ANZ provides a full range of banking and financial services to retail, institutional and corporate customers and will deliver a third-quarter trading update on the 18th of August.

The impact of the coronavirus shook the banking industry. ANZ froze payments on personal, home, and business loans, making provisions for bad debts, and slashing dividends.

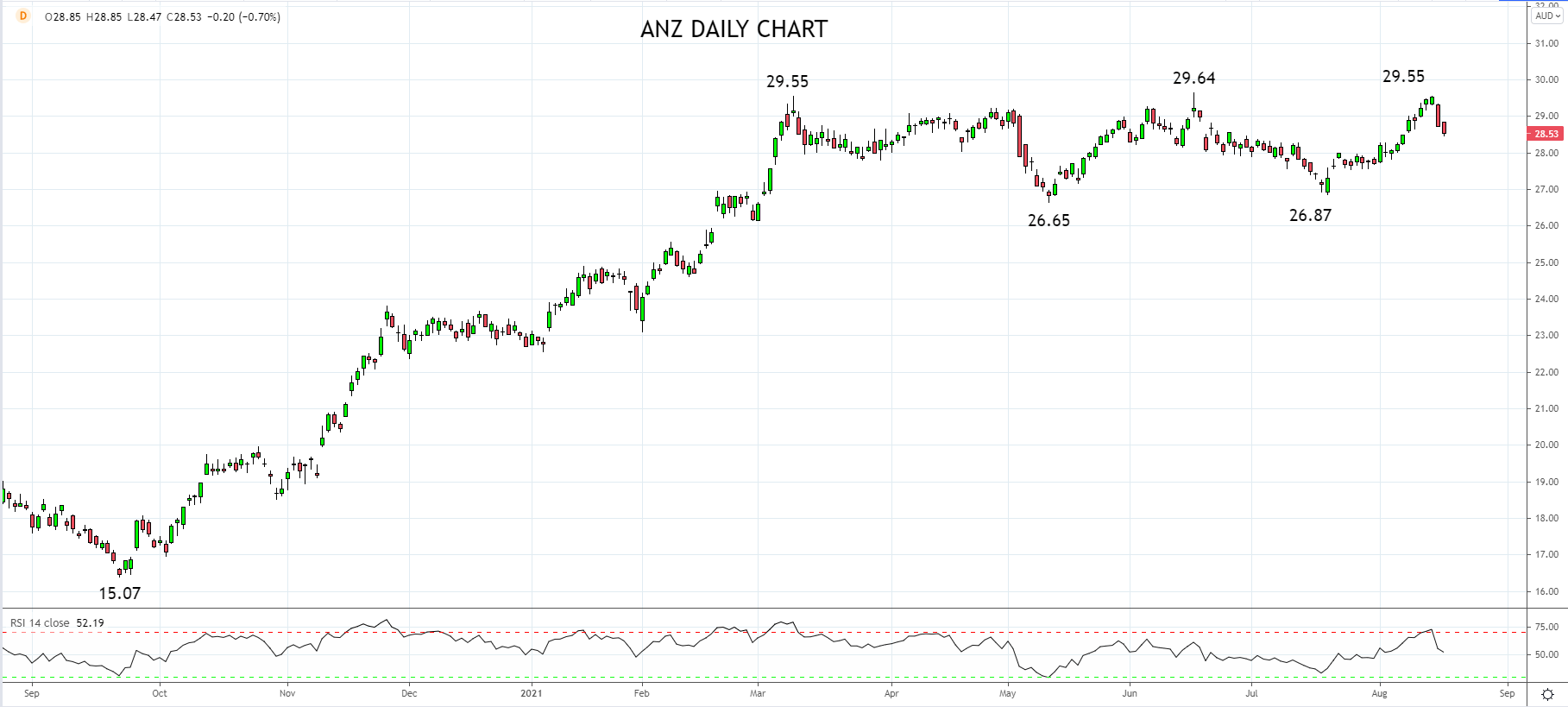

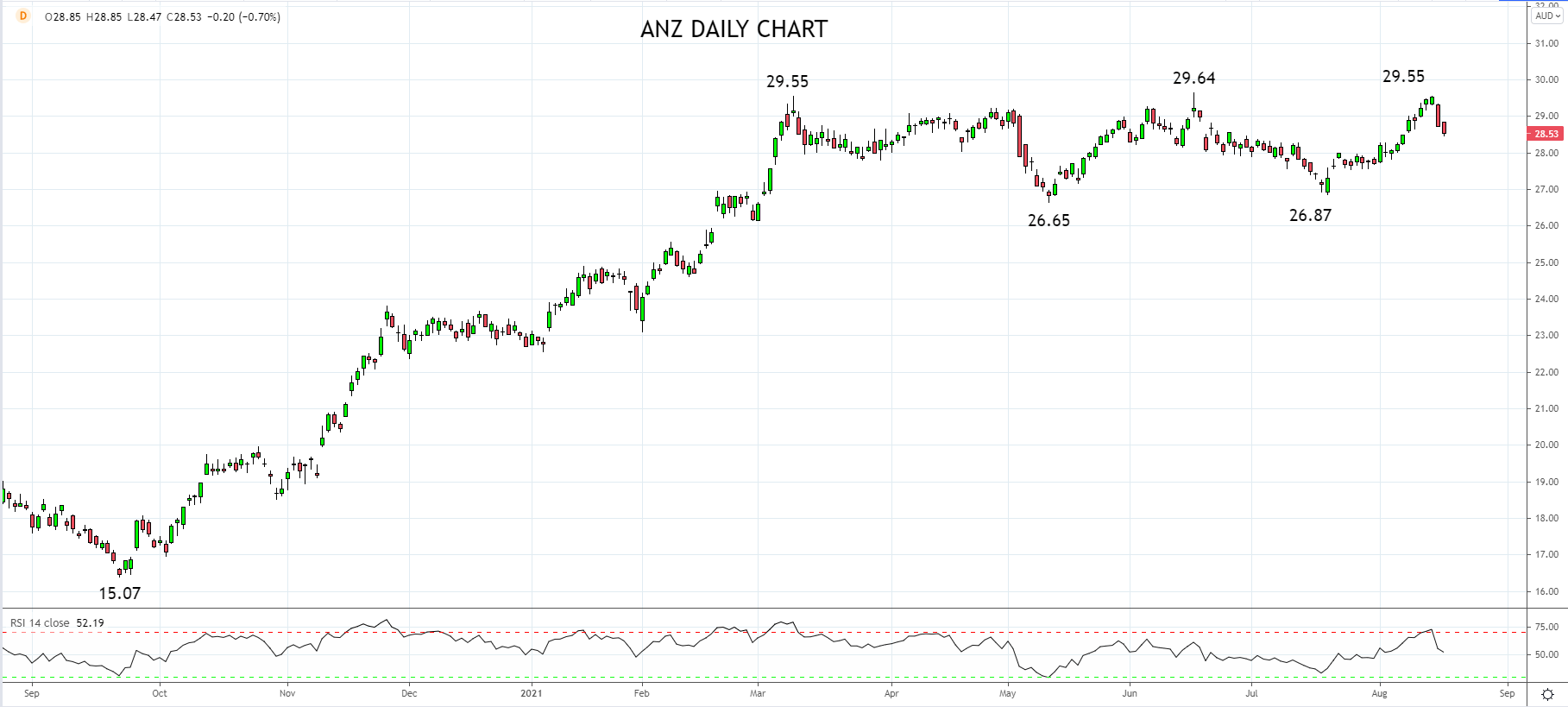

However, the recession turned out to be less severe than forecast. Following a strong rebound in the housing market and demand for home loans, the share price of ANZ has rallied by over 25% since the beginning of the year, and it is trading ~100% higher than its Covid crash low back in March 2020 of $14.10.

Part of the recent outperformance is courtesy of a $1.5bn share buyback announced after the market closed Monday the 19th of July. The market welcomed the announcement, and it helped propel the share price from below $27.00 to a high of $29.55.

ANZ's Q3 earnings update will provide investors with a guide as to how the bank is tracking the market's full-year expectations and whether ANZ shares are reasonably priced.

Analysts expect a solid third-quarter update in August, with the market forecasting cash earnings from continuing operations of $1.3 billion for the three months, driven by relatively unchanged banking income and further improvements in operating expenses.

ANZ is expected to pay a fully franked dividend per share of 145 cents in FY 2021 and 165 cents in FY 2022 and implies potential yields of 5.1% and 5.8%, respectively.

Technically, there is now a double top in place from the March 2021 $29.55 high, which becomes a formidable resistance level. ANZ needs to break/close above this level to avoid rotating back towards the bottom of the range and the medium-term buy level near $27.00.

Source Tradingview. The figures stated areas of the 17th of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation