The escalation in trade tensions continues to dominate headlines as China released its white paper over the weekend, which predicts a long drawn out trade war. Also, out over the weekend news that U.S. President Trump had terminated India’s developed nation status, under which India has been allowed to export nearly 2000 products into the U.S. duty-free.

The termination of India’s preferential agreement effective June 5, 2019, comes after the U.S. administration decided last month to terminate a similar preferential trade agreement with Turkey, designed to promote economic development. It also follows the announcement last week that all imports from Mexico would be subject to a 5% tariff effective June 10, 2019, unless Mexico “illegal migrants”.

According to reports in the New York Times, Australia has narrowly avoided becoming the latest casualty in the trade war after Australian aluminium exports to the U.S. surged by 350% year on year in the first quarter of 2019. The threat of jeopardising the U.S. relationship with Australia, a crucial ally in the Asian region at a time when negotiations and relations with China have deteriorated, prompted sharp opposition from officials within the Pentagon and State Department and caused the U.S. administration to have second thoughts.

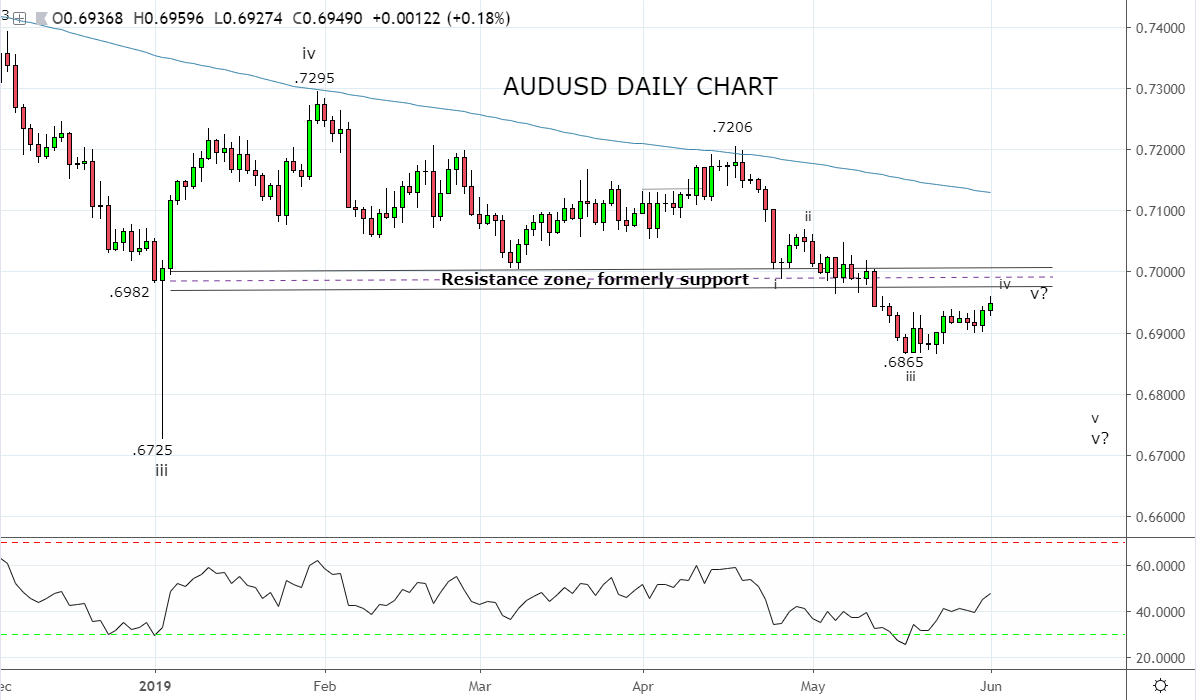

A relief to Australia and with the threat of tariffs removed at least for now, the AUDUSD has continued today to build on its rally that commenced after the surprise Federal election result two weeks ago. However, with the Reserve Bank of Australia (RBA) likely to cut the cash rates by 25bp to 1.25% at its meeting tomorrow, the AUDUSD is unlikely to have the impetus to break through the strong band of overhead resistance between .6980 and .7020 in the near term.

Likewise, with the market already fully priced for three RBA interest cuts over the next 12 months, the bar to the RBA “out doving” the market at tomorrow’s meeting is set high. As such, the .6865 low which held on four separate occasions two weeks ago will provide strong support if tested.

Source Tradingview. The figures stated are as of the 3rd of June 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.