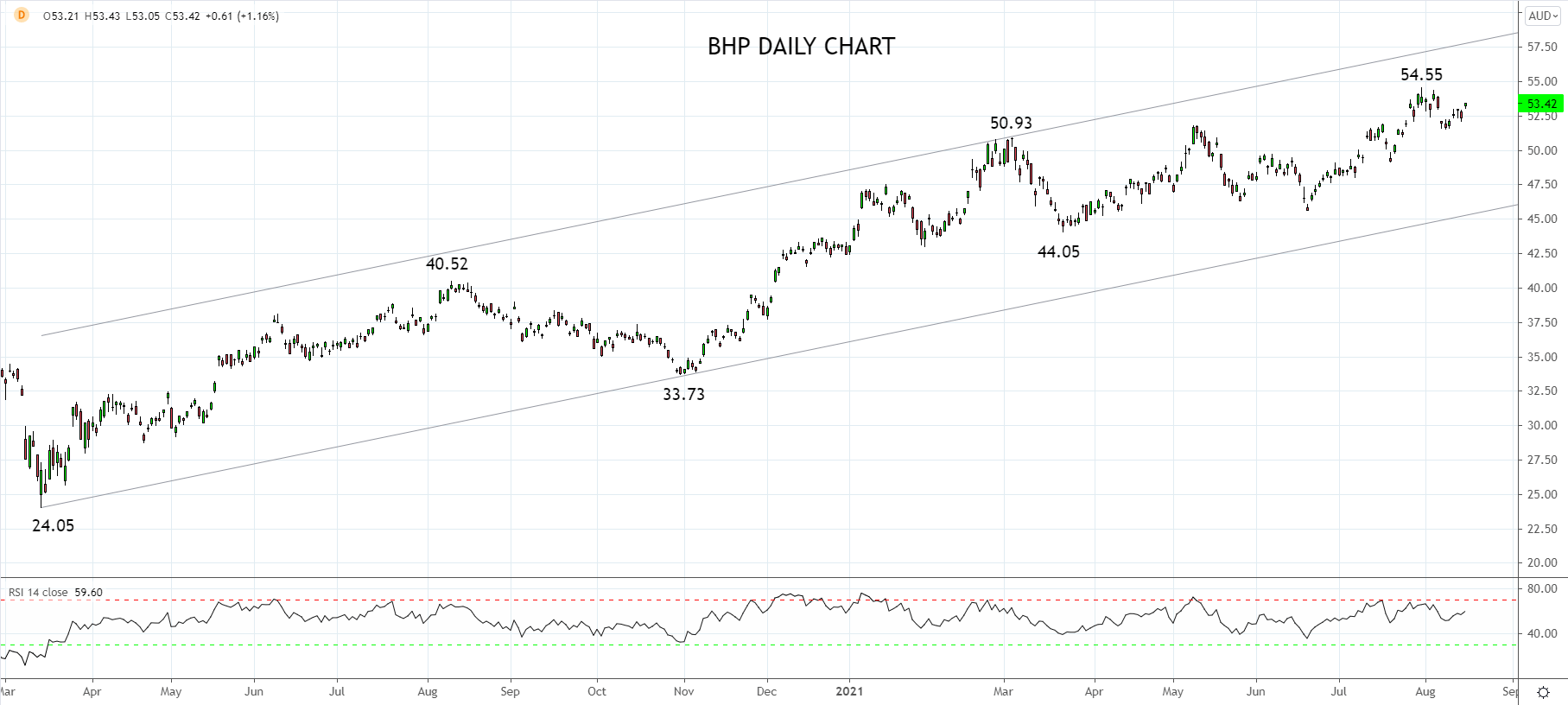

Technically, BHP is trading in an uptrend coming from the March 2020 $24.05 low. Resistance is viewed at the late July $54.55 high and above that at $57.50 coming from trend channel resistance. On the downside, initial support is at $50.00 before trend channel support at $45.50.

Source Tradingview. The figures stated areas of the 16th of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM