The US Dollar was mixed against all of its major pairs on Monday.

On the U.S. economic data front, there was no major news.

The Euro was under pressure against all of its major pairs. In Europe, the eurozone Sentix Investor Confidence Index for August was released at -13.4 (vs -16.0 expected). The Bank of France posted Business Industry Sentiment Indicator for July at 99 (vs 92 expected).

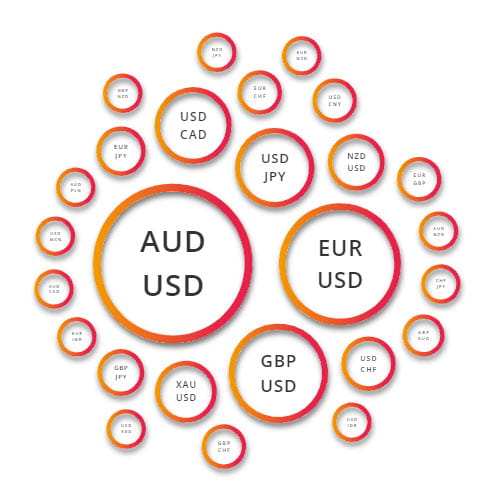

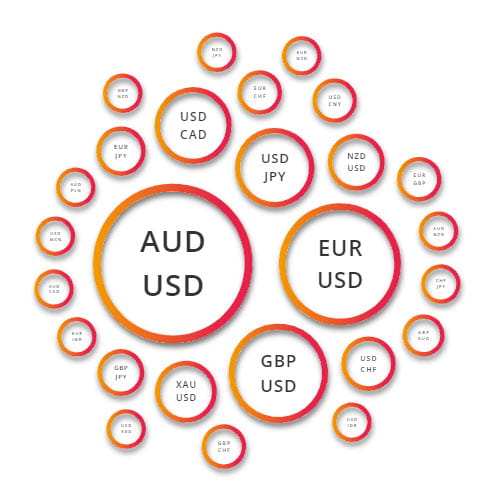

The Australian dollar was mixed against all of its major pairs. Looking at the AUD/USD news sentiment in "TC Market Buzz" the AUD is trending with an increase in news volume.

Source: TC Market Buzz

On a long term Weekly chart, the AUD/USD is challenging a very important declining trend line in place since 2014. A break above could signal the beginning of a major multi-year rebound. If the trend line holds as resistance, look for a drop down towards 0.6515 and 0.617 in extension.

Source: GAIN Capital, TradingView

On the U.S. economic data front, there was no major news.

The Euro was under pressure against all of its major pairs. In Europe, the eurozone Sentix Investor Confidence Index for August was released at -13.4 (vs -16.0 expected). The Bank of France posted Business Industry Sentiment Indicator for July at 99 (vs 92 expected).

The Australian dollar was mixed against all of its major pairs. Looking at the AUD/USD news sentiment in "TC Market Buzz" the AUD is trending with an increase in news volume.

Source: TC Market Buzz

On a long term Weekly chart, the AUD/USD is challenging a very important declining trend line in place since 2014. A break above could signal the beginning of a major multi-year rebound. If the trend line holds as resistance, look for a drop down towards 0.6515 and 0.617 in extension.

Source: GAIN Capital, TradingView

The AUD/USD is our currency pair of the week, read more about why here.

Happy Trading

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM