The release of the confidence data coincided with the AUDUSD probing into the support near .7200c coming from the trendline drawn from the June .6776 low. A combination that provided the catalyst for the AUDUSD’s subsequent recovery as noted here.

No news was good news for the AUDUSD this morning as the September RBA meeting minutes lacked any further details following the inclusion of the dovish sentence below into the statement of the September 1st board meeting.

“The board…continues to consider how further monetary measures could support the recovery.”

Following the minutes, the AUDUSD reclaimed the .7300c handle. However whether the rally can continue will depend on the outcome of the Tier 1 data doubleheader on Thursday - the FOMC meeting and then August Labour Force data for the Australian economy.

For an outline on what to expected from the FOMC meeting, please find below a link to City Index analyst Fiona Cincotta’ s excellent preview here.

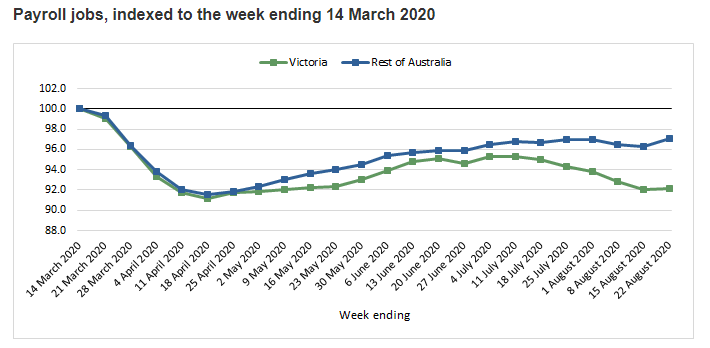

Australian Labour Force data will be a tough one as always. Weekly ABS payroll data shows that Payroll jobs across Australia fell by 0.4%, over the month to 22 August, (ABS chart below).

This suggests a fall of about -40k jobs is likely on Thursday. However, because of the methodology variation between the payroll and ABS survey measure, there is cause to look through the ABS data series and a +40k print wouldn’t surprise either. Hence, as usual, the clearest read will be via the unemployment rate which is expected to rise from 7.5% to 7.7%.

Technically, providing the AUDUSD remains above uptrend support .7220/90 and then trades above short-term resistance .7320/30 it would set the AUDUSD up for a retest of .the .7414 high, before .7500c.

Keeping in mind that a break/close below .7200/.7180 would be a negative development and warn of a deeper correction towards .7075/65.

In light of this, my preference is to take profit on AUDUSD longs and reassess after the dust from Thursday has settled.

Source Tradingview. The figures stated areas of the 15th of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation