Aussie Dragged by Downbeat Jobs Report

This morning, the Australian dollar weakened against the U.S. dollar following a downbeat jobs report.

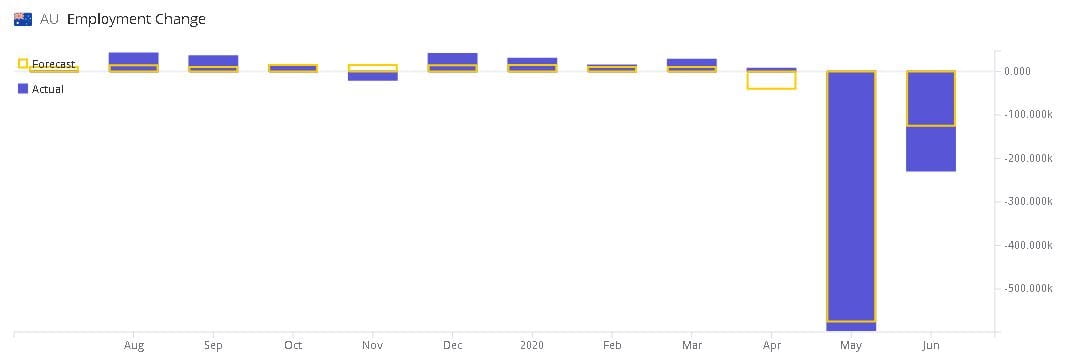

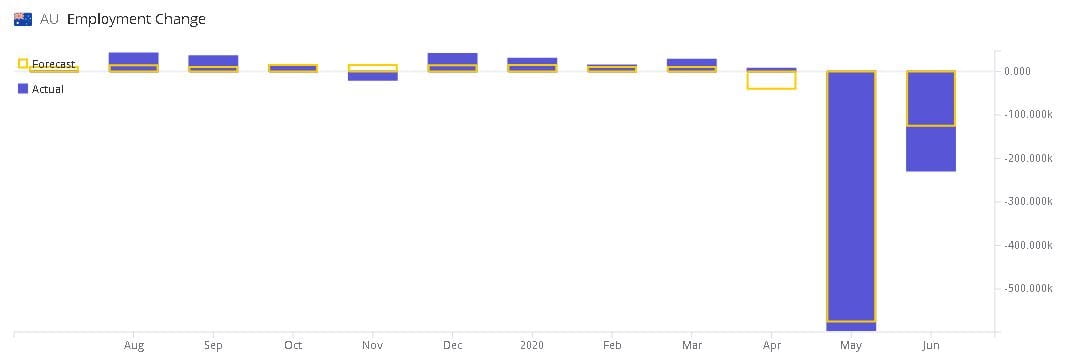

Source: Trading Economics

Obviously, the impacts of the coronavirus pandemic are still lingering.

In fact, market sentiment is seeing renewed drag caused by worries over a second-wave coronavirus pandemic. Authorities of Chinese capital city Beijing ordered the lockdown of residential communities following surging infections. In the U.S., the number of coronavirus cases in Arizona, Florida and Texas reached new highs.

Meanwhile, Qantas Airways, Australia's flag carrier, has canceled all international flights until late October. The decision came after Australian Tourism Minister Simon Birmingham said the country's border for overseas travel would only reopen next year.

The Australian dollar should find it difficult to strengthen against the greenback.

On an Intraday 30-minute Chart, AUD/USD is testing the Immediate support at 0.6835.

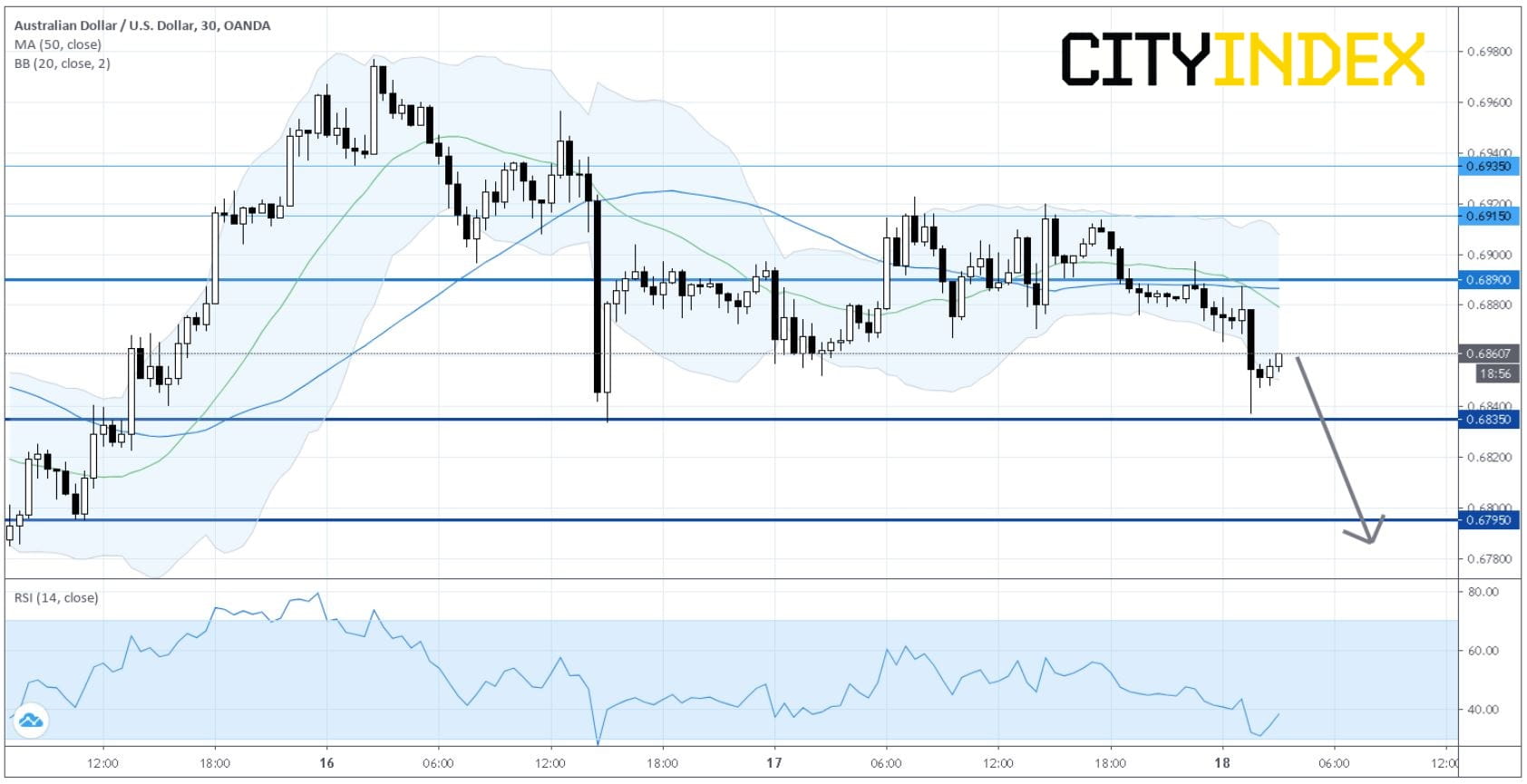

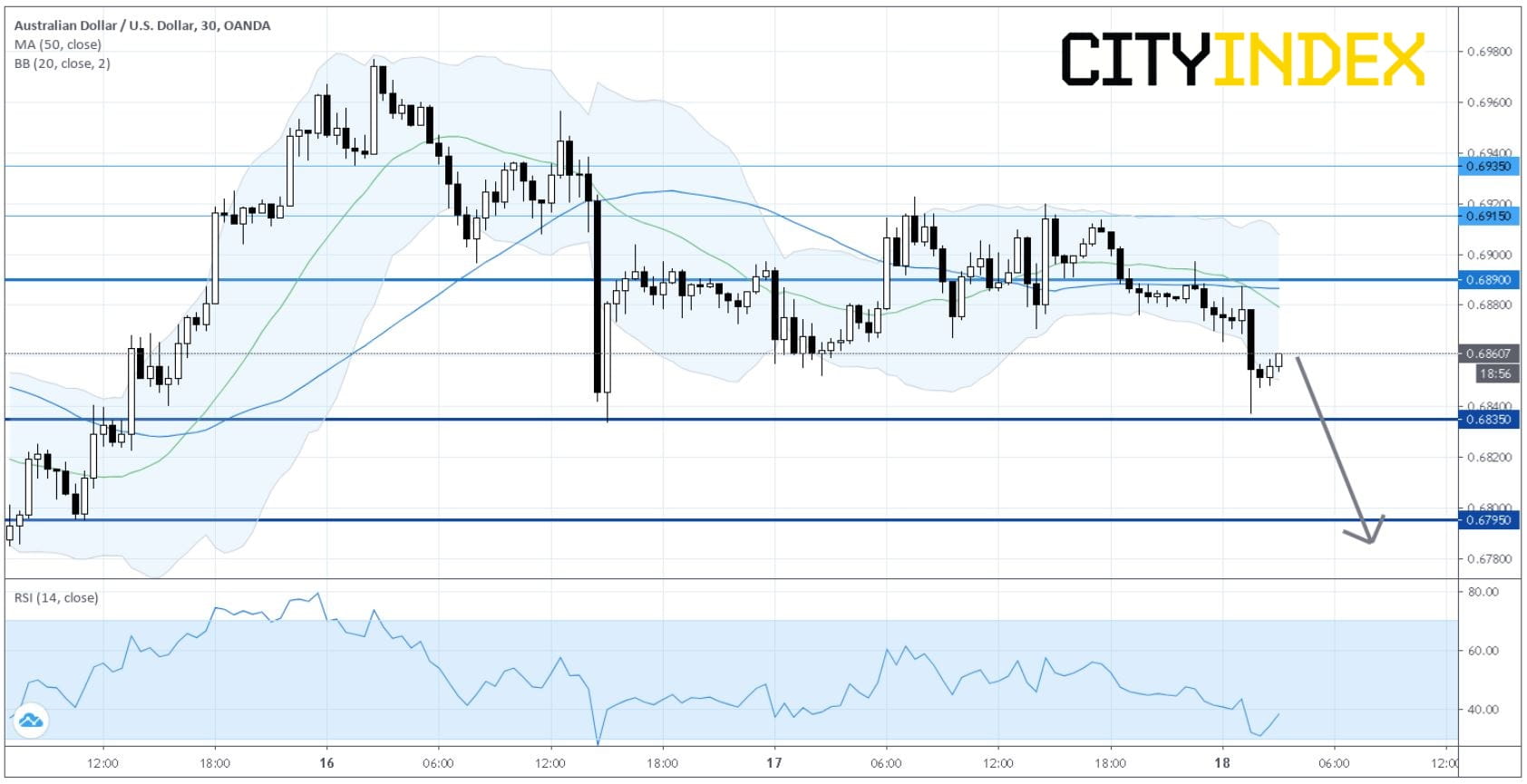

Source: GAIN Capital, TradingView

A Key Resistance has been located at 0.6890 (around the 50-period moving average).

The 20-period moving average has just crossed below the 50-period one, helping to keep the intraday bias as bearish.

A break below the immediate support at 0.6835 would open a path toward the next line of support at 0.6795.

Alternatively, a return to the key resistance at 0.6890 would trigger a further advance toward 0.6915 on the upside (around the high of yesterday).

Official data showed that Employment in Australia plunged 227,700 in May, much worse than a reduction of 78,800 expected. The Jobless Rate jumped to 7.1% (6.9% expected) from 6.4% in April.

Source: Trading Economics

Obviously, the impacts of the coronavirus pandemic are still lingering.

In fact, market sentiment is seeing renewed drag caused by worries over a second-wave coronavirus pandemic. Authorities of Chinese capital city Beijing ordered the lockdown of residential communities following surging infections. In the U.S., the number of coronavirus cases in Arizona, Florida and Texas reached new highs.

Meanwhile, Qantas Airways, Australia's flag carrier, has canceled all international flights until late October. The decision came after Australian Tourism Minister Simon Birmingham said the country's border for overseas travel would only reopen next year.

The Australian dollar should find it difficult to strengthen against the greenback.

On an Intraday 30-minute Chart, AUD/USD is testing the Immediate support at 0.6835.

Source: GAIN Capital, TradingView

A Key Resistance has been located at 0.6890 (around the 50-period moving average).

The 20-period moving average has just crossed below the 50-period one, helping to keep the intraday bias as bearish.

A break below the immediate support at 0.6835 would open a path toward the next line of support at 0.6795.

Alternatively, a return to the key resistance at 0.6890 would trigger a further advance toward 0.6915 on the upside (around the high of yesterday).

Latest market news

Today 08:15 AM