As a guide, most Australian companies report half-year earnings in February for the first six months of the new financial year (July 1 to December 31), before full-year earnings are reported in August.

Learn how to trade shares here

Before last August's reporting season, the Australian and the global economy were suffering under the weight of the Covid-19 pandemic which bought with it lockdowns, implementation of travel restrictions, and a sharp rise in the unemployment rate.

Many companies were forced to the market to raise capital to shore up balance sheets. While others deferred, slashed, or canceled the attractive dividend payouts that investors and retirees had come to rely upon.

There were some notable exceptions, including key iron ore producers Rio Tinto Ltd (RIO), Fortescue Metals Group Ltd (FMG), BHP Group Ltd (BHP) who benefited from strong demand from China and high prices for iron ore, as supply from rival miners in Brazil were hampered by Covid-19.

The economy since that point has made a remarkable turnaround supported by unprecedented central bank policy responses and government intervention. Covid-19 cases in Australia have remained low, fostering a stronger rebound than even the most optimistic forecasters predicted.

For this reporting season, the firmer recovery path reinforced by an imminent rollout of a Covid-19 vaccine should provide company management with the confidence to give more detailed guidance - a feature that went missing in the uncertainty of the last reporting season.

In terms of the key dates to watch, Week 2 (8th of February – 12th of February) is when the action begins to hot up with reports from companies including two we will be previewing in detail, the Commonwealth Bank of Australia (CBA) and CSL Limited (CSL).

Week 3 (15th to 19th of February) will see more than 20 results coming out on Wednesday, February the 17th before companies with a combined market capitalization of $450 billion report on Thursday the 18th of February. We will be previewing two stocks reporting in Week 3, BHP Group Ltd (BHP) and Qantas Airways Limited (QAN).

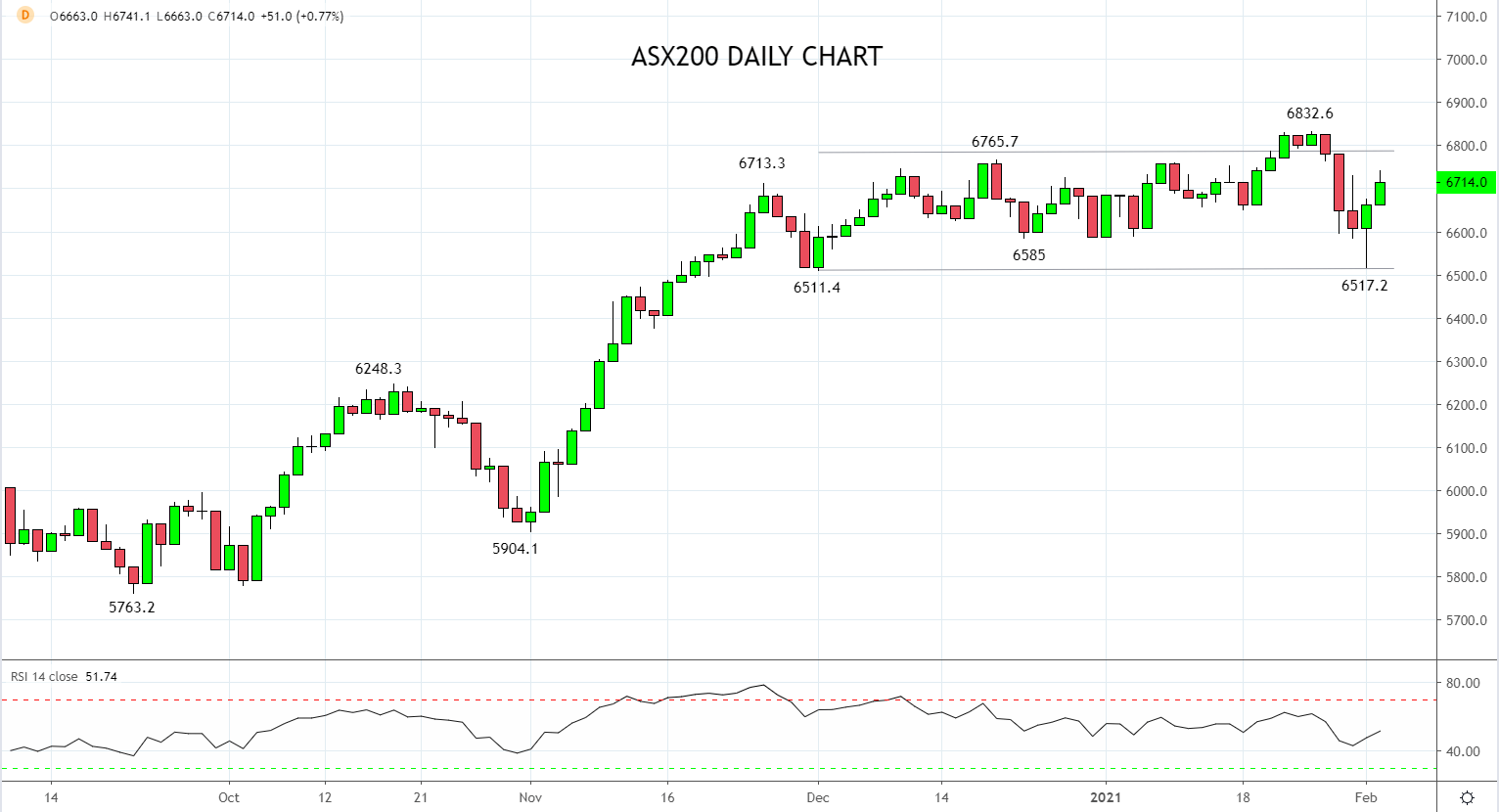

Source Tradingview. The figures stated areas of the 2nd of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation