Encouraging price action in equities overnight as the S&P 500 closed over 1% higher, recording its first back to back daily increase since mid-February.

At one point, the S&P 500 was up over 5%, boosted by an in-principal agreement to approve the U.S$ 2tn fiscal stimulus bill, before a disagreement over unemployment benefits delayed formal passage and caused equities to slip into the close.

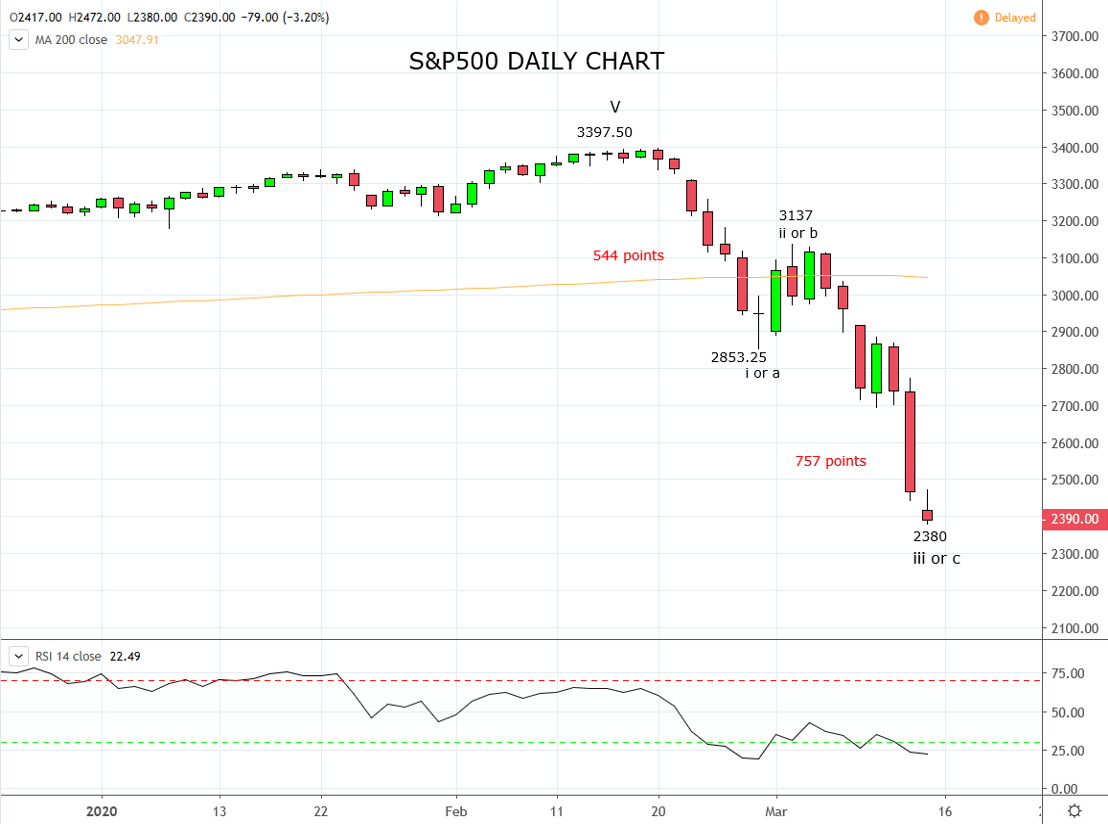

Overall our view remains that markets may have already or are very close to turning the corner. Supporting this outlook, liquidity is slowly returning to fractured credit markets and the VIX index which measures volatility is over 25% below its highs from 10 days ago.

A potential calming in markets, massaged by an unprecedented level of central bank and government stimulus was one of the reasons why we wrote on Tuesday that the U.S. dollar index, the DXY was vulnerable to a pullback here.

The bullish U.S. dollar narrative is currently one of the strongest and most widely held views amongst market participants - a warning in itself and it wasn’t a surprise to receive some pushback to the thoughts contained in the article. However, with the DXY having fallen almost 2.50% fall from its recent high, we feel our call has been vindicated.

In fact, looking at the U.S. dollar through the lens of the AUDUSD and other high beta FX pairs, the U.S. dollar uptrend may soon be set to resume. After breaking through the support offered by the Global Financial Crisis (GFC) low of .6007, the AUDUSD fell quickly to a low of .5508, in an impulsive manner.

The subsequent recovery appears to be part of a counter-trend rally and was punctuated by a bearish daily candle overnight at the .6073 high, that warns the AUDUSD downtrend may soon be set to resume.

In a nutshell, the AUDUSD should continue to find sellers in the .6000/.6200c region and providing the AUDUSD trades no higher than .6330, the expectation is for a retest and break of last weeks .5508 low.

Source Tradingview. The figures stated areas of the 26th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation