Aussie Pairs Nearing Key Support: AUD/CAD, AUD/JPY, AUD/USD

The Reserve Bank of Australia’s (RBA) Kent spoke last evening and hinted that the central bank is considering further easing in monetary policy. This comes after the RBA recently said that they are considering buying longer term bonds to help keep yields low. As a result, the Aussie has been hit. But for some pairs, the Australian Dollar is running into support.

AUD/CAD

AUD/CAD has been forming a rounding top since May. The pair is currently moving towards a support zone between .9120 and .9200. The RSI has also moved into oversold territory, indicating that price may be ready for a bounce. Buyers may be looking at this area to get in for a move back up to horizontal resistance near .9400.

Source: Tradingview, City Index

AUD/JPY

AUD/JPY is closing in on a key horizontal support level near 74.00. The pair has been forming a descending triangle since making recent highs on August 31st. If support is broken, the pair could move quickly towards 70.50! The target for the break of the descending triangle is near 69.00, which is also the 50% retracement from the lows of March 19th to the highs on August 31st. If the 74.00 level holds, watch for a bounce back up to the downward sloping trendline near 76.00.

Source: Tradingview, City Index

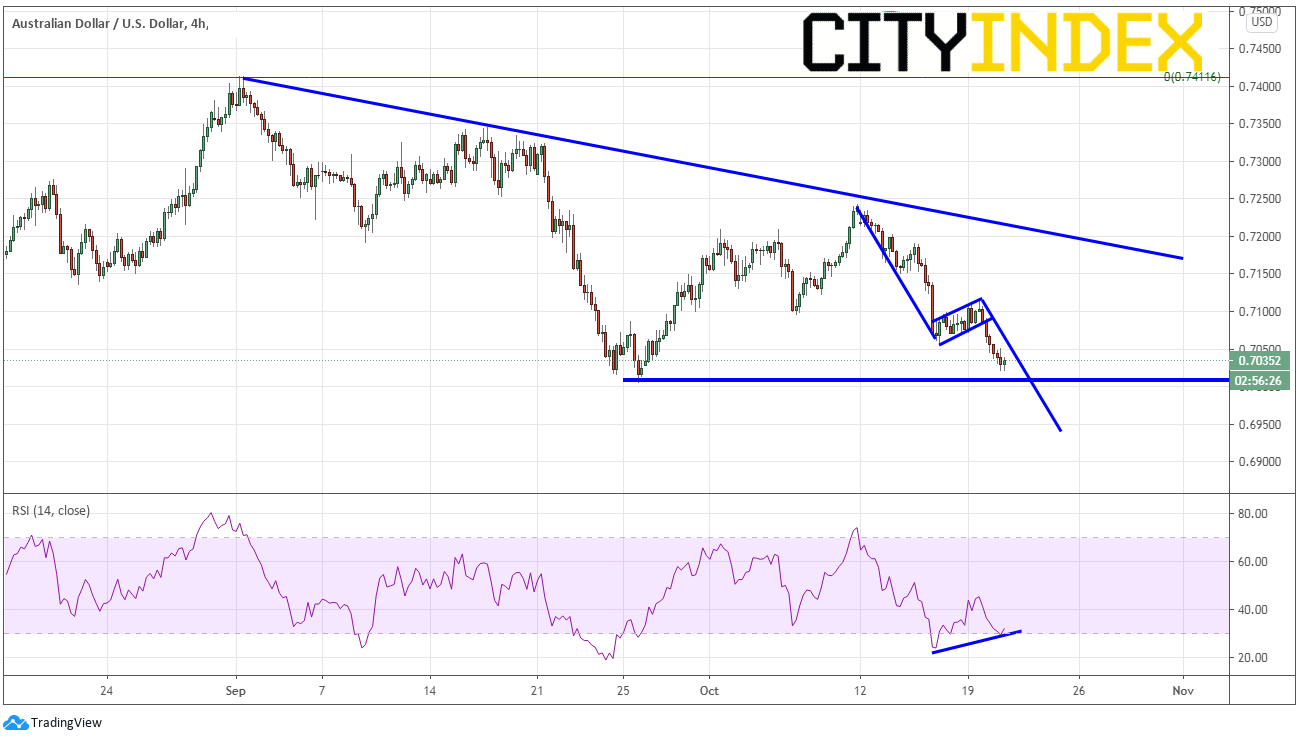

AUD/USD

AUD/USD has also been forming a descending triangle since September 1st. Note however on the 240-minute timeframe, price has formed a flag pattern within the triangle. The pair is nearing recent lows around .7000, which is also psychological, big round number support. Also notice how the RSI is diverging from price, indicating a possible reversal. Buyers may be looking to enter here for a move back up to the top of the flag near .7100, then the downward sloping trendline of the triangle near .7200. If price does break through .7000, the target for the flag pattern is near .6940.

Source: Tradingview, City Index