The improvement in risk sentiment helping the AUDUSD to close higher at .7315 (+0.60%), recovering all ground lost during September after a series of headwinds hit, including;

- Iron ore falling over 20%

- Higher U.S. yields providing support for the U.S. dollar

- The fall of Evergrande

- APRA has begun to tighten lending requirements which in theory delays the need for the RBA to start raising rates.

- Production cuts in China to comply with energy intensity targets a significant drag on Chinese growth.

Possibly contributing to the AUDUSD’s outperformance, after 106 days in lockdown, restrictions begin to ease this weekend in NSW, and Sydney looks set to make the most of it.

Restaurants, bars, and shops re-open. School resumes the following week with all kids back to school by October 25th, and holidays are again on the agenda.

Further helping the AUDUSD, an assumption that Chinese steel mills will increase production as power caps are lifted and after the National Development and Reform Commission (NRDC) urged miners to secure long-term coal supplies to generate electricity.

Overnight the CEO of Brazilian iron ore miner Vale told an industry conference that the iron ore market was “relatively tight” and will be “more balanced” going forward.

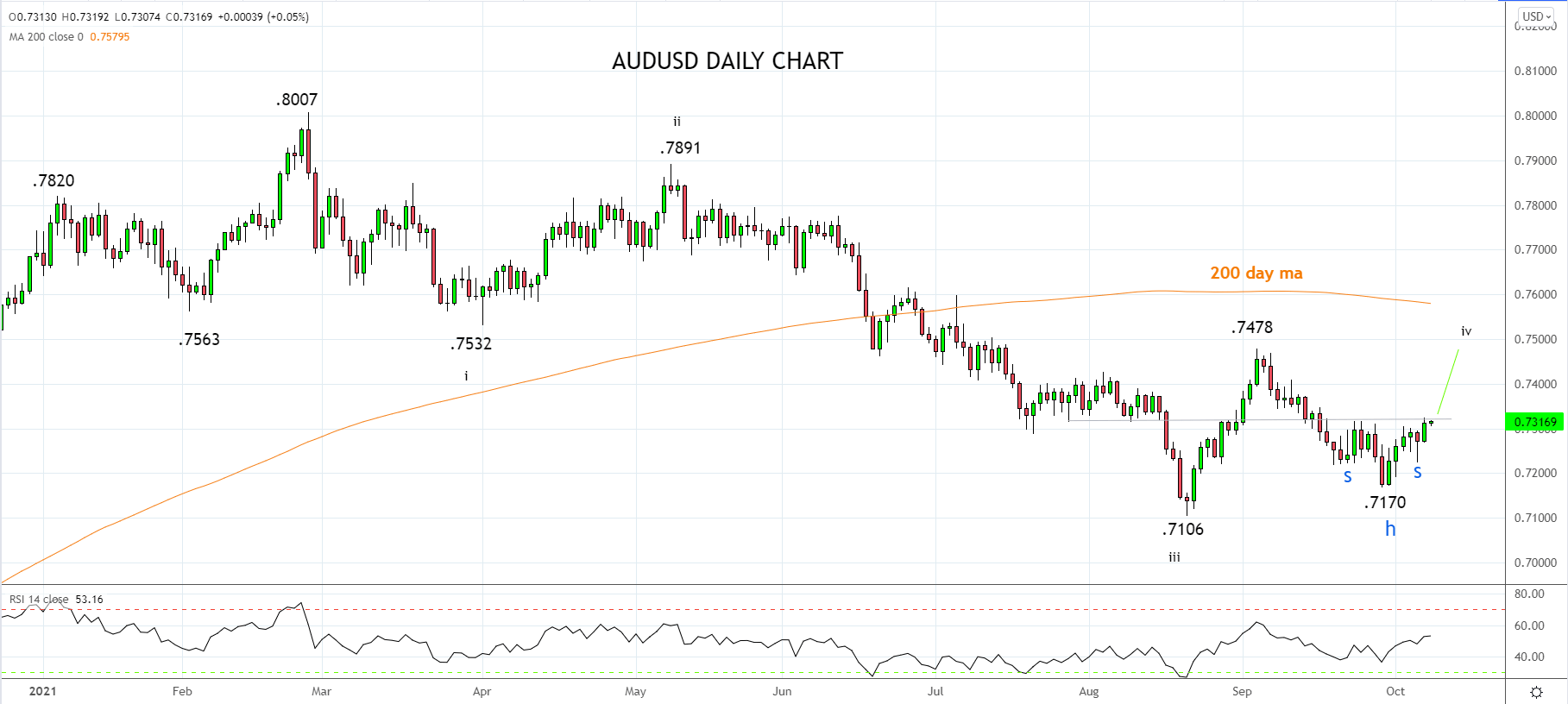

Turning to the charts, the AUDUSD appears to have carved out a potential inverted head and shoulders bottom on the intraday charts, noteworthy as the market sits very short the AUDUSD.

Should the AUDUSD break/close above the .7320/40 resistance area after tonight’s non-farm payrolls data, I would expect to see a short-covering rally commence with scope towards .7500c.

Source Tradingview. The figures stated areas of October 8th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation